Lewis and Clark Homeowners Eligible for 2026 Homestead Tax Reduction

State tax guidance issued Jan. 7 clarified that Montana homeowners could apply beginning Dec. 1, 2025 for the 2026 homestead reduced tax rate, with a required attestation that the property will be the owner’s principal residence for at least seven months during 2026. The guidance requires specific property and owner identification and notes that most properties receiving the 2025 property tax rebate will generally qualify automatically, but homeowners should verify eligibility and complete any required application steps.

State tax guidance made available in early January confirmed that Montana homeowners may seek the 2026 homestead reduced tax rate, with applications accepted beginning Dec. 1, 2025. The reduction applies to owner-occupied principal residences and carries a seven-month occupancy attestation for calendar year 2026, a requirement homeowners must affirm when applying.

To complete an application, property owners must provide the property’s physical address, the property geocode, and owner names along with Social Security numbers or other required identification information. The inclusion of geocodes and federal identification information is intended to match claims to parcel records and prior program participation. The guidance also states that properties which qualified for the 2025 property tax rebate will generally qualify automatically for the 2026 homestead reduced rate, although homeowners are encouraged to check their individual eligibility and submit any required paperwork as directed by state tax authorities.

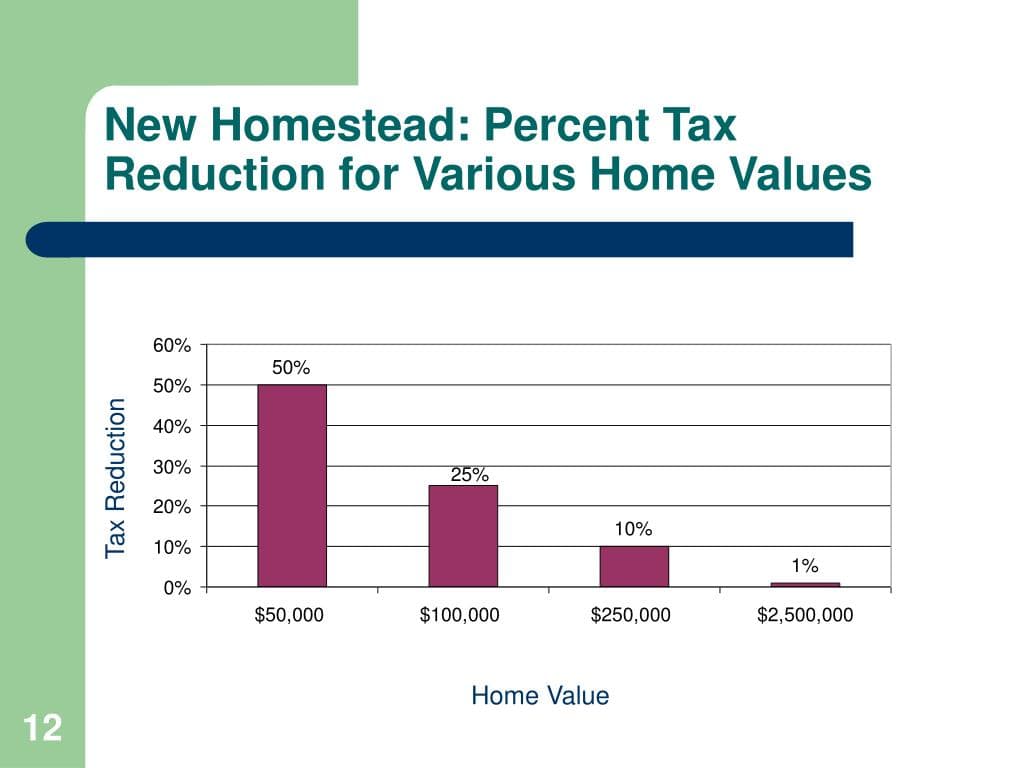

For residents of Lewis and Clark County, the development matters for household budgets and for local tax administration. Households that qualify for the homestead reduced rate can expect a lower assessed tax burden on their primary residence, while county officials will need to reconcile state-level adjustments with local property rolls. Because applications require sensitive personal information, homeowners should confirm secure submission methods and clarify how identification data will be handled and protected by state systems.

Local government offices, including the county assessor and treasurer, play a practical role helping residents identify parcel geocodes and confirming prior rebate status. Homeowners who are unsure whether their property qualified for the 2025 rebate or who cannot locate a geocode should contact county offices for assistance. The state tax department’s homestead application pages provide the official application steps and any additional documentation requirements.

Transparency in application processing and clear public communication will be important in the coming weeks as residents verify eligibility and submit applications. Homeowners should review the state guidance, confirm the information required, and apply or confirm automatic qualification to ensure they receive the appropriate reduced rate for 2026. County offices are likely to be the first point of contact for many residents seeking help with parcel identifiers or questions about past rebate status.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip