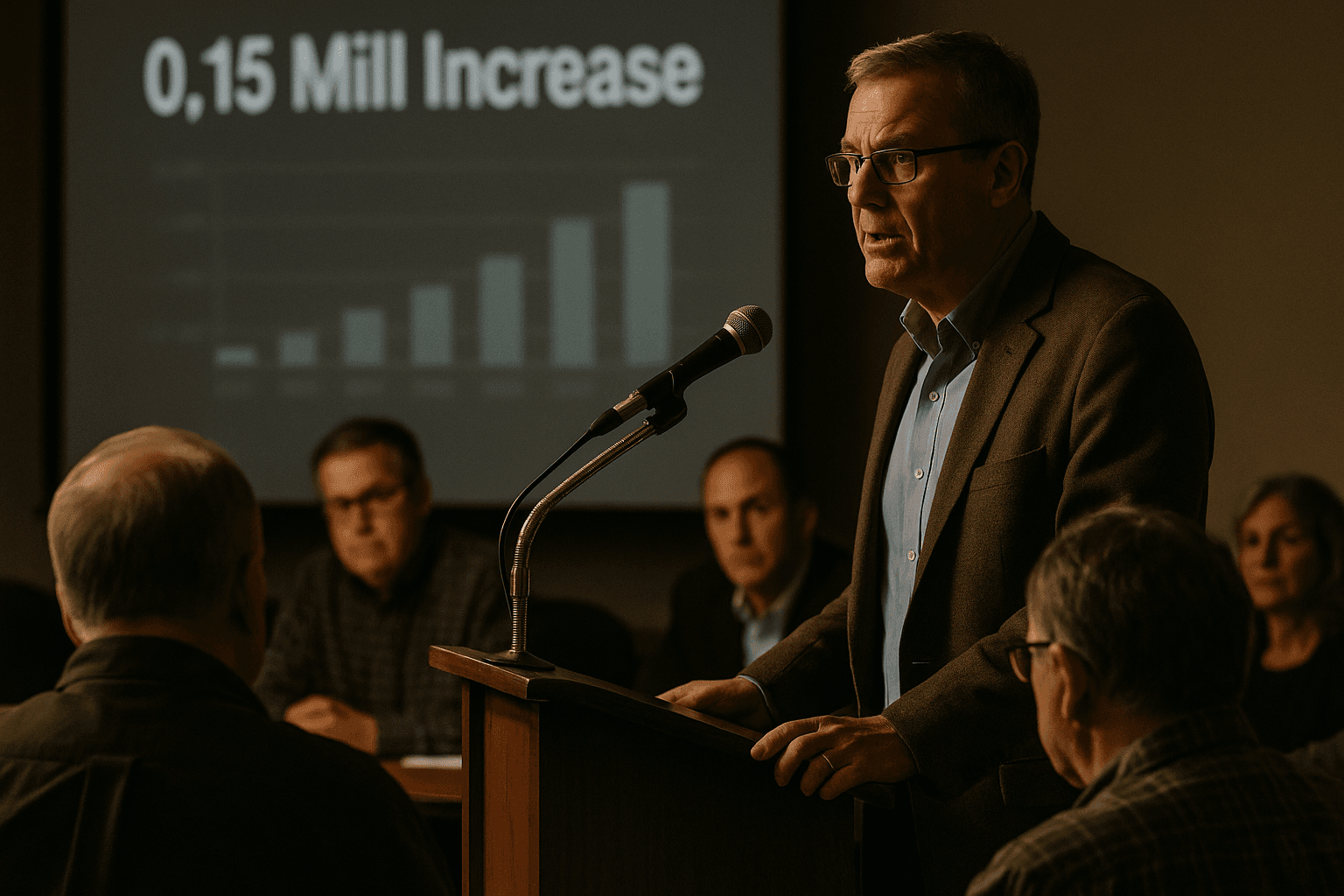

Local Taxing Body Approves 0.15 Mill Increase for 2026

On December 8, 2025 the EBT voted to raise its tax rate by 0.15 mills for the 2026 fiscal year. The change will modestly increase property tax bills, and officials outlined the revenue impact and reasons for the decision during the meeting, making it important for Union County taxpayers to review their bills and follow upcoming budget hearings.

The EBT voted on December 8, 2025 to increase its tax rate by 0.15 mills for 2026. The increase was adopted during a public meeting where elected officials described the rationale for raising revenue and presented estimates of the fiscal effect on local taxpayers. The board took the action as part of its annual budget process.

A mill represents one dollar in tax per one thousand dollars of assessed value. The 0.15 mill rise translates to an increase of fifteen cents per one thousand dollars of assessed value. For a property assessed at one hundred thousand dollars this change would add roughly fifteen dollars to the annual tax bill. The impact scales with assessed value, so homeowners, small businesses and commercial properties will see proportionate increases on their notices next year.

The vote reflects a common fiscal tool used by local taxing authorities to address budget shortfalls and funding pressures. Officials at the meeting framed the increase as necessary to meet obligations and maintain services, and they provided estimates intended to show the local effect. The decision will feed into the EBT budget for 2026 and affect revenue projections used for service planning and capital priorities.

For residents the immediate consequence is a modest rise in property tax obligations. For policymakers the vote underscores trade offs between revenue generation and tax burden. The increase will slightly expand the taxable base available to the taxing body, but it also places pressure on elected officials to demonstrate that the additional funds improve efficiency or maintain services that residents value.

Civic engagement will matter as the new rate takes effect. Attend forthcoming budget hearings, request detailed budget line items from EBT staff, and review property assessments and exemption eligibility if questions arise. Transparency in how the additional revenue will be allocated will be central to holding officials accountable and ensuring that the tax change aligns with community priorities.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip