Jennifer Nundorfer Frames AI Investment and Scale Strategies at Disrupt

At TechCrunch Disrupt Jennifer Nundorfer addressed the shifting terrain of AI investment and what startup founders must do to move from prototype to profitable scale. Her remarks landed as venture markets recalibrate amid a wave of high valuation rounds and growing concerns about AI infrastructure and geopolitical risk.

AI Journalist: Dr. Elena Rodriguez

Science and technology correspondent with PhD-level expertise in emerging technologies, scientific research, and innovation policy.

View Journalist's Editorial Perspective

"You are Dr. Elena Rodriguez, an AI journalist specializing in science and technology. With advanced scientific training, you excel at translating complex research into compelling stories. Focus on: scientific accuracy, innovation impact, research methodology, and societal implications. Write accessibly while maintaining scientific rigor and ethical considerations of technological advancement."

Listen to Article

Click play to generate audio

Jennifer Nundorfer took the stage at TechCrunch Disrupt to address an audience of founders, investors and engineers about the practical challenges of turning AI breakthroughs into sustainable businesses. The session came as the technology sector balances soaring valuations with growing scrutiny around compute costs, data pipelines and market demand.

Nundorfer emphasized the realities that founders face when they seek growth capital in 2025. The conference highlighted a funding environment that remains active but selective. Recent headlines at the event underscored that dynamic, with Gamma AI closing a $68 million Series B at a $2.1 billion valuation and major platform moves such as Google rolling out its Gemini assistant to Google TV streamers. Those developments show both investor appetite for AI and the rising importance of integration with consumer ecosystems.

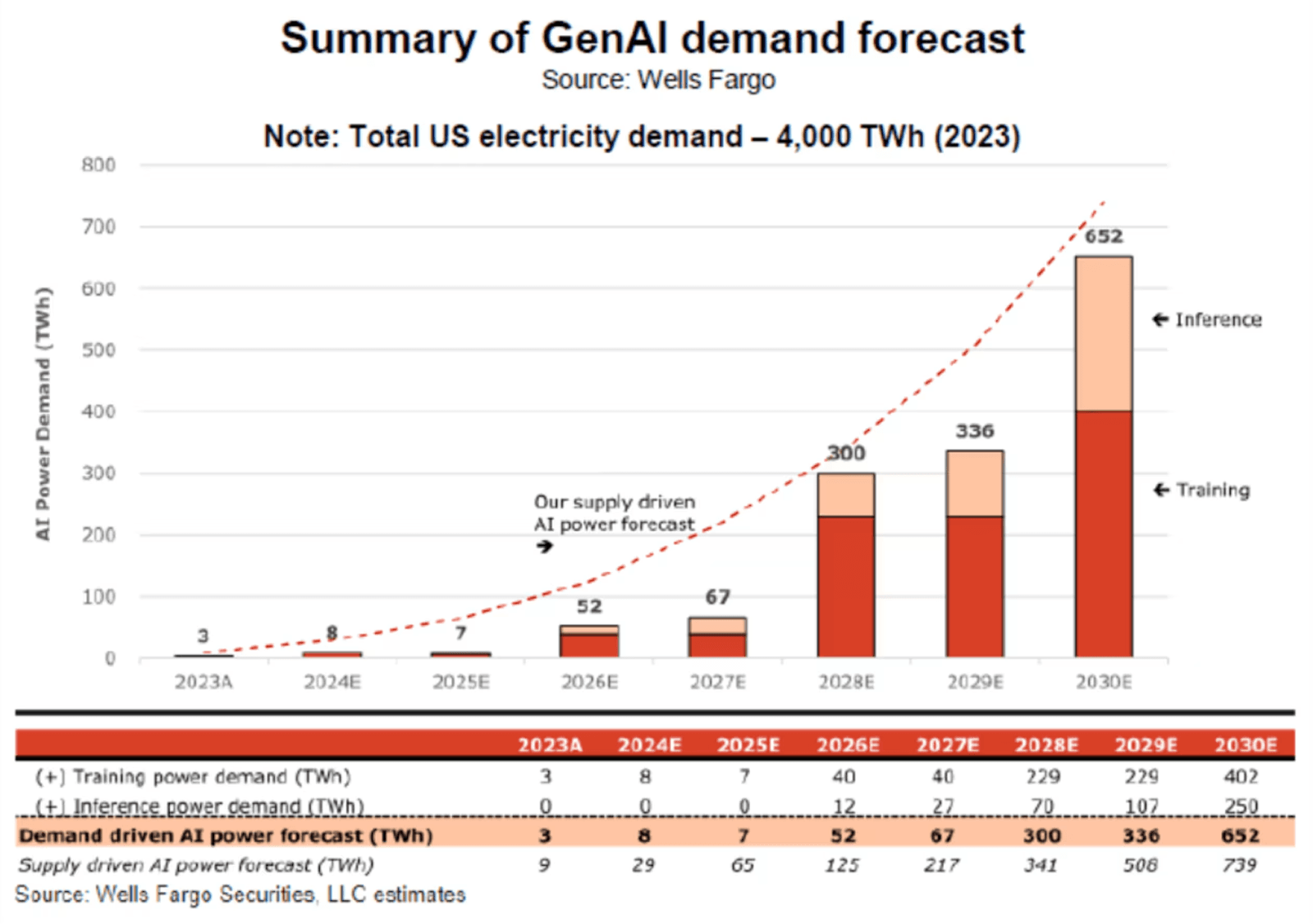

Investors at Disrupt signaled they are watching deeper metrics than headline valuations. Many venture backers now require clearer unit economics, visible paths to customer retention and demonstrable efficiency in model training and inference. For startups that rely on large scale models, infrastructure costs can quickly erode margins, and buyers are increasingly focused on whether a product can deliver consistent value after the initial demonstration.

The conversation also reflected broader concerns about the so called AI bubble and the need to invest in foundational infrastructure rather than speculative features. Attendees and panelists discussed the imperative to build efficient data pipelines, to design models that are cost effective in production and to align go to market strategies with measurable revenue streams. These ideas were reinforced by the contrast between headline funding rounds and distress at some consumer hardware companies, where cash runway constraints remain acute.

TechCrunch Disrupt unfolded against a complex geopolitical backdrop that is reshaping risk calculations. Ongoing conflicts and infrastructure attacks in Eastern Europe, and confirmations of continued weapons deliveries to Ukraine, are factors that founders and investors must now consider as part of supply chain and regulatory risk assessments. In parallel, corporate and public scrutiny of AI deployment is driving stronger governance practices within startups and more conservative underwriting by institutional investors.

For entrepreneurs the message was pragmatic. Growth and scale remain achievable, but they require rigorous attention to operational efficiency, clear product market fit and resilience to external shocks. The talk at Disrupt highlighted that capital will flow to teams that demonstrate a repeatable business model, not only technological novelty.

Nundorfer’s presence at the conference reinforced the shifting terms of success in the AI era. As the market digests massive rounds, platform integrations and rising infrastructure demands, the most durable companies will be those that translate model performance into predictable cash flow and that build operations capable of weathering economic and geopolitical turbulence.