Jumbo Mortgage Rates Rise Again, Pressuring Buyer Affordability

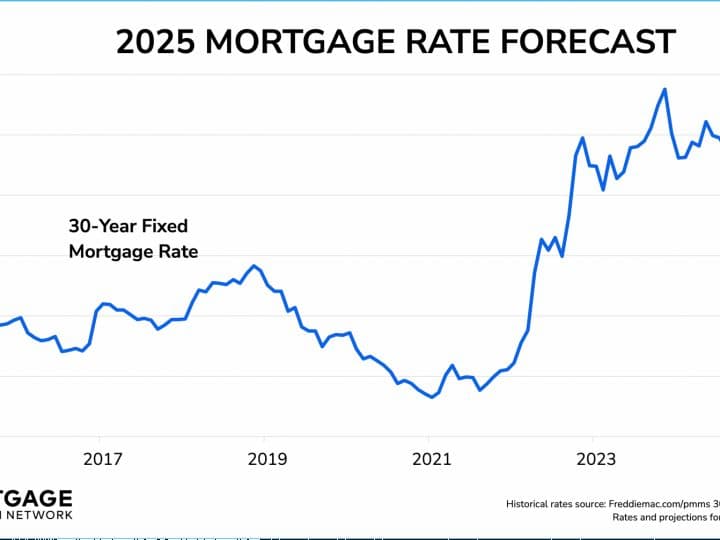

Mortgage rates climbed for a third straight day, with the average 30-year jumbo rate reaching 6.72%, up from 6.67% last week, tightening borrowing costs for high-value homebuyers. The move pushes monthly payments and lifetime interest obligations higher and underscores persistent market volatility that matters for affordability, refinancing decisions and housing demand.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Mortgage borrowing costs ticked higher on Thursday as the average interest rate for a 30-year fixed-rate jumbo mortgage — loans above the 2025 conforming limit of $806,500 in most areas — reached 6.72%. That is up from 6.67% a week earlier and marks the third consecutive daily increase in broader rate measures tracked by market lenders.

At today’s jumbo rate, borrowers would pay approximately $646 a month in principal and interest for every $100,000 borrowed on a 30-year fixed loan, translating into roughly $133,089 in total interest paid over the life of the loan. These figures make clear how even modest moves in headline rates compound into substantial additional lifetime cost for higher-balance mortgages that are common in expensive metro markets.

Across the conventional market, the average 30-year fixed mortgage rate stood at 6.33% today, a change the reporting source describes as 2.88% higher than last week. Lenders’ all-in cost measure, the annual percentage rate, rose to 6.35% from 6.18% a week earlier, reflecting both higher nominal rates and the effect of lender fees on effective borrowing costs.

Mortgage rate fluctuations are driven by a mix of macroeconomic and market forces that borrowers cannot control: Treasury yields, inflation expectations, Federal Reserve policy signals and shifts in lender demand and risk pricing. The small week-to-week uptick in APR — a 17 basis-point rise — suggests that tighter underlying yields combined with persistent lender costs are making credit more expensive for consumers.

The market implications are immediate. Higher rates erode purchasing power, meaning prospective buyers qualify for smaller loans at the same monthly payment or face substantially larger payments at the same loan size. For example, the $646 monthly payment per $100,000 at jumbo rates amplifies rapidly for typical jumbo balances well north of the conforming limit. Higher financing costs also depress refinancing activity, which tends to be most active when rates fall; rising rates shut off that avenue for many homeowners.

Longer-term, the persistence of rates above the 6 percent mark continues to reshape housing demand and supply dynamics. Elevated borrowing costs tend to cool buyer demand, which can put downward pressure on price growth but also slow new-home construction and reduce closing activity that supports related sectors of the economy. For lenders and investors, sustained higher rates change the calculus on mortgage credit supply and the pricing of mortgage-backed securities.

For borrowers weighing home purchases or refinances, the current environment stresses the importance of comparing rate offers and understanding APRs, closing costs and loan features. Policy watchers will be looking to inflation readings and Fed communications for cues on whether yields will stabilize or head higher, directly influencing how expensive mortgages will be for the remainder of the housing cycle.

%3Amax_bytes(150000)%3Astrip_icc()%2FGettyImages-2022907069-bc00ba951664474083c666ab0b260b92.jpg&w=1920&q=75)