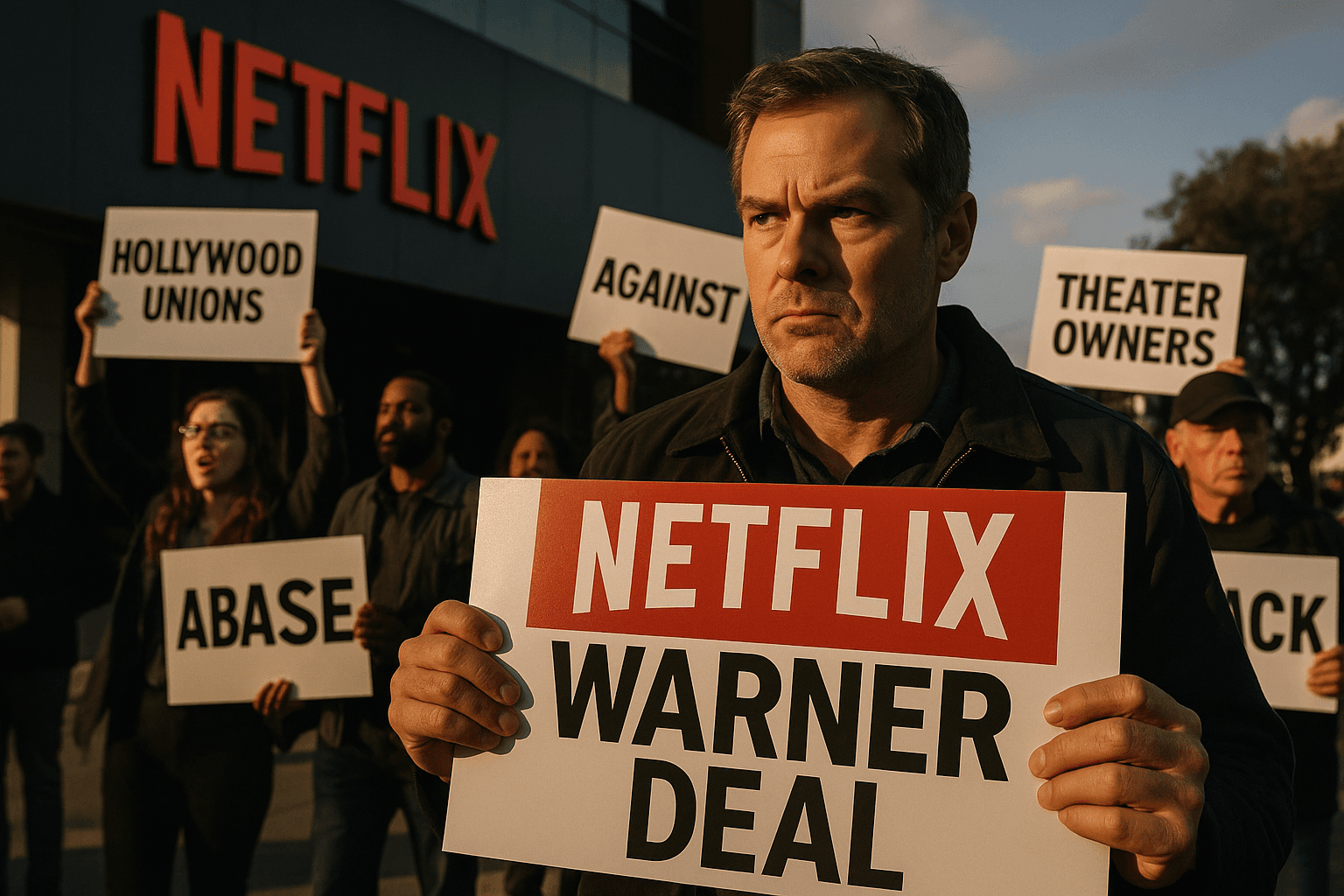

Hollywood Unions and Theater Owners Rally Against Netflix Warner Deal

Major Hollywood unions and cinema owners publicly challenged Netflix's proposed acquisition of Warner Bros Discovery on December 6, citing risks to theatrical distribution, employment and bargaining power. Their coordinated objections raise the stakes in a likely transatlantic regulatory fight that could reshape where films are made, how they reach audiences, and who benefits financially from new releases.

On December 6, a coalition of major Hollywood unions and exhibitors sounded a rare, coordinated alarm about Netflix's proposed acquisition of Warner Bros Discovery, warning that the deal could concentrate industry power, reduce theatrical releases and put thousands of jobs at risk. The objections, led by Writers Guild chapters and the Teamsters alongside Cinema United and other exhibitors, urged U.S. and European antitrust regulators to scrutinize the transaction closely and signaled that labor will press for enforceable commitments from Netflix on theatrical windows, employment and collective bargaining impacts.

The unions and theater owners framed their opposition around both economic and cultural stakes. Exhibitors told regulators that a shift in studio ownership toward a streaming first distribution model could materially reduce box office revenue. For theater chains that rely on a steady pipeline of event films to fill screens and support concessions revenue, loss of tentpole releases would not only strain balance sheets, it would erode a distinct cultural ecosystem where communal viewing and the social life of films flourish.

Labor concerns focused on the downstream effects for writers, drivers, projection and stage crews, and other behind the scenes workers who rely on theatrical production cycles and union contracts. Unions warned that consolidation under a streaming giant could tilt bargaining power, reduce the number of large scale productions that sustain union employment, and complicate residual structures that are often linked to traditional release windows.

Netflix has publicly responded that it would maintain theatrical releases and invest in production as part of its plan for Warner Bros Discovery, but industry pushback suggests that assurances will not be enough without enforceable conditions. Some guilds said they will press Netflix for formal commitments on theatrical windows and protections for employment and collective bargaining, a demand that could become a bargaining chip in regulatory review or a condition imposed by competition authorities.

Beyond immediate labour and box office implications, the dispute highlights broader industry trends. The past decade has seen the blurring of distribution windows, rapid vertical consolidation and the rise of global streaming platforms that combine production, distribution and audience analytics. Regulators will now assess not only traditional antitrust metrics, but also how platform control over content libraries and direct consumer relationships affects cultural plurality and market access for independent filmmakers and regional cinemas.

The confrontation is also a political and social moment. Labor mobilization against a single corporate transaction underscores how media consolidation has become a flashpoint for debates over cultural power, creative autonomy and the future of work in the creative economy. If regulators intervene, their remedies could define how films are financed, released and monetized for years to come.

As the deal advances through regulatory review, the outcome will determine whether a combined Netflix and Warner Bros Discovery becomes a new kind of integrated studio space that prioritizes global streaming first, or whether safeguards will be required to preserve theatrical exhibition, union strength and a diverse filmmaking ecosystem. The stakes are cultural as well as commercial, and the industry is watching closely.