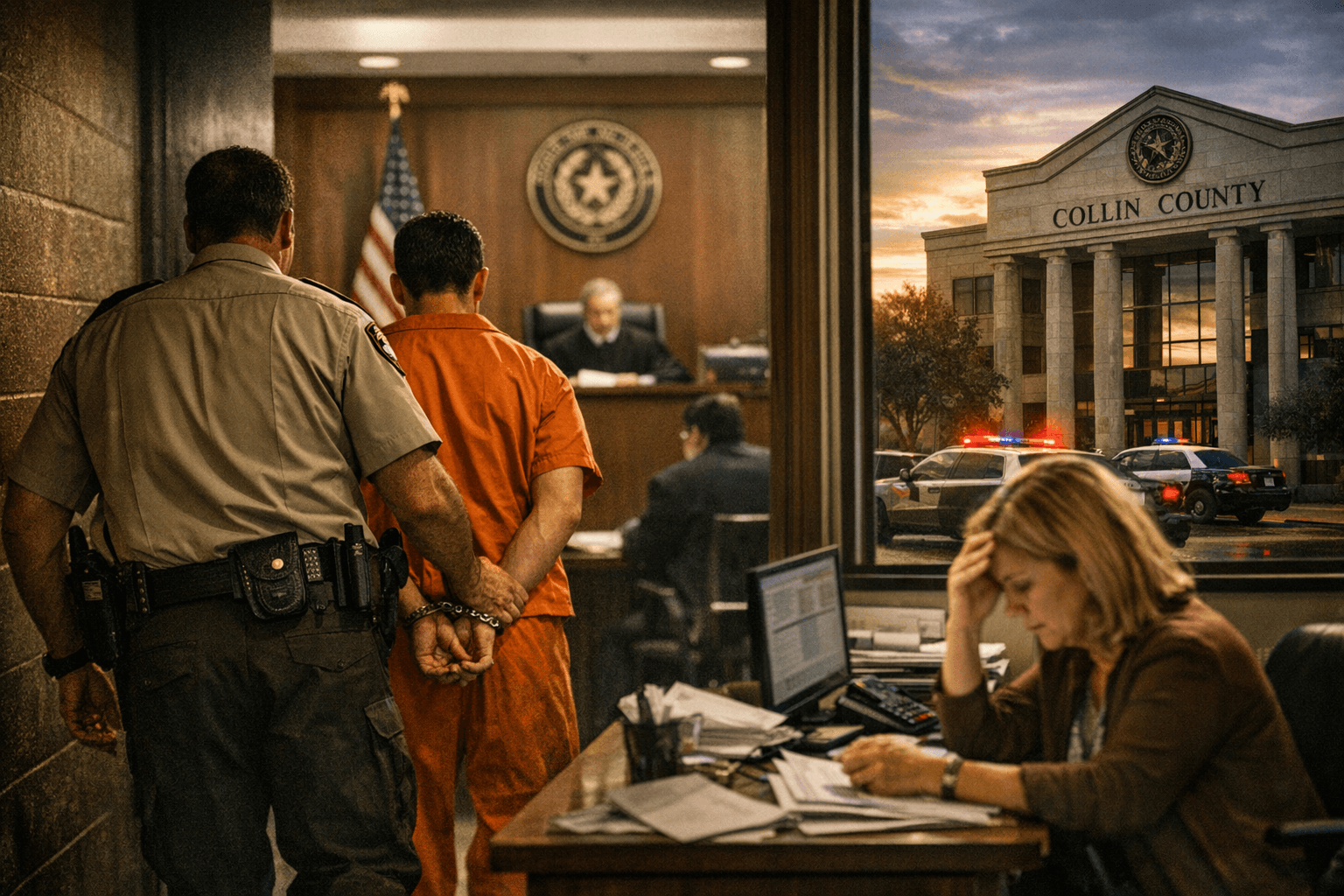

New 2026 Texas laws reshape Collin County services and budgets

More than 30 new state laws took effect Jan. 1, changing rules for jails, business taxes and evictions that could affect county budgets and daily life.

More than 30 new Texas laws took effect Jan. 1, 2026, and several carry direct implications for Collin County operations, budgets and residents. Two measures stand out for their likely local impact: SB 8, which requires sheriff cooperation with federal immigration authorities in counties that operate jails, and HB 9, which changes business inventory tax exemptions. Other statutes adjust eviction procedures, tech regulation and state infrastructure funding, all of which will reach into county services and municipal planning.

SB 8 creates a state duty for sheriffs in jail-operating counties to work with U.S. Immigration and Customs Enforcement. For Collin County that could mean changes to booking and detention practices, training needs for corrections staff, increased legal and administrative costs, and potential shifts in federal reimbursement claims. Practical decisions about how the sheriff’s office implements cooperation, and how the county absorbs any new expenses, will fall to the Collin County Sheriff’s Office and the Commissioners Court. Expect policy reviews, possible changes to intake procedures, and legal counsel consultations as local officials weigh liability and operational tradeoffs.

HB 9 alters the inventory tax exemption for businesses. That adjustment will ripple through the county tax base, affecting revenue projections for Collin County, local school districts and municipalities. Changes to inventory valuation and exemptions can lower property tax receipts from businesses even as population growth drives demand for services. County budget planners and the tax assessor-collector will need to model revenue scenarios and consider whether rate adjustments or spending changes are necessary to balance services such as public safety, road maintenance and courts.

Other laws that took effect touch eviction timelines and tenant protections, measures regulating technology and data, and new state-level infrastructure funding mechanisms. Revised eviction rules could increase workload for Collin County justice courts and alter timelines for landlords and tenants. Tech-related statutes may affect county procurement, data handling and cybersecurity requirements. New state infrastructure funding formulas could bring targeted dollars for roads, water projects or broadband expansion, but may also carry matching requirements or eligibility rules that require local budget adjustments.

For residents, the changes matter in practical ways: jail policies can affect family interactions and civil rights questions; tax shifts influence the local business climate and property tax bills; eviction rules affect housing stability; and infrastructure funding decisions shape commute times and utility service. Collin County officials will be the first line for implementation questions, and county meetings this winter and spring are likely to include policy briefings and budget amendments.

Our two cents? Keep an eye on the Commissioners Court agenda, ask the county tax office and sheriff’s office for clear implementation plans, and bring specific questions to public hearings. Staying engaged now gives residents the best chance to influence how these laws play out at the local level.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip