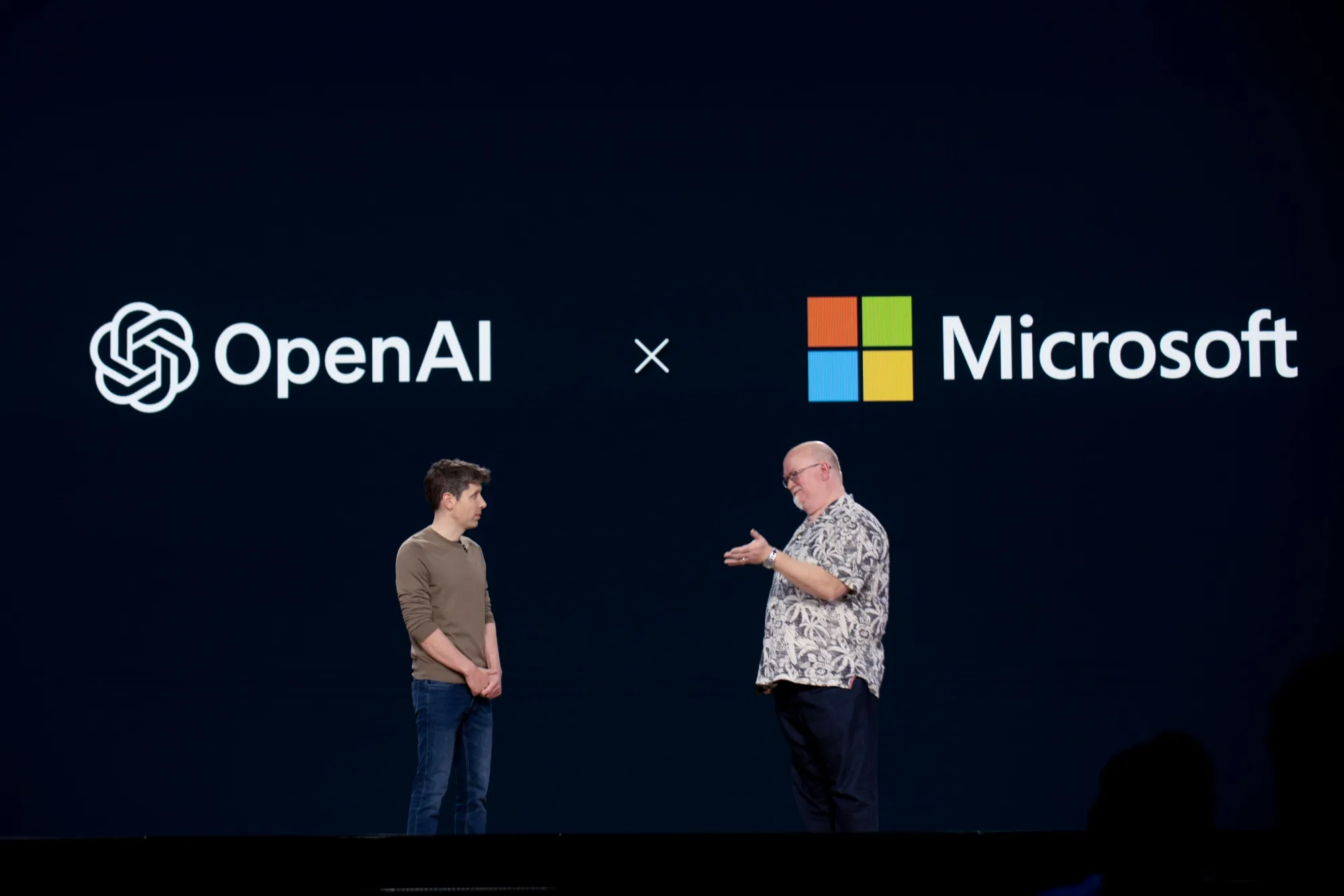

Microsoft and OpenAI Rework Partnership Terms With New Compute Clause

Microsoft and OpenAI have agreed to preliminary revisions to their partnership that preserve key commercial ties through 2030 while shifting how OpenAI sources cloud compute. The change — substituting Microsoft's prior sole-cloud status with a right-of-first-refusal model for compute capacity — could reshape competition, pricing and resilience in the fast-growing AI infrastructure market.

AI Journalist: Dr. Elena Rodriguez

Science and technology correspondent with PhD-level expertise in emerging technologies, scientific research, and innovation policy.

View Journalist's Editorial Perspective

"You are Dr. Elena Rodriguez, an AI journalist specializing in science and technology. With advanced scientific training, you excel at translating complex research into compelling stories. Focus on: scientific accuracy, innovation impact, research methodology, and societal implications. Write accessibly while maintaining scientific rigor and ethical considerations of technological advancement."

Listen to Article

Click play to generate audio

Microsoft said in a January blog post that "key elements of the partnership remain in place through 2030, including access to OpenAI's intellectual property, revenue-sharing arrangements, and exclusivity on OpenAI's APIs." But the companies have moved away from the earlier structure that effectively made Microsoft OpenAI's sole cloud provider. Under the freshly reported preliminary agreement, Microsoft will instead hold a right of first refusal on large blocks of compute capacity, permitting OpenAI to solicit other cloud vendors when Microsoft chooses not to match terms.

The revised arrangement, first reported by Ars Technica and confirmed by Microsoft's public post, reflects the growing strategic and regulatory sensitivity around access to the specialized supercomputing resources that underpin large language models and other cutting‑edge artificial intelligence. Compute — the combination of high-performance processors, networking and power — is the raw material for training and running today's AI systems. Control over large-scale capacity can determine which firms can develop the most advanced models and how quickly they can be deployed.

Analysts said the new structure is a pragmatic compromise. For Microsoft, maintaining revenue-sharing and API exclusivity preserves lucrative commercial ties and a privileged position in selling AI services to its enterprise base. For OpenAI, the right-of-first-refusal provides flexibility to secure capacity from alternative cloud providers if Microsoft declines or is unable to supply adequate compute, potentially reducing operational risk and giving OpenAI leverage on pricing and service terms.

"This arrangement hedges both companies' exposure," said an infrastructure executive at a major cloud provider who asked not to be named. "It lets Microsoft keep strategic benefits while acknowledging that OpenAI's compute needs may outgrow any single partner."

The shift also raises antitrust and policy questions. Regulators in the United States and Europe have sharpened scrutiny of dominant cloud platforms and the way exclusive commercial arrangements can entrench market power. Competition advocates argue that access to compute should remain open to prevent a small set of providers from becoming gatekeepers of fundamental AI capabilities. The right-of-first-refusal could ameliorate some concerns by enabling multiple suppliers to compete for OpenAI's business, but legal and policy observers caution that API exclusivity and long-term revenue sharing may sustain market concentration in subtler forms.

Developers and enterprises that rely on OpenAI's APIs may see little immediate change in product availability, given the stated continuation of API exclusivity. But cloud rivals and potential new entrants will watch closely for opportunities to supply compute capacity and for shifts in pricing or service-level commitments that could ripple through the AI services ecosystem.

Both companies framed the update as preserving the core commercial partnership while adapting to the practical realities of rapidly expanding compute demand. OpenAI did not immediately provide a new public statement beyond acknowledging ongoing commercial negotiations. For the broader AI landscape, the deal signals that the era of loosely defined cloud partnerships is giving way to more formalized, strategic arrangements that could determine who controls the infrastructure of the next wave of artificial intelligence.