Kimball Electronics Doubles Profits, Boosting Local Economic Stability

Kimball Electronics reported a jump in quarterly net income to $10.1 million and a doubling of adjusted earnings per share, even as revenue edged down 2% year‑over‑year. The results, improved cash flow and lower debt strengthen the company’s local foothold in Dubois County and offer a measure of resilience for workers and suppliers amid automotive sector weakness.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

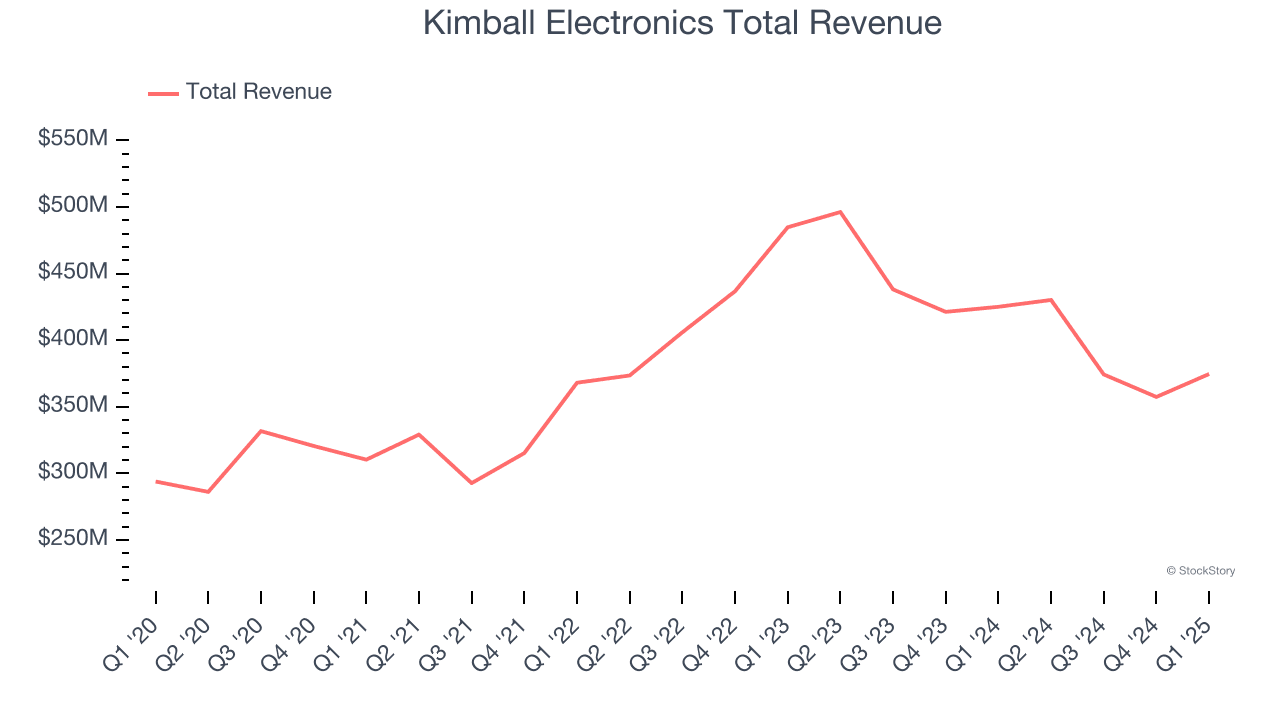

Kimball Electronics delivered stronger-than-expected profitability for the quarter ended Sept. 30, producing net income of $10.1 million, or $0.40 per share, up from $3.2 million, or $0.12 per share, a year earlier. On an adjusted basis, earnings per share rose to $0.49 from $0.22. Revenue for the quarter was $365.6 million, a 2 percent decline versus the same period last year, as automotive sales fell 10 percent while medical revenue increased 13 percent.

For Dubois County, where Kimball operates manufacturing and administrative facilities, the results matter beyond headline financials. The company reported seven straight quarters of positive operating cash flow and has reduced total debt to $138 million, the lowest level in more than three years. That combination of steady cash generation and a strengthened balance sheet improves Kimball’s ability to sustain local operations, preserve jobs and continue contracting with area suppliers at a time when parts of its end market are soft.

Management also reiterated full‑year fiscal 2026 guidance calling for $1.35 to $1.45 billion in sales and an adjusted operating margin of 4.0 to 4.25 percent. That outlook suggests management expects overall demand to remain roughly stable through the fiscal year, while continuing to prioritize margin recovery and cash generation. For local stakeholders, steady guidance can translate into predictable production schedules and support for ancillary businesses such as logistics, maintenance and local vendors.

The composition of revenue shifts is particularly relevant to the county’s economic mix. A 10 percent decline in automotive sales reflects broader industry cycles that have pressured auto‑component suppliers nationwide. Conversely, a 13 percent increase in medical revenue underscores a diversification that can buffer the company—and by extension the local economy—against cyclical automotive downturns. Continued strength in medical electronics could prompt hiring in specialized assembly and testing roles and create opportunities for workforce training partnerships with local educational institutions.

Market implications from these results are mixed. Improved profitability and lower leverage are favorable signals to investors and creditors, while the modest revenue decline and automotive exposure remain downside risks if industry conditions worsen. From a policy perspective, county economic development officials may view Kimball’s stabilized finances as a platform to pursue targeted initiatives that deepen ties with the medical electronics supply chain and mitigate sectoral risk.

In sum, Kimball Electronics’ latest quarter points to stronger earnings, healthier cash flow and reduced debt—factors that bolster the company’s local presence in Dubois County even as the broader industry mix shifts. The coming quarters will reveal whether medical growth can sustainably offset automotive softness and how that balance will affect jobs, suppliers and the county’s economic outlook.