New York Fed Sees Rising Concern Over Job Market, Inflation

A New York Fed survey in September found Americans more worried about the future of the labor market even as short-term inflation expectations edged higher, complicating the Fed's policy calculus. The findings underscore growing consumer caution that could slow spending and influence Federal Reserve deliberations on interest rates.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Americans reported growing worry about the future of the job market in September, the Federal Reserve Bank of New York said on Tuesday, even as households raised their near-term inflation expectations modestly. The survey adds to evidence the central bank faces a delicate trade-off between stamping down inflation and cushioning a labor market that Federal Reserve officials say has softened over the past year.

The New York Fed’s monthly release, based on the Survey of Consumer Expectations and other monitoring tools, showed a clear uptick in anxiety about jobs compared with the summer months. While the bank did not portray the labor market as collapsing, the shift reflects a widening gap between consumers’ views of current conditions and their outlook, with implications for spending, saving and wage negotiation. New York Fed President John Williams, speaking on Sept. 29, framed the challenge bluntly: “we have a balancing act here” between reducing inflation and supporting a job market that “has been gradually softening over the past year.”

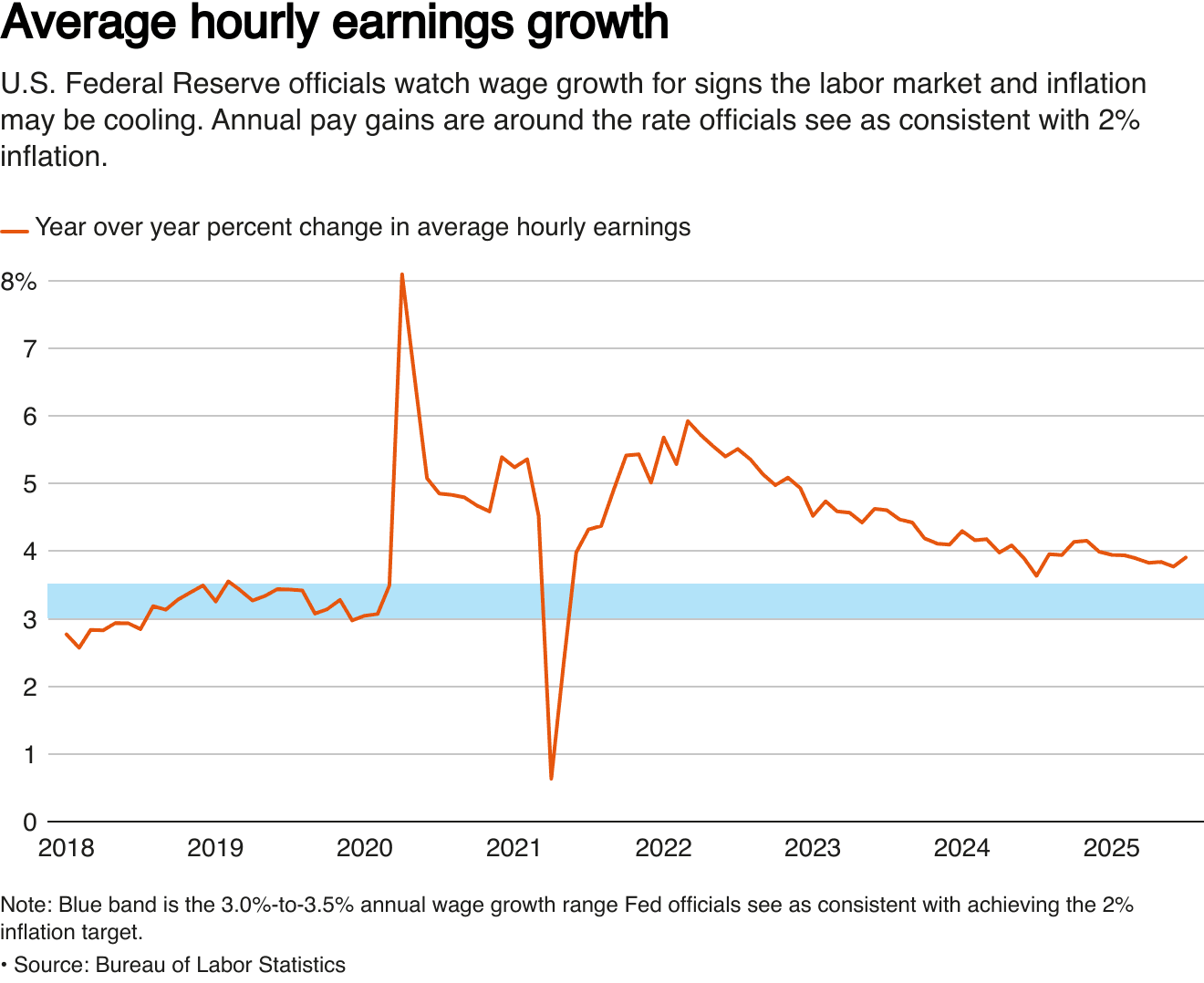

The report also noted a small but notable upward revision to households’ projections for near-term inflation, a metric policymakers watch closely because it can feed into wage demands and broader inflation dynamics. Williams cautioned at his September remarks that tariff effects on prices “have been smaller than most people thought,” and he did not see signs that inflationary pressures were reemerging in a sustained way. Still, the combination of rising short-run inflation expectations and increasing job-market worry creates a policy dilemma for the Federal Reserve as it weighs the appropriate path for interest rates.

Markets already price in sensitivity to such signals. Financial markets typically respond to higher inflation expectations with upward pressure on short-term bond yields and to signs of labor-market deterioration with increased volatility in equities and risk-sensitive assets. For the Fed, a persistently weaker jobs outlook could reduce the urgency to tighten further, while any firming in inflation expectations could argue for holding rates higher for longer.

Economists note that household perceptions can be both leading and lagging indicators. Increased worry about jobs can damp consumer spending — the dominant component of U.S. growth — which would slow inflationary pressure over time. Conversely, if inflation expectations become unanchored, businesses may raise prices preemptively and workers may demand larger pay increases, complicating the Fed’s task.

Policy makers will be watching subsequent labor-market releases and inflation data closely to see whether the September shift in sentiment presages real changes in hiring, wages and prices. For now, the New York Fed’s findings underscore a central tension facing the U.S. economy: cooling labor demand that may ease inflationary pressures but also risk hobbling growth if consumer confidence and spending decline. As Williams put it, achieving both objectives simultaneously remains a delicate exercise in economic management.