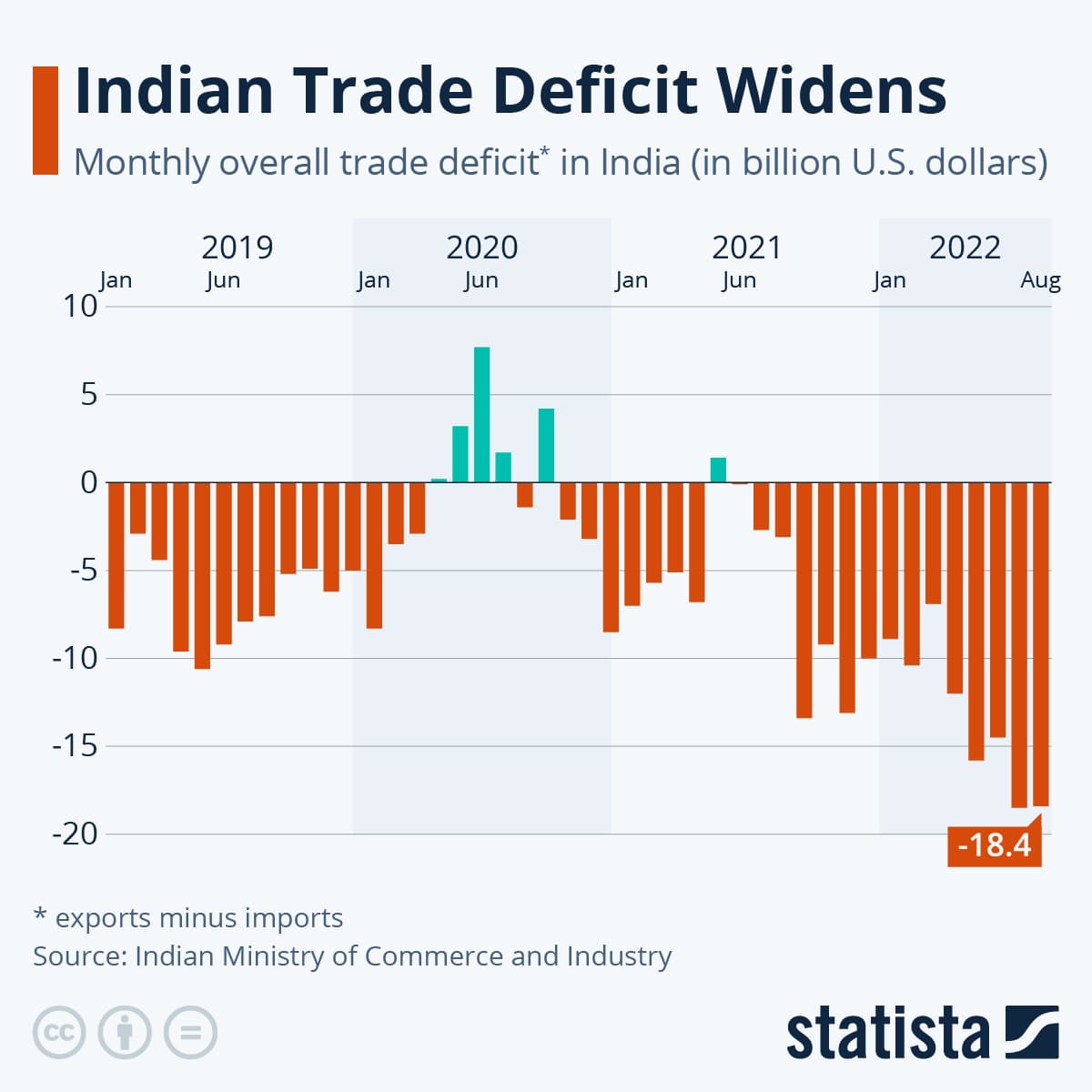

India's trade deficit surges to record, gold imports skyrocket

India's goods trade deficit hit a record $41.7 billion in October as a sharp seasonal jump in gold imports and pressure from steep U.S. tariffs on exports widened the gap. The surge has pushed current account risks higher, prompting warnings from ICRA that the deficit could spike in the coming quarter and complicate monetary and external financing choices.

India's goods trade deficit hit an all-time high of $41.7 billion in October, driven principally by a dramatic surge in gold imports and weaker exports to the United States, Moody's-owned credit research firm ICRA said on Monday. Gold purchases jumped roughly 200 percent as consumers and jewellers stocked up for the festival season, overwhelming the offsetting effect of modest export gains in other categories.

ICRA warned that the balance of payments impact is likely to be concentrated in the third quarter of the fiscal year that ends in March 2026, forecasting that the current account deficit could widen materially to between 2.4 and 2.5 percent of gross domestic product in that quarter. The firm added that the full year ratio of the current account deficit to GDP could be around 1.2 percent in fiscal 2026 if steep U.S. tariffs, including measures that have reached 50 percent on some items, remain in place until the end of March.

The October figures underscore two interacting forces that have altered India’s external position this autumn. First, the scale of gold imports, which are highly seasonal, overwhelmed merchandise balances. Second, exporters have faced rising trade barriers in key markets, with exports to the United States cited as taking a particular hit from recent tariff actions. Together these factors pushed the monthly goods gap well beyond market estimates and raised near term financing questions.

ICRA expects merchandise imports to cool in November and December as festival related gold demand ebbs and some export recovery occurs. That sequential moderation would ease monthly headline pressures, but analysts say the broader implications are more durable. A sustained widening of the current account would increase reliance on volatile capital flows, place downward pressure on the rupee, and complicate monetary policy choices for the Reserve Bank of India.

For policymakers, the October shock highlights tradeoffs between supporting domestic demand during a key retail season and maintaining external stability. A larger and more persistent current account deficit could force the RBI to step up foreign exchange intervention to stabilise the currency or to keep policy rates tighter for longer to deter capital outflows, both of which could have knock on effects for growth and inflation.

Longer term, the episode reinforces the case for accelerating export diversification and deeper import substitution in areas where tariff barriers abroad have raised costs for Indian producers. It also underscores the vulnerability of India’s external accounts to commodity swings and discretionary import behavior, such as seasonal gold buying.

Markets will be watching incoming data on trade and capital flows closely over the coming weeks, and policymakers will likely weigh targeted measures to manage volatility. If gold demand normalises and export shipments recover modestly as ICRA expects, headline pressures could be transitory. If tariff related shocks persist, however, the balance of risks for India’s external position will remain tilted toward wider deficits into early 2026.

%3Amax_bytes(150000)%3Astrip_icc()%2FGettyImages-1659539820-1d6d3aa7d0824b26877f2538f9ae7ab2.jpg&w=1920&q=75)