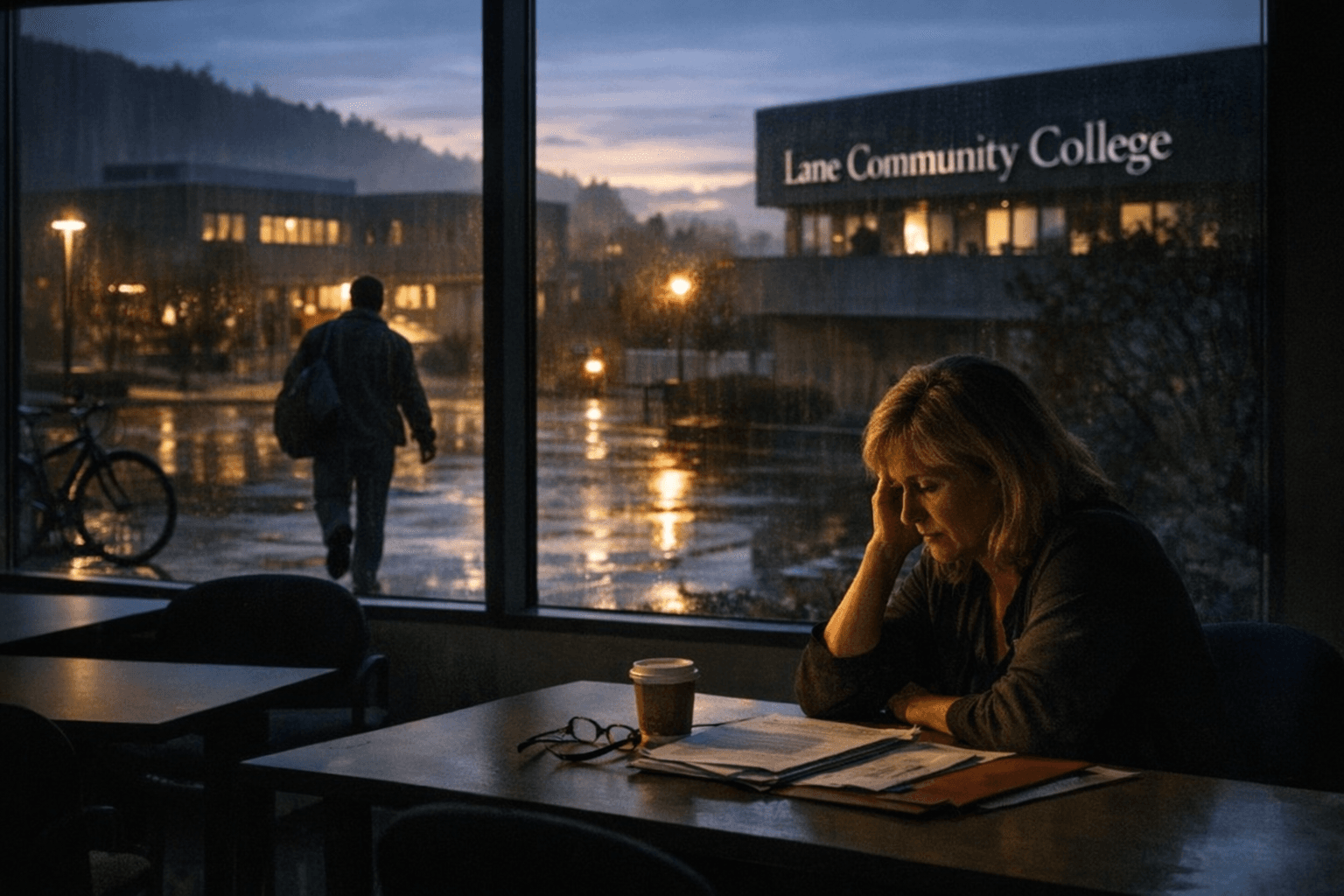

Lane Community College approves three-year plan to cut $8 million

Lane Community College approved a three-year plan cutting $8 million to restore a 10% ending fund balance. The move aims to stabilize finances and shape campus operations.

The Lane Community College Board of Education on Wednesday approved a three-year financial plan that reduces spending by $8 million and aims to generate a 10% ending fund balance each year. Board members framed the vote as a step to meet an explicit board policy that the ending fund balance be at, equal to, or greater than 10% of total expenditures and transfers.

Administrators told the board the spending reductions are designed to close a budget gap that has pressured college finances in recent cycles. The plan is intended to produce the targeted 10% balance annually, a level trustees said is necessary to maintain fiscal stability and meet policy requirements as enrollment and state funding remain uncertain.

Details presented to the board emphasized long-term stability as a priority. Administrators said they will align operations with the new spending plan, identifying where expenditures can be pared while preserving core instructional programs and essential student services. The board directed college leadership to move from plan to implementation with continuing oversight at future meetings.

For students, employees and community partners across Lane County, the approved plan signals changes to how the college will prioritize spending. Reductions of this size typically affect discretionary budgets, capital projects and operational spending before direct instructional dollars. The college has stated the goal is to protect classroom capacity and workforce training programs, but the precise distribution of cuts and any program-level impacts will become clearer as administrators present implementation details to the board.

The board vote closes one phase of LCC’s budget response but opens the next: execution and public accountability. Trustees will need to monitor actual year-end balances and adjust if revenues or spending trends shift. Community members and college employees should expect more detailed budget proposals and timelines from the administration, including how savings will be achieved and how the college will measure progress against the three-year target.

Our two cents? Watch the numbers and the details. The headline figure — $8 million in reductions and a 10% fund balance target — shows the college is trying to avoid deeper financial stress later, but the consequences will hinge on implementation choices. Attend upcoming board meetings, review posted financial reports, and ask administrators for clear timelines so residents and students can understand what the plan will mean for classes, services and the college workforce.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip