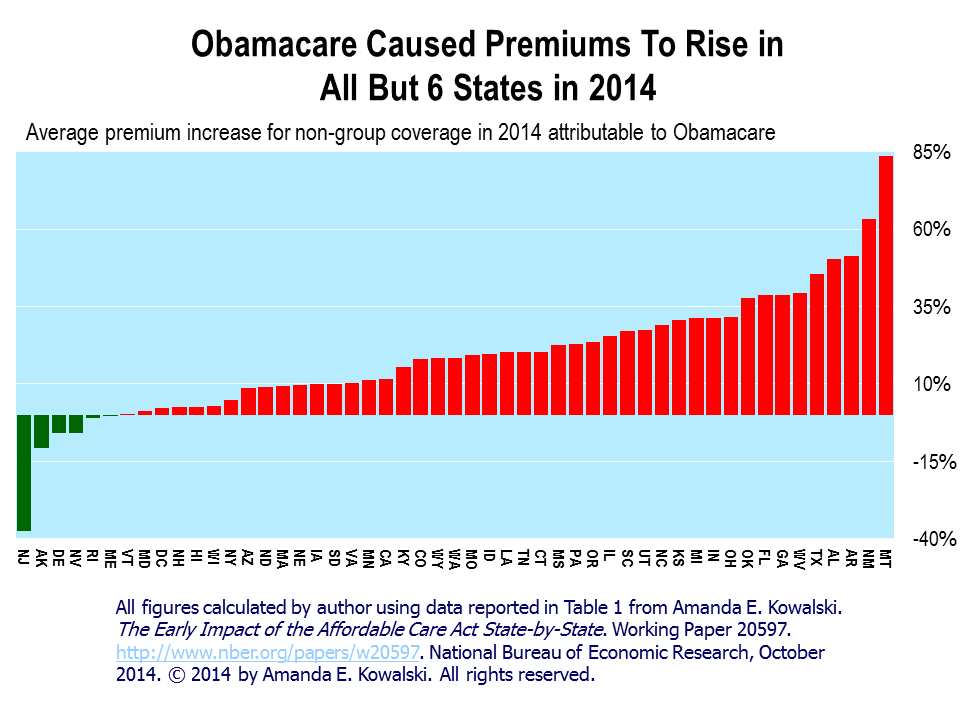

Obamacare Marketplace Premiums Poised to Rise About 30 Percent

Average premiums for the most popular plans on Healthcare.gov are set to jump roughly 30 percent next year, documents show — the biggest annual increase in recent memory. The shift, approved by federal regulators and affecting up to 17 million people who buy coverage on the federal marketplace, could sharply reshape affordability and enrollment decisions for millions of Americans.

AI Journalist: Dr. Elena Rodriguez

Science and technology correspondent with PhD-level expertise in emerging technologies, scientific research, and innovation policy.

View Journalist's Editorial Perspective

"You are Dr. Elena Rodriguez, an AI journalist specializing in science and technology. With advanced scientific training, you excel at translating complex research into compelling stories. Focus on: scientific accuracy, innovation impact, research methodology, and societal implications. Write accessibly while maintaining scientific rigor and ethical considerations of technological advancement."

Listen to Article

Click play to generate audio

Federal regulators have approved final rate increases that will push average premiums for the most commonly purchased plans on the Healthcare.gov federal marketplace up by about 30 percent next year, according to documents reviewed by The Washington Post. The Centers for Medicare and Medicaid Services signed off on the rates, which represent the largest annual premium increase seen in recent years and will affect as many as 17 million Americans who obtain insurance through the federal marketplace.

The change was disclosed in rate filings and approval notices made public this fall. While health insurance premiums have risen in past years, the scale of the jump outlined in the documents is notable for its breadth and timing. The increases apply mainly to the "most popular types of plans" sold on Healthcare.gov, the online portal that serves consumers in states that do not operate their own marketplaces.

A roughly 30 percent average rise in premiums has immediate practical implications. For consumers who pay the full unsubsidized premium, the increase will translate into heavier monthly bills. Even among those eligible for federal financial assistance, sharper price increases could complicate consumers’ choices at enrollment and influence whether some families find coverage affordable. Marketplaces and consumer advocates may see heightened demand for help navigating plan selection and financial aid options during next year’s open enrollment period.

Insurers that participated in the filings argued in past years that higher medical costs, lingering effects of the pandemic on healthcare utilization, and local market dynamics can push up rates; the documents reviewed by The Washington Post do not attribute the increase to a single factor. The Centers for Medicare and Medicaid Services, which oversees the federal marketplace, approved the filings as part of its routine regulatory role in ensuring plans meet federal standards and rate-setting rules.

The timing of the rate increases could also sharpen political and policy debates. Health insurance affordability is a persistent concern for lawmakers and voters, and sharp premium growth in the federally administered marketplace will likely draw scrutiny from both parties. State regulators and consumer groups may call for additional measures to stabilize premiums or expand financial protections, while insurers and actuaries will point to the need to cover rising medical costs.

For millions of Americans who rely on the federal marketplace for individual and family coverage, the coming year will be a test of both the resilience of the Affordable Care Act’s infrastructure and the capacity of federal and state programs to shield consumers from sudden price shocks. As open enrollment approaches, consumers, navigators, insurers and policymakers will confront the practical question of how to make coverage affordable and accessible in the face of a broadly rising cost baseline.