Nigeria and EU Sign MoU for Anambra Drug Manufacturing Hub

The Federal Government of Nigeria and the European Union have signed three Memoranda of Understanding under the Presidential Initiative for Unlocking the Healthcare Value Chain to boost distribution, supply and local pharmaceutical manufacturing, including a planned plant in Anambra State. The move aims to reduce reliance on imported medicines, strengthen supply-chain resilience and create new industrial capacity at a time when Africa-wide calls for local drug production are growing louder.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

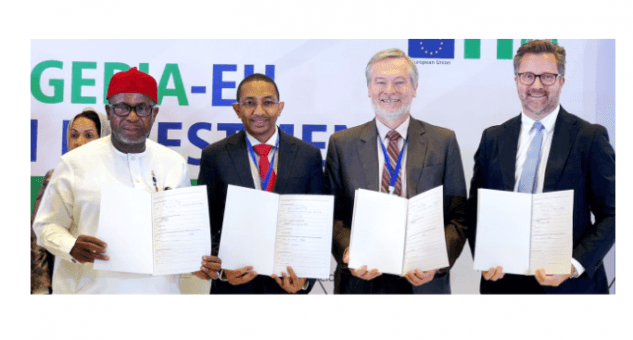

The Federal Government and the European Union formalized three memoranda of understanding on Saturday under the Presidential Initiative for Unlocking the Healthcare Value Chain (PVAC), marking a strategic push to expand Nigeria’s domestic pharmaceutical capacity. One MOU targets the construction of a pharmaceutical manufacturing facility in Anambra State, a step officials say is intended to shore up medicine availability and cut dependence on imports.

Nigeria’s healthcare sector has long been exposed to global supply shocks and currency volatility because much of the country’s pharmaceutical needs are met by foreign producers. The new agreements, focused on manufacturing, distribution and supply-chain strengthening, are designed to build local capacity across the value chain—from active pharmaceutical ingredients and formulation to packing and logistics. The PVAC framework will serve as the coordination platform for technical cooperation, regulatory alignment and potential investment facilitation with EU partners.

Economically, the Anambra plant signals multiple market effects. A functioning local manufacturing base could reduce foreign exchange outflows associated with pharmaceutical imports and lower the exposure of public procurement to international price fluctuations. For private-sector firms, greater local capacity may expand opportunities for contract manufacturing, attract anchor investors and stimulate ancillary services such as cold chain logistics and packaging. For consumers, enhanced domestic production should help stabilize drug availability and potentially constrain price spikes during global disruptions.

However, the practical impact depends on execution and supporting policy. Nigeria will need to address persistent bottlenecks: unreliable power supplies that raise production costs, limited access to affordable financing for capital-intensive facilities, gaps in quality assurance systems and a shortage of locally produced active pharmaceutical ingredients. Aligning Nigeria’s regulatory standards with international and EU norms will be critical to ensure local output meets both domestic safety standards and export requirements for regional markets.

The initiative arrives amid a broader continental push to localize pharmaceutical manufacturing. African governments and development partners have repeatedly emphasized the need to close the continent’s manufacturing gap and reduce reliance on imports. Regional trade arrangements such as the African Continental Free Trade Area (AfCFTA) could amplify the economic benefits of a Nigerian plant by opening larger West and Central African markets to competitively priced, locally made medicines.

Risks remain. Without guarantees of sustained demand through strategic procurement policies or financing support, new plants can face underutilization. Competition from entrenched importers and the economics of producing complex biologics versus generic formulations will shape the long-term viability of the project. Still, if the Anambra facility proceeds at scale, it could serve as a proof of concept for deeper EU-Nigeria industrial cooperation that bolsters health security while generating manufacturing jobs and export potential.

The three MOUs are a starting point; the next phase will hinge on investment commitments, timelines, and regulatory reforms that translate promises on paper into medicines on pharmacy shelves.

%3Amax_bytes(150000)%3Astrip_icc()%2FWarren-Buffet-berkshire-hathaway-9a0292ce51ba4f44ac3dd940d01af096.jpg&w=1920&q=75)