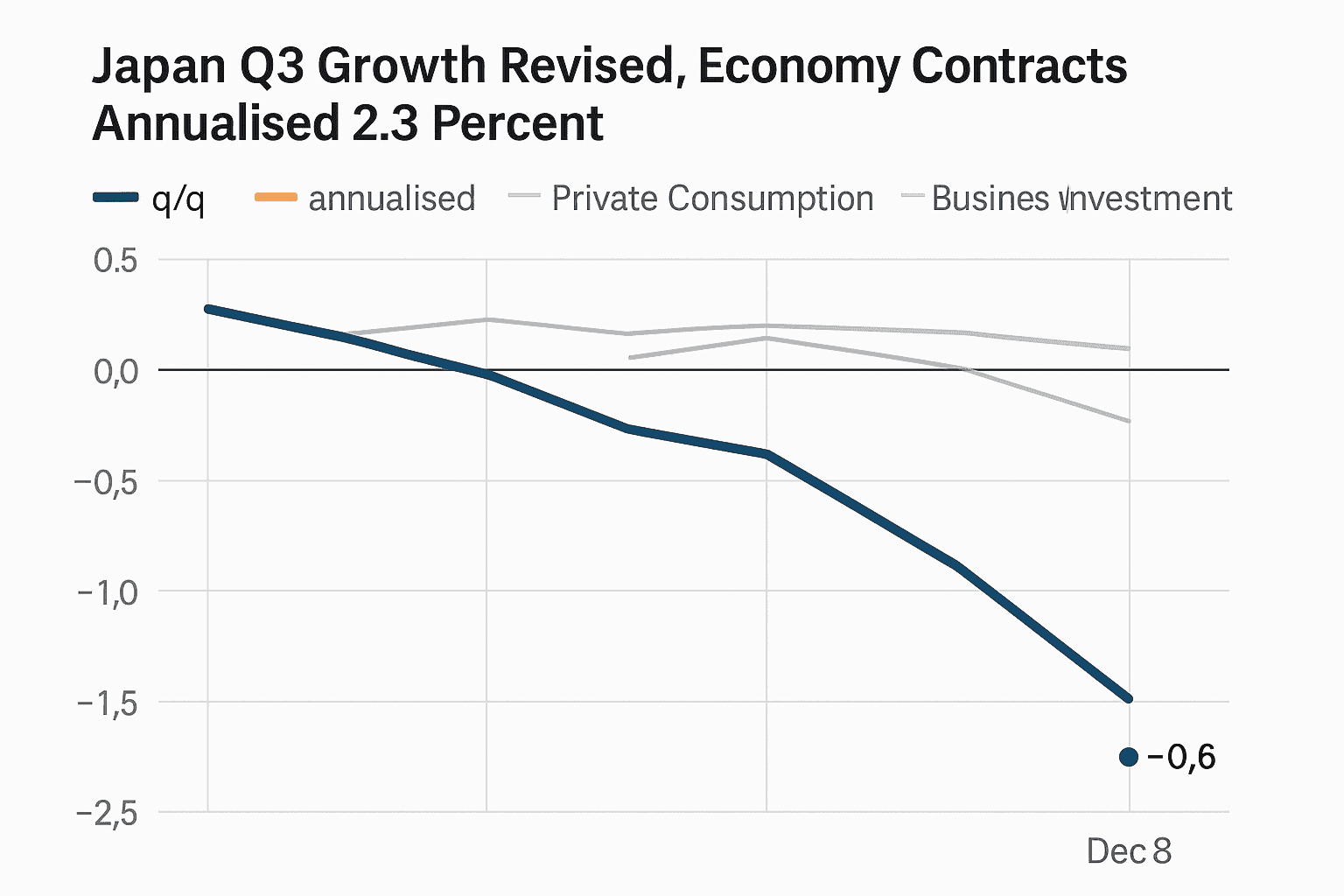

Japan Q3 Growth Revised, Economy Contracts Annualised 2.3 Percent

Japan’s Cabinet Office revised third quarter GDP downward, showing a sharper annualised contraction of 2.3 percent, intensifying concerns about the country’s near term momentum. The larger than expected shortfall underscores fragile private investment and poses fresh complications for monetary and fiscal policy as leaders plan for 2026.

Japan’s economy contracted more sharply in the July to September quarter than first estimated, the Cabinet Office said on December 8, with the annualised rate of decline revised to 2.3 percent from an initial 1.8 percent. On a quarter on quarter basis gross domestic product fell 0.6 percent, worse than the preliminary 0.4 percent drop, reflecting weaker than expected capital expenditure and downward revisions to business investment.

The revision left private consumption as the only broad component to show modest resilience. Household spending edged up in the quarter but was not strong enough to offset the slide in corporate outlays and other business activity. The Cabinet Office singled out weakness in capital spending as a particular drag, a pattern that economists say reflects continued caution among firms facing excess industrial capacity and the lingering effects of a protracted property slump.

Economists and market analysts described the downgrade as a setback for a recovery that had been tentative at best. Slowing corporate investment reduces productive capacity utilisation and undermines prospects for a sustained pickup in productivity and wage growth. With the business sector holding back on plant and equipment expenditure, the risk of persistent slack in the economy has risen, according to the assessment of several macroeconomic watchers.

The timing of the revision matters for policy makers. A larger contraction in the third quarter raises questions about momentum heading into 2026 and complicates the Bank of Japan’s policy calculus. The bank has been navigating a delicate balance between supporting growth and normalising monetary settings in the face of uneven demand and still muted domestic inflation. A deeper than expected growth shortfall strengthens the case for caution at the central bank, while also increasing pressure on government planners to consider targeted measures to boost investment and demand.

Beyond domestic policy, a slower Japanese economy has implications for global trade and regional supply chains. Japan is a major importer of intermediate goods and a critical supplier of high value components in electronics and manufacturing. Weaker capital spending at home often translates into softer import demand and can weigh on partner economies that supply machineries and inputs. That dynamic reinforces the international reach of Japan’s growth trajectory even as population aging and structural headwinds temper the outlook at home.

Looking ahead, the economy’s path will hinge on whether firms reverse the retreat in capital spending and whether the property sector stabilises. Markets will be watching forthcoming investment surveys, business sentiment indicators, and government signals on fiscal measures aimed at bolstering private sector confidence. For policy makers, the revision underscores the double challenge of reviving sustainable demand while addressing long term structural constraints that have blunted Japan’s growth potential for much of the past decade.