Medicare Advantage Insurers Defy Headwinds and Rapidly Expand

A subset of Medicare Advantage insurers is growing enrollment and geographic reach even as rivals retrench, reshaping competitive dynamics in the senior health-care market. That expansion matters for beneficiaries, hospitals and federal spending because it accelerates private-plan penetration of Medicare and concentrates market power among a smaller group of aggressive players.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Several Medicare Advantage insurers are pursuing expansion strategies that run counter to broader industry retrenchment, according to reporting in Modern Healthcare. These carriers are increasing network footprints, beefing up supplemental benefits and making targeted investments in care management, betting that scale and product differentiation will deliver profitable growth even as regulatory scrutiny and reimbursement volatility rise.

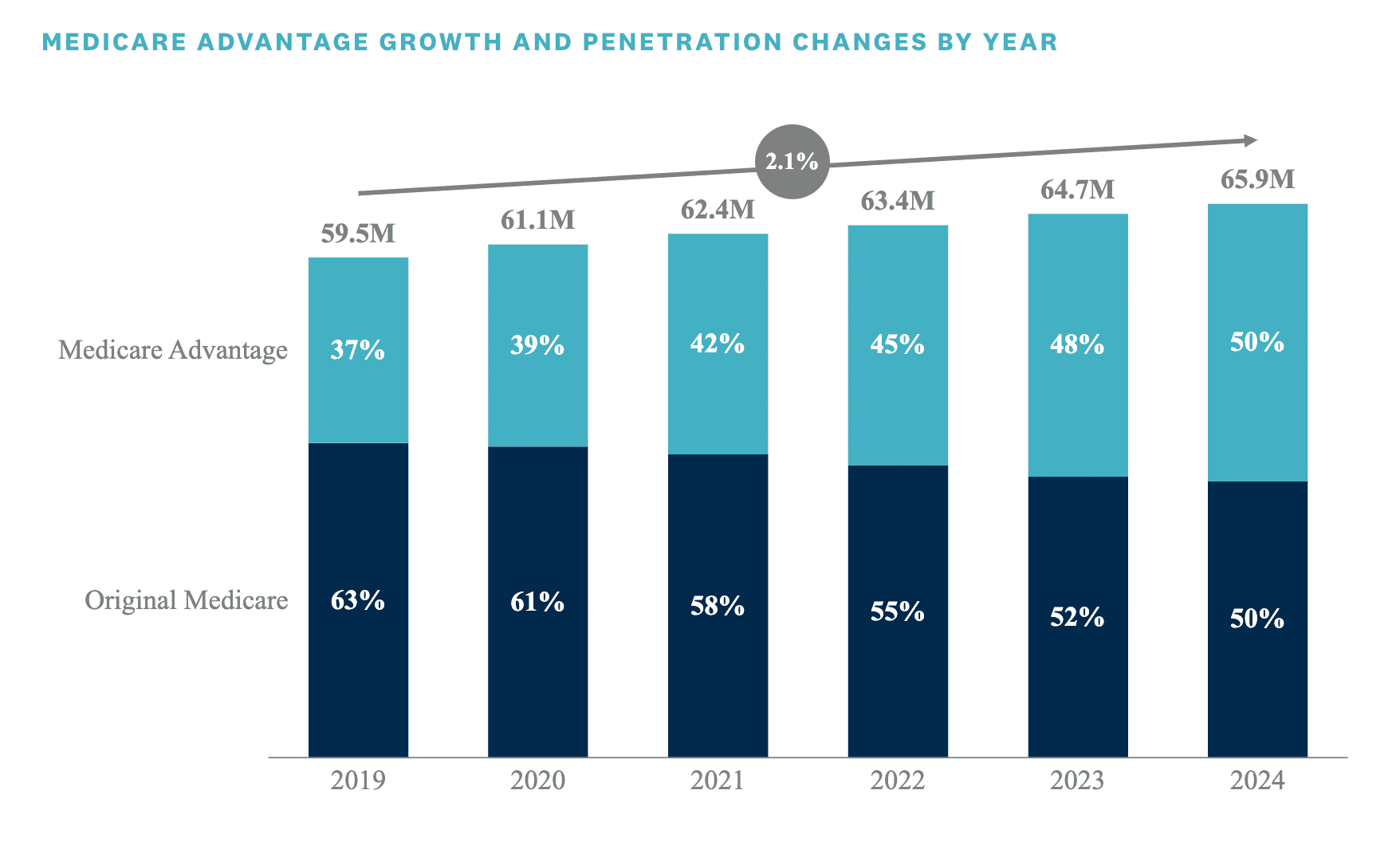

Medicare Advantage has been the fastest-growing segment of the nation’s Medicare program for years, and private plans now cover roughly half of beneficiaries. That secular shift has created a crowded, competitive market in which some firms have pulled back from unprofitable counties, while others are doubling down. The insurers expanding now tend to be those with sophisticated risk-adjustment analytics, deeper capital reserves and integrated care capabilities that allow them to manage chronic conditions more tightly and lower medical-loss ratios.

Market incentives favor larger, data-driven operators. Federal payments to Medicare Advantage plans are tied to risk scores and encounter data, which rewards firms that can accurately document enrollee complexity and deploy interventions that reduce costly utilization. Insurers that have invested in population health platforms, home- and community-based services, and value-based contracting with physician groups report stronger margins and greater confidence to expand into new regions. Those moves shift negotiating leverage toward private plans in local markets, with downstream effects on hospitals and independent physician practices that increasingly rely on MA referrals and capitation.

The current expansion comes amid heightened policy risk. Regulators have signaled interest in reining in aggressive risk coding and enhancing oversight of supplemental benefit design, and the Centers for Medicare & Medicaid Services continues to refine payment methodologies tied to social risk and encounter data. Any tightening of auditing, payment reductions or changes to star-rating incentives would compress margins and could force a re-evaluation of expansion plans. For now, however, insurers with diversified business models and robust analytics see a window to capture membership as traditional Medicare’s market share declines.

For hospitals and health systems, the advance of a concentrated set of MA leaders poses both opportunity and pressure. Stronger plan markets can channel more referrals into integrated networks and create steady revenue via value-based contracts, but they also increase bargaining power to demand lower unit prices and tighter utilization controls. Rural and safety-net hospitals remain particularly exposed if dominant plans steer patients to narrower networks or telehealth-first care models.

Longer-term implications extend to federal finances and beneficiaries’ access to care. Greater penetration of Medicare Advantage affects the profile of federal spending, shifting more beneficiaries into capitated arrangements that can slow acute-care cost growth but raise questions about service limits, prior authorization and the scope of supplemental benefits. Policymakers will need to balance incentives for efficient care management against protections for beneficiary choice and access.

As some insurers grow, the industry is simultaneously testing the boundaries of regulatory tolerance and market sustainability. The outcome will determine whether Medicare’s private-plan experiment continues to expand benignly or prompts more aggressive policy responses to safeguard program integrity and patient access.