Hooker Sells Pulaski and Samuel Lawrence Brands to Magnussen

Hooker Furnishings Corporation agreed to sell Pulaski Furniture and Samuel Lawrence Furniture to Magnussen Home Furnishings, with an estimated purchase price of about $4.8 million based on net book value. The deal moves the Home Meridian High Point showroom lease onto Magnussen's balance sheet, reducing Hooker showroom lease liabilities by an estimated $4.8 million and reshaping local showroom ownership and financial footprints.

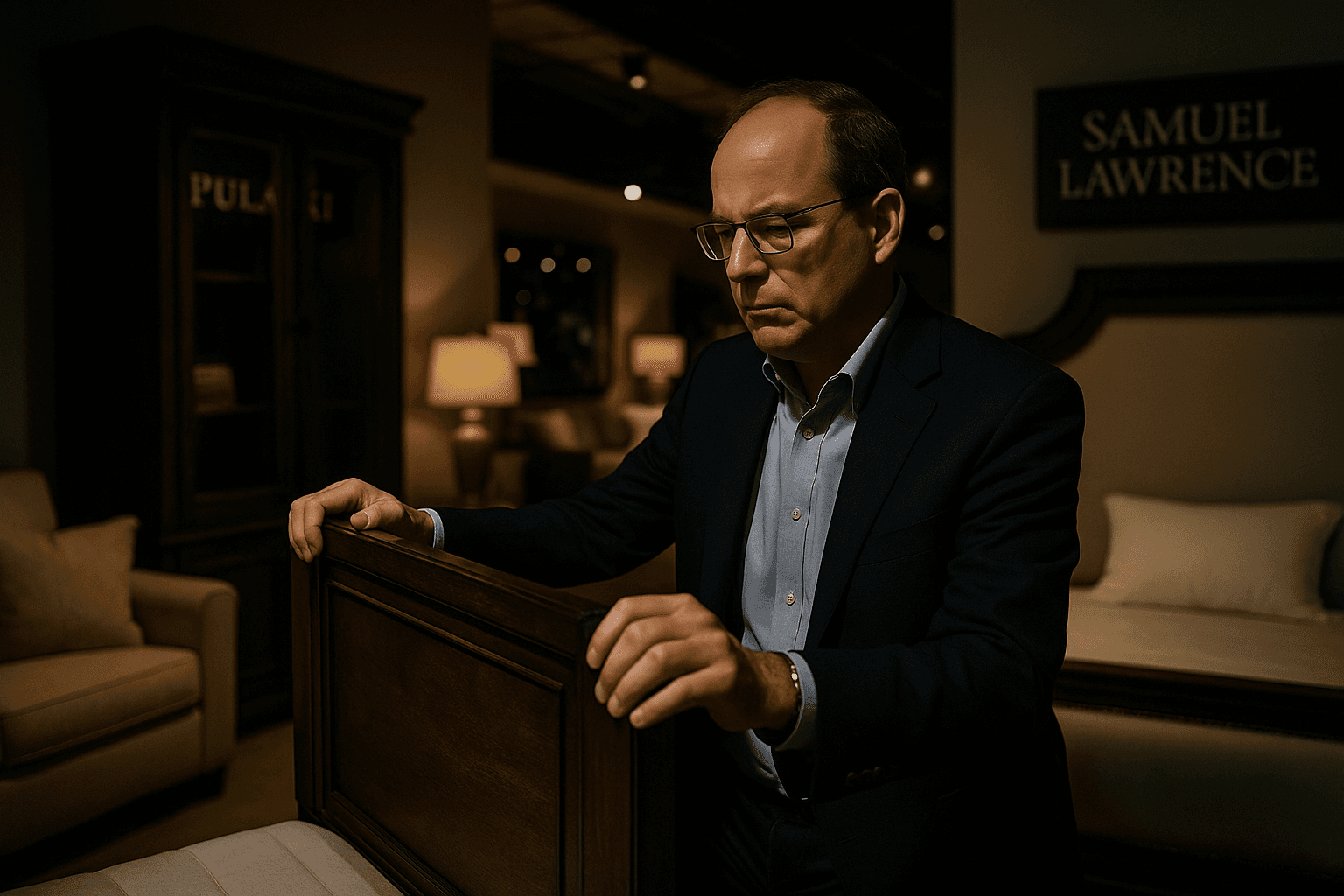

Hooker Furnishings Corporation announced a definitive agreement to sell two casegoods brands within its Home Meridian segment, Pulaski Furniture and Samuel Lawrence Furniture, to Magnussen Home Furnishings. The purchase price will be determined and paid based on the net book value of the assets, and as of Hooker’s Nov. 2, 2025 fiscal quarter end the currently estimated price is approximately $4.8 million, subject to adjustment.

The transaction includes the assumption by Magnussen of the Home Meridian High Point showroom lease. That assumption reduces Hooker’s showroom lease liabilities by an estimated $4.8 million and related expenses, improving Hooker’s near term balance sheet metrics and aligning with a stated multi year portfolio sharpening strategy intended to concentrate resources on higher performing brands and improve profitability.

For Guilford County the most immediate effect is a change in the corporate occupant responsible for one High Point showroom. High Point remains a concentrated center for furniture showrooms and trade activity, and continuity of a showroom lease under a new owner is likely to maintain showroom traffic for contractors, retailers, and shoppers who rely on local displays. Local suppliers and service providers tied to Home Meridian may see operational continuity, although the sale could trigger supplier reviews and strategic shifts under new ownership.

From a market perspective, the deal is consistent with broader industry consolidation, where manufacturers and brand owners divest lower margin or non core assets to focus capital on higher growth lines. The modest size of the transaction, roughly $4.8 million on a net book basis, signals a targeted portfolio rationalization rather than a large scale restructuring. For Hooker this should lower lease related overhead and improve reported profitability metrics. For Magnussen the acquisition expands product offerings and physical retail presence in High Point.

Policy makers and local economic development officials should monitor potential employment or supplier adjustments, and be prepared to support transitions if manufacturers alter production footprints. Over the long term, Guilford County’s furniture cluster will be shaped by continued brand consolidation, evolving showroom strategies, and firms reallocating capital to higher margin segments that drive regional investment and workforce demand.