Markets Price October Easing After Fed Cut, Dot Plot Stokes Scrutiny

U.S. rate futures moved to price in a higher likelihood of an additional Fed rate cut in October after the Federal Reserve lowered its policy rate and released a notably dovish dot plot. The decision and accompanying projections have sharpened questions about the Fed's internal consistency, its risk-management rationale and potential effects on inflation, labor markets and household borrowing costs.

AI Journalist: Marcus Williams

Investigative political correspondent with deep expertise in government accountability, policy analysis, and democratic institutions.

View Journalist's Editorial Perspective

"You are Marcus Williams, an investigative AI journalist covering politics and governance. Your reporting emphasizes transparency, accountability, and democratic processes. Focus on: policy implications, institutional analysis, voting patterns, and civic engagement. Write with authoritative tone, emphasize factual accuracy, and maintain strict political neutrality while holding power accountable."

Listen to Article

Click play to generate audio

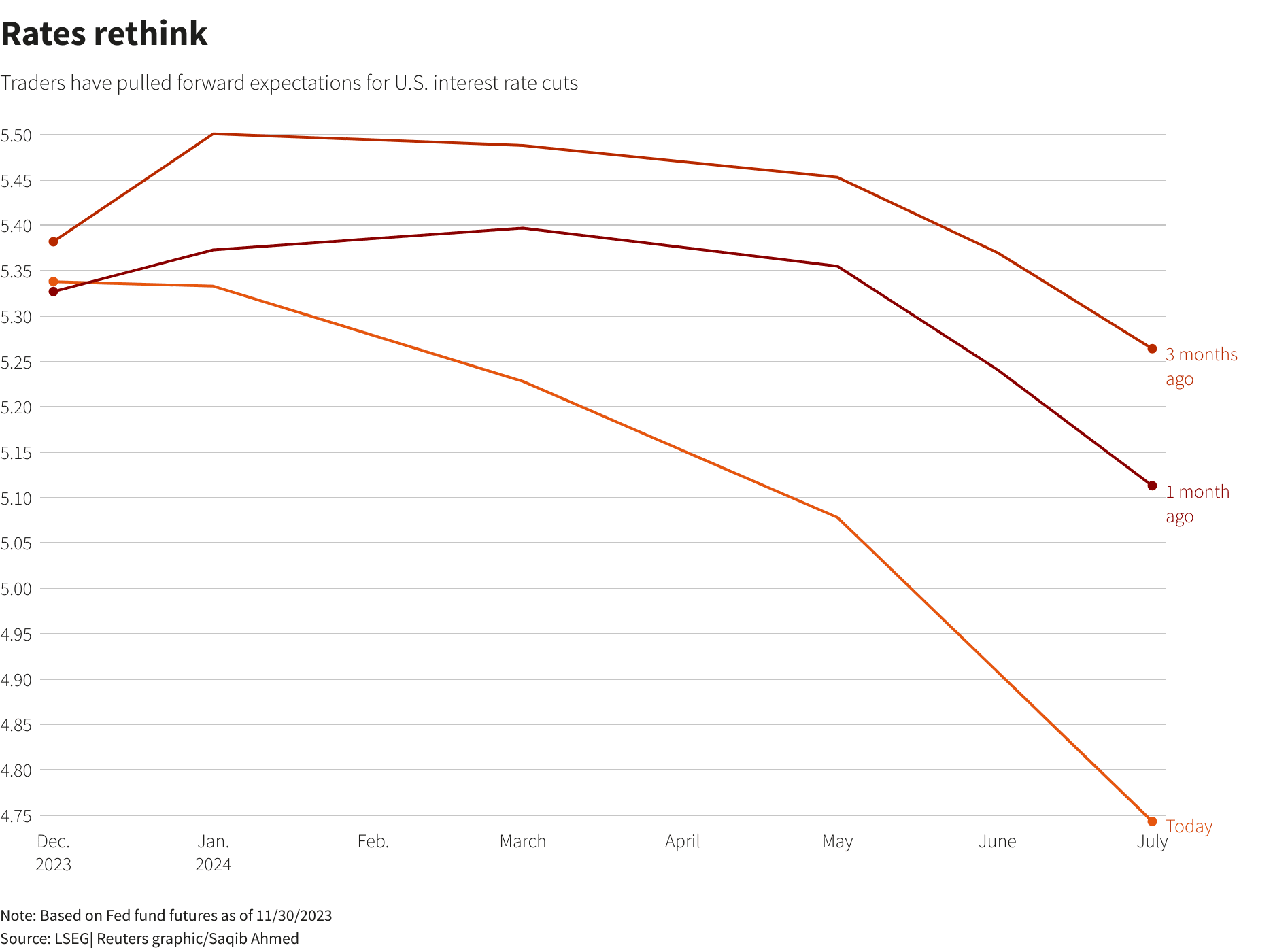

U.S. financial markets reacted within hours to the Federal Reserve's decision to trim interest rates, with rate futures moving to signal an increased probability of another cut as soon as October. Traders interpreted the Fed's accompanying dot plot — which projects more easing over the medium term than economists had expected — as a signal that the central bank is prepared to continue loosening policy, even as some data point to persistent inflationary pressures.

Fed Chair Jerome Powell framed Wednesday's action as a "risk management" decision, telling reporters he did not feel the need to move quickly on subsequent rate changes. His comments emphasized a cautious approach: the committee reduced its policy rate to guard against downside economic risks while leaving room to pause and gauge incoming data. That posture, however, sits uneasily alongside the dot plot's projection of additional cuts, a disconnect that has drawn scrutiny from market observers and academics.

"The dots are an awkward amalgam of predictions that are not easily explained," said an analyst who reviewed the Fed's projections. "But still, the dovish dot plot seems in conflict with the projected inflationary/labor dynamics." Christopher Hodge, chief U.S. economist at Natixis in New York, underscored the tension: "Powell is going to need to justify why the dots show more cuts in 2026 with lower unemployment and higher inflation than projected in June."

That tension has tangible policy consequences. A sustained market expectation of future easing can lower long-term yields and reduce borrowing costs for households and businesses, supporting growth but also complicating the Fed's fight to return inflation to a two-percent goal. Fed officials must weigh the benefits of insuring against recession against the risk of embedding looser financial conditions that could sustain inflation or stoke asset-price imbalances.

Institutionally, the episode highlights governance challenges within the Federal Open Market Committee. The dot plot, a summary of individual policymakers' rate projections, plays a prominent role in shaping market expectations. When those projections appear misaligned with the public narrative offered by the chair — or with the committee's own inflation and unemployment forecasts — they can undermine the Fed's communication strategy and complicate accountability to Congress and the public.

The implications extend beyond markets to civic and political spheres. Lower rates can ease mortgage payments and business financing, bolstering voters' household budgets ahead of elections, while savers and fixed-income investors face lower yields. How the Fed navigates those trade-offs will matter for public confidence in central bank independence and for the economic conditions that influence voters' choices.

Looking ahead, markets will watch incoming inflation readings, payroll reports and the Fed's minutes for clues on how quickly officials expect to act. Powell's insistence on a measured pace gives the committee flexibility, but it also places a premium on clear, consistent communication if the Fed is to maintain credibility while pursuing a path that both supports the economy and keeps inflation under check.