Mortgage Refinance APR Edges Up to 6.42 Percent, Refinancing Stays Costly

The annual percentage rate on a 30 year, fixed rate mortgage rose to 6.42 percent from 6.39 percent last week, signaling only a modest uptick but reinforcing the high rate environment homeowners face. With national averages lingering in the mid to high 6 percent range for most of 2025, borrowers must weigh fees and timing carefully before refinancing.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

The annual percentage rate on a 30 year, fixed rate mortgage climbed to 6.42 percent on November 11, up from 6.39 percent a week earlier, according to daily market tallies. The APR measures the all in cost of a home loan, the interest rate including any fees or extra costs, and is a more comprehensive gauge for borrowers than the headline interest rate alone.

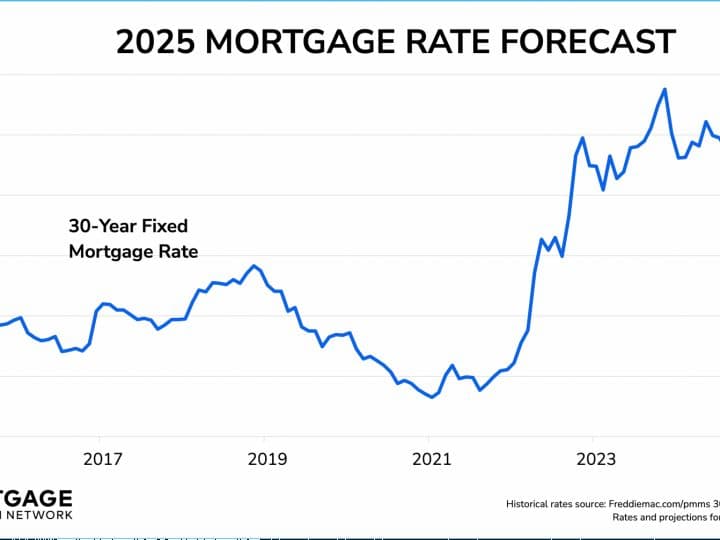

Mortgage rates have spent most of 2025 in the mid to high 6 percent range, and industry observers predict that pattern will persist for the remainder of the year. That backdrop has narrowed the potential savings window for homeowners considering refinancing, especially when origination fees and closing costs are included. Small moves in the APR can materially change the break even horizon for a borrower, shifting the calculus on whether refinancing pays off over time.

The recent uptick is modest in absolute terms, but it comes amid a steady structural shift in borrowing costs since the 2020s low rate era. Long term yields, which help determine mortgage pricing, have remained elevated relative to the early 2020s, reflecting a combination of tighter central bank policy, firmer inflation readings earlier in the year, and ongoing demand dynamics in the Treasury and mortgage backed securities markets. Those forces have kept mortgage lenders cautious and pricing centered in the current band.

For borrowers, the APR movement underlines two practical points. First, the difference between advertised interest rates and APRs matters. A lower advertised rate accompanied by high fees can yield a higher APR and a longer time to recoup costs. Second, not all refinance options are equivalent. Some loans tend to offer lower interest rates, and lender competition remains a feature of the market with comparison shopping a necessary step. Industry lists such as the Best Mortgage Refinance Lenders of 2025 continue to be a resource for borrowers seeking to match loan features and fees to their financial plans.

Market implications extend beyond individual households. Persistently elevated mortgage costs can weigh on housing turnover, as sellers and buyers face higher financing headwinds. Lower mobility can constrain supply in some markets, supporting home prices even as affordability challenges deepen. On the flip side, reduced refinancing activity can dampen the flow of mortgage backed security issuance, influencing secondary market liquidity and spread dynamics.

Policy decisions will remain central to how this story evolves. If the central bank signals a clear shift toward easing and long term yields fall, mortgage rates could trend lower, improving refinance prospects. Conversely, if inflation forces a longer period of tighter policy, rates are likely to stay in the current band, keeping refinancing opportunities limited to those with a clear financial gain after fees.

For prospective refinancers, comparing APRs, calculating break even points, and evaluating total costs remain the most reliable steps in a market where small percentage changes carry large dollar consequences.