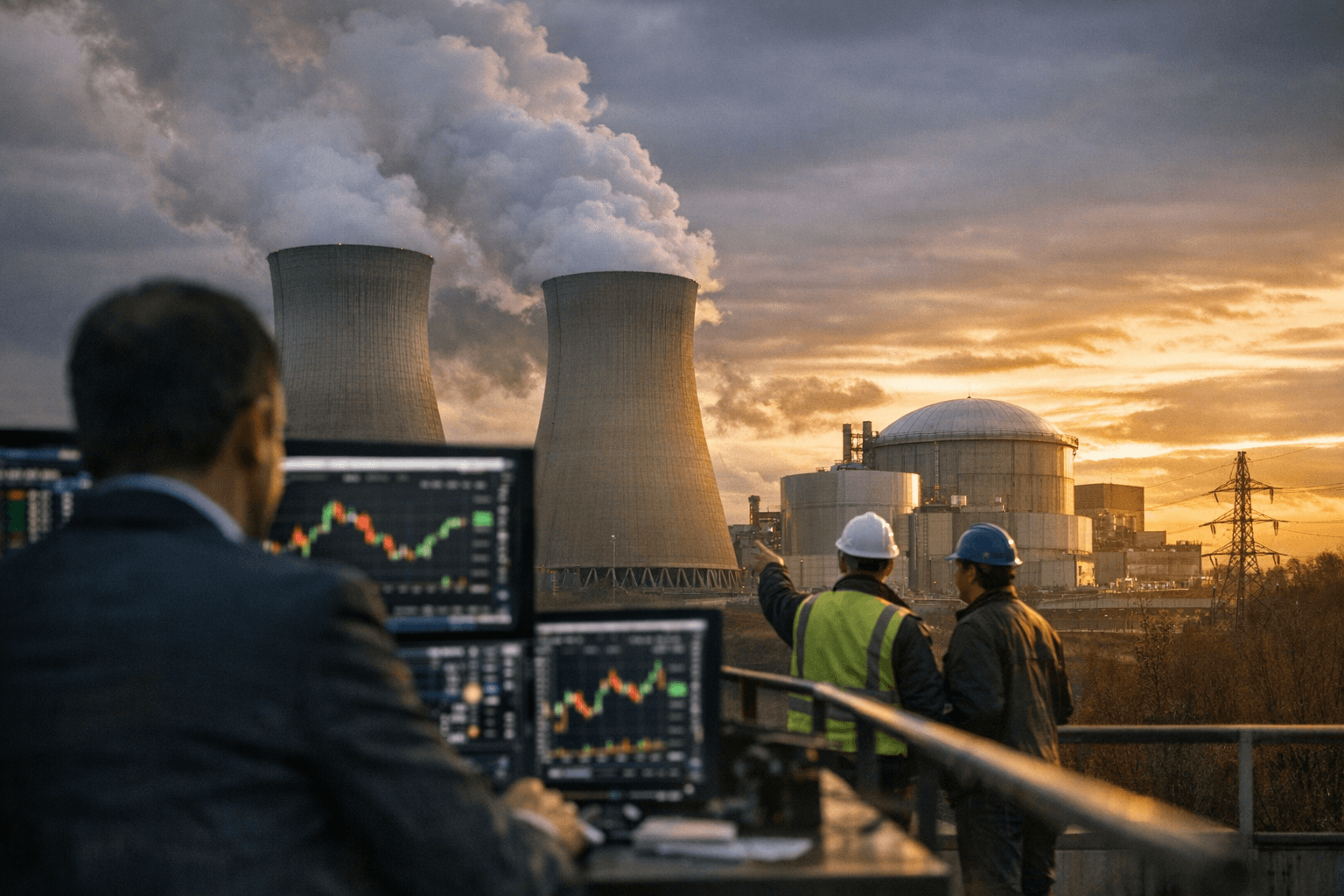

Meta’s Nuclear Deals Propel SMR Stocks and Utilities Higher, Shaking Markets

Meta’s announced commitments to support small modular reactors and existing nuclear utilities on January 9 triggered sharp market moves as investors priced in faster project timelines and reduced financing risk. The shockwave highlights how corporate offtake and capital can alter energy project economics, reshape power markets and press policymakers to accelerate permitting and grid planning.

Meta’s disclosure on January 9 that it had signed agreements involving offtake and funding for nuclear projects sparked a pronounced repricing across energy and financial markets on January 9. Investors treated the commitments as a potential risk-reduction mechanism for small modular reactor developers and a long-term demand underpin for utility-scale nuclear plants, sending shares of SMR-focused firms and nuclear utilities sharply higher and trading volumes well above recent averages.

On the day of the announcement, SMR developer stocks rose broadly in the range of about 20 percent to as much as 40 percent intraday, while larger incumbent nuclear utility names climbed roughly 8 percent to 15 percent. Nuclear-focused exchange-traded funds and supplier stocks posted double-digit gains, and trading volumes in the sector were commonly two to four times their three-month medians, according to market proxies. Credit spreads on some corporate bonds issued by utilities and reactor vendors tightened, reflecting investor expectations of reduced construction and revenue risk when large corporate customers commit to offtake or provide capital.

Analysts said Meta’s involvement could materially lower financing costs for early-stage projects by improving cash-flow visibility and making developers more attractive to banks and institutional lenders. Under typical project finance models, credible long-term offtake agreements can compress debt yields and reduce equity risk premiums, potentially shortening time-to-finance and cutting the levelized cost of electricity by a material margin for first-of-a-kind SMRs. That recalibration matters because one of the main barriers to new nuclear deployment in recent decades has been high upfront capital intensity and financing uncertainty.

The market reaction also reanimated debates over energy policy and permitting. Federal incentives introduced earlier this decade - including production tax credits, loan programs and targeted research funding - have already nudged private capital toward advanced nuclear. Meta’s move puts pressure on regulators to accelerate licensing reviews and on grid operators to plan for integrating firm low-carbon capacity where it can replace or complement gas-fired peakers. At the same time, supply-chain constraints for key components and skilled labor remain binding; faster deployment will require coordinated industrial policy and workforce investment.

For corporations, the deals illustrate an emerging model: large electricity consumers securing long-duration, firm zero-carbon power directly as part of their decarbonization strategies. Data centers and cloud infrastructures have driven substantial incremental electricity demand; global data centers consume roughly 1 percent of global electricity, and that share has been rising with electrification across the economy. For investors, the episode underscores how corporate procurement can act as a catalyst, moving capital into technologies that are otherwise considered too risky on a stand-alone basis.

Longer term, widespread replication of Meta-style commitments could reduce financing frictions for a new wave of nuclear projects, change merchant power-price dynamics by adding low-variable-cost firm capacity, and accelerate a structural shift toward low-carbon baseload supply. But the ultimate scale-up will depend on execution: project construction performance, regulatory timelines, and the ability of policy to address supply-chain and siting bottlenecks. Markets have priced in hope for now; the next test will be whether contracts translate into completed reactors and sustained generation.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip