Mortgage Rates Hold, Jumbo Loans See Modest Decline

Mortgage rates were largely steady on November 12, 2025, while jumbo loan rates ticked down, easing borrowing costs for high value home buyers. The small movement matters for affordability and refinancing calculations, particularly for borrowers weighing the one time cost of switching loans.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

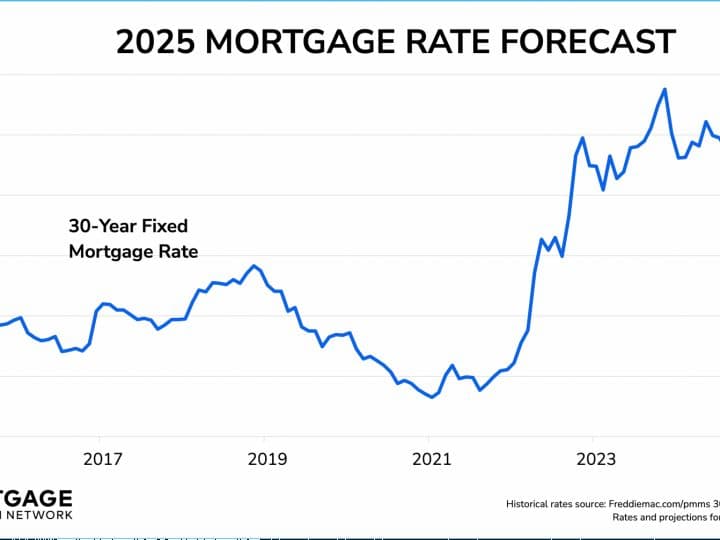

Mortgage rates showed stability on November 12 as the national market remained anchored near multi year highs, with a modest reprieve for jumbo borrowers that could influence the upper end of the housing market. The average interest rate on a 30 year fixed rate jumbo mortgage, which applies to loans above the 2025 conforming loan limit of $806,500 in most areas, is 6.68 percent. That compares with 6.74 percent a week earlier, a decline of 0.06 percentage point.

For borrowers using jumbo financing the practical impact is measurable. At the current jumbo rate, a borrower would pay $644 per month in principal and interest for each $100,000 borrowed, translating to $132,228 in total interest over the life of the loan. Those figures underscore how even small moves in rates compound over 30 years for large loan balances.

Across the broader market the average rate on a 30 year fixed mortgage stands at 6.31 percent, down from 6.32 percent a week ago, according to the Mortgage Research Center. The 30 year rate therefore eased by 0.06 percentage point in the same reporting period. The annual percentage rate on a 30 year fixed mortgage is reported at 6.34 percent this week, unchanged from last week, reflecting lender fees and other costs in addition to the headline interest rate.

Borrowers seeking faster payoff saw a larger weekly movement. The average rate on a 15 year fixed mortgage fell to 5.42 percent, a decline of 0.35 percentage point from the previous week, which can meaningfully reduce total interest paid and shorten amortization for those who can manage higher monthly payments.

The incremental declines leave the refinance calculus finely balanced. Lender fees and closing costs can erase the savings from a small reduction in rate, so borrowers are advised to compare their existing loan terms with current market rates and factor in the APR, which captures both interest and fees. For many homeowners the decision will hinge on how long they plan to hold the property and whether the monthly savings justify the upfront expense.

From a market perspective the split between jumbo and conforming rates remains important. The current spread of roughly 0.37 percentage point between jumbo and conventional 30 year rates reflects lender risk management and liquidity for larger loans. Modest declines in jumbo rates can help support demand at the top of the market, where affordability has been most strained by elevated prices and mortgage costs.

Looking ahead investors and borrowers will watch Treasury yields and central bank guidance for direction. While rates are off the troughs seen earlier in the decade, small week to week movements continue to influence housing demand, refinancing activity, and credit availability, particularly for buyers and owners whose decisions depend on the margin between current rates and their existing mortgage.