Laramie Council Weighs 1% SPET Measure for May Special Election

At its Jan. 6 City Council meeting, Laramie officials considered Resolution 2026-05 to place a countywide 1% Specific Purpose Excise Tax (SPET) proposition on the May 5, 2026 special election ballot. The resolution includes a detailed project list and budget information, a development that could affect local infrastructure priorities and the county tax picture if voters approve.

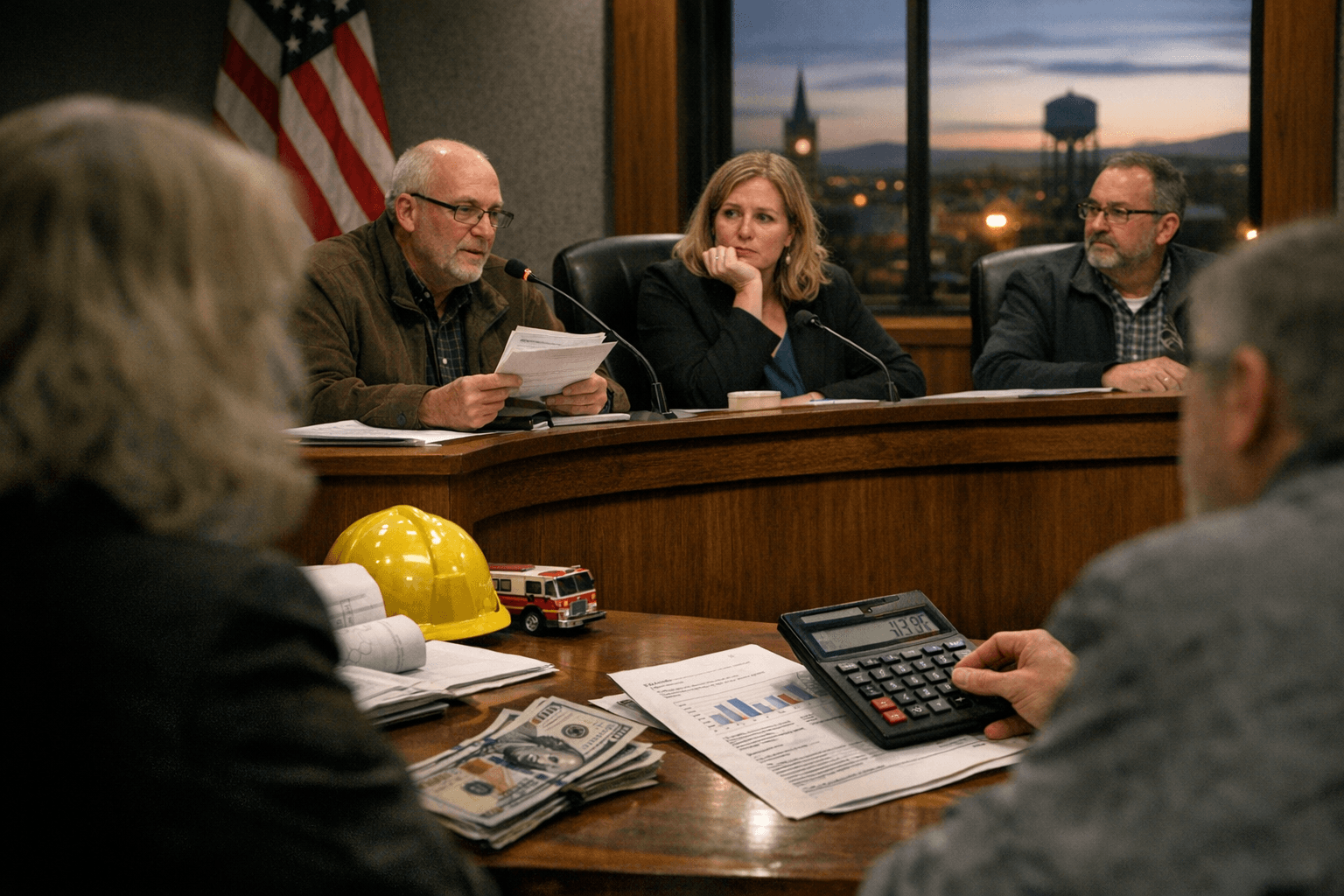

The Laramie City Council met in the City Hall Council Chambers on Jan. 6 and considered a package of municipal actions centered on a proposed 1% Specific Purpose Excise Tax for Albany County. Resolution 2026-05 would authorize placement of a SPET proposition on the May 5, 2026 special election ballot and is accompanied by a two-page summary and an 18-page proceedings document containing the full resolution, a detailed project list, legal authority and budget and fiscal information.

Council discussion of the SPET item focused on the mechanics of placing the tax before voters and on the project and budget details that would determine where new revenue would be allocated if the measure passes. The proceedings present the legal framework the city would use to impose the tax and an itemized set of projects tied to the revenue stream. Voters in Albany County will decide the proposition at the May special election, and the outcome will shape whether the listed projects move forward using the proposed SPET revenue.

Other matters on the Jan. 6 agenda included routine meeting logistics, appointments to the Traffic Safety Commission, a community partner funding application, an ordinance related to surface water drainage, and additional scheduling items. The traffic safety appointments will affect local oversight of traffic-related policies and projects, while the surface water drainage ordinance signals attention to stormwater management and related development standards that can have direct implications for property owners and public infrastructure planning.

For Albany County residents, the most immediate impact will be the May 5 ballot. A decision to approve the 1% SPET would redirect specific excise-tax revenue toward projects outlined in the resolution and accompanying proceedings. Those materials include the fiscal analysis intended to show projected revenues and how funds would be allocated across the listed projects. If voters reject the measure, the city and county will need to consider alternative funding strategies for those priorities.

The council's January meeting set a clear timetable for public consideration: the SPET proposition will be on the May special election ballot, and related municipal actions remain subject to further administrative scheduling and public engagement. Residents seeking detail on the proposed projects and fiscal implications should review the resolution and proceedings provided by the city ahead of the election to understand what a vote for or against the SPET would mean for local services and capital investment.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip