Klimt Portrait Fetches $236.4 Million at Sotheby’s, Sets Modern Art Record

A Gustav Klimt portrait commanded $236.4 million at Sotheby’s New York sale, becoming the highest priced modern art work ever sold at auction and the second most expensive lot overall. The result underscores soaring demand for blue chip masterworks, reshapes market expectations and raises fresh questions about cultural value and the role of institutions.

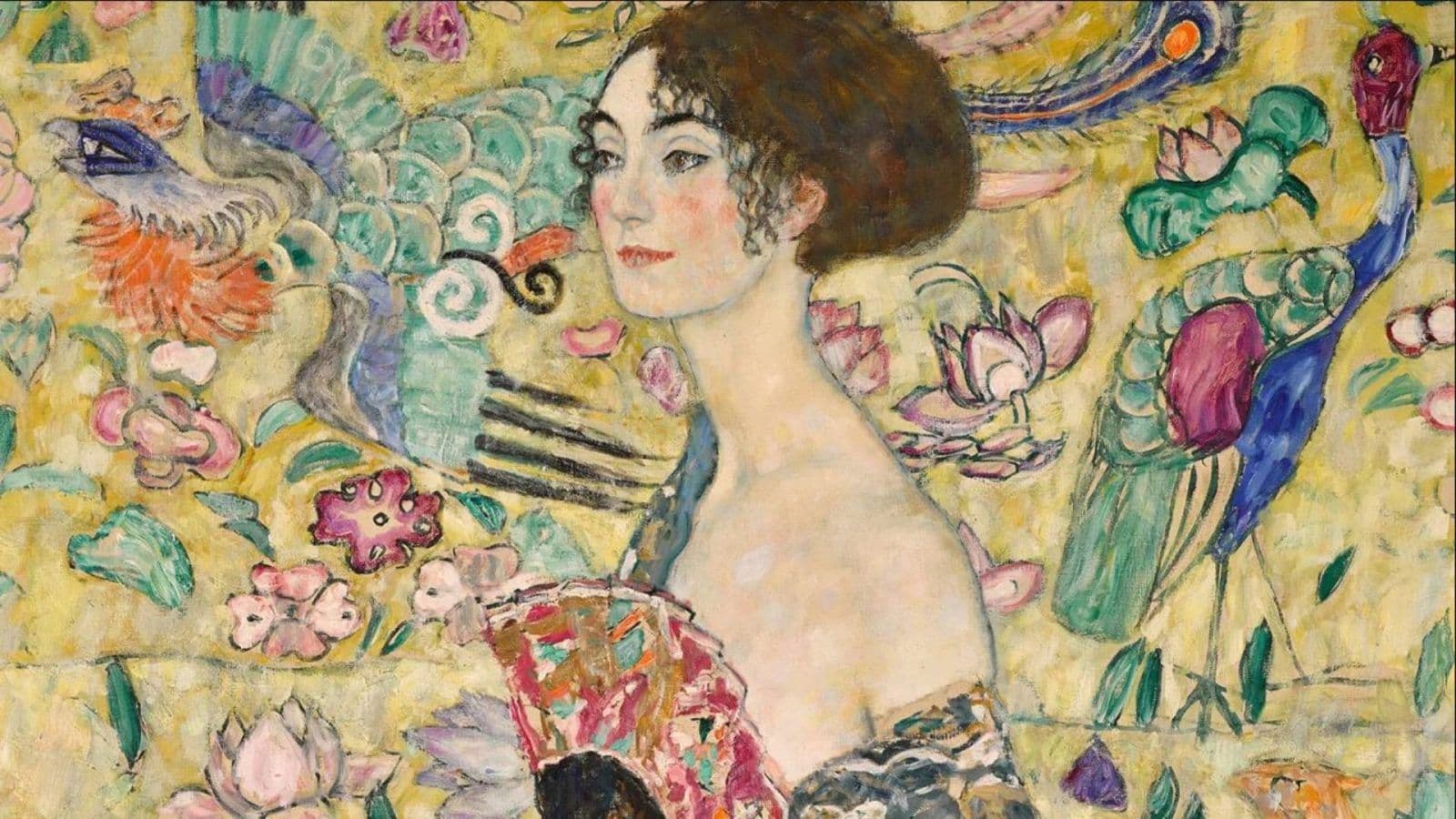

A Gustav Klimt portrait, Portrait of Elisabeth Lederer, sold for $236.4 million at Sotheby’s New York evening sale, establishing a new record for a modern art work at auction and ranking as the second most expensive lot ever sold at auction. The monumental painting, one of only two full length Klimt society portraits still in private hands, drew a 19 to 20 minute bidding war and blew past pre sale estimates, anchoring a marquee evening that marked Sotheby’s debut at the Breuer building.

The lot came from the Leonard A. Lauder collection, a trove of modern masterworks that has already reshaped museum galleries and philanthropic giving in recent years. The painting’s performance on the block is a clear statement about scarcity and provenance in today’s market. Collectors and dealers competed aggressively for a work that combines the rarity of a full length portrait with Klimt’s enduring cultural cachet, driving prices well beyond what underwriters and auction houses had anticipated.

The sale illuminated several ongoing trends in the art market. First, the appetite for canonical names is undiminished, and the market has shown a willingness to funnel massive sums into single visible lots. Second, auctions continue to be the arena where price discovery for trophy pieces is most dramatic. Third, the evening highlighted the coexisting appetite for both classical collectible painting and provocative contemporary works, a juxtaposition made evident when Maurizio Cattelan’s solid gold toilet titled America sold at the same sale for $12.1 million.

Those parallel results speak to a broader cultural dynamic. The Klimt price reinforces a hierarchy of cultural value that privileges certain historical narratives and aesthetics, even as contemporary artists command headlines with sensational objects. The two sales together symbolically bracket the conversation about what art firms as investment, what it means as cultural capital, and how public access to iconic works is negotiated between private collectors, museums and auction houses.

There are social and institutional implications as well. When individual works move for sums in the hundreds of millions, donor and acquisition priorities at museums can shift, and expectations about private collecting and philanthropy intensify. Large auction outcomes also revive questions about provenance and restitution more generally, since the top echelon of art is often intertwined with complicated histories. The prominence of the Lauder collection in this sale underlines how major private holdings continue to redirect the flows of masterpieces to new owners or to public institutions through gifts and sales.

For Sotheby’s, the evening at the Breuer building was more than a financial success, it was a signal of theatricality and market leadership. For the market as a whole, the Klimt sale recalibrates benchmarks and will likely influence estimates and strategies for consignors and buyers in the months ahead. The result confirms that in a market driven by rarity and reputation, a single painting can still reshape perceptions of value and the boundaries between art, wealth and public culture.