OneAZ Credit Union to Acquire 1st Bank Yuma, Expanding Local Lending

1st Bank Yuma announced on November 10, 2025 that it has reached an agreement to be acquired by OneAZ Credit Union of Phoenix, a move bank representatives say will broaden products and speed access to funds for local customers. The change matters to Yuma County residents because expanded consumer lending and quicker fund availability can affect household cash flow, small business financing, and local economic activity.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

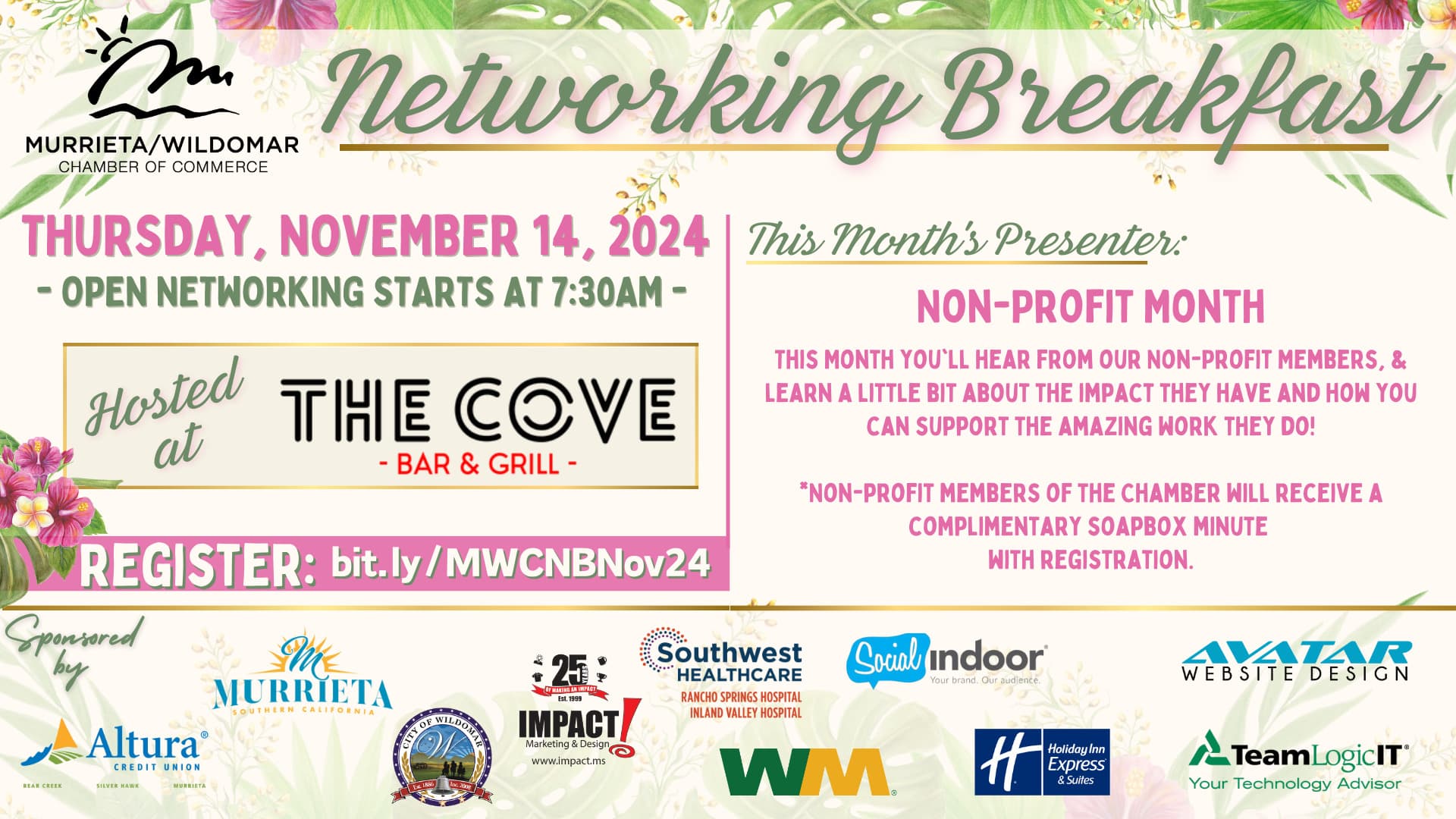

YUMA, Ariz., Nov. 10, 2025. 1st Bank Yuma announced an agreement to be acquired by OneAZ Credit Union, a Phoenix based credit union, in a transaction that bank officials say will expand products and services available to local customers. Bank representatives indicated customers should see benefits such as expanded consumer lending and faster access to funds, and Ricardo Perez of 1st Bank Yuma described the expected benefits and community impact.

The acquisition places a local retail bank under the ownership of a larger, member owned credit union based in the state capital. For Yuma County consumers this can mean a broader menu of loan options, potentially faster processing for some transactions, and operational changes as accounts and services are integrated into OneAZ systems. Local residents who use 1st Bank Yuma for checking, savings, consumer loans or small business banking will want to track notices from both institutions about timing and any steps required to move accounts.

Economically the deal is significant at the local level because changes in the availability and price of consumer credit flow through to household spending and small business investment. Expanded consumer lending can increase local consumption and support sectors such as retail, housing related services, and vehicle sales. Faster access to funds can ease cash flow for households living paycheck to paycheck and for small businesses that rely on timely deposits and lines of credit to manage payroll and seasonal expenses. Those effects are particularly relevant in Yuma County where agriculture and seasonal labor shape income volatility for many residents.

The transaction also reflects broader trends in the financial sector where banks and credit unions pursue consolidation to achieve scale, broaden product offerings, and reduce costs of technology and compliance. As a credit union, OneAZ operates under a member focused structure which often translates into different fee and rate policies compared with for profit banks. Customers should expect communications that explain any changes to account terms, membership eligibility, and where deposits are insured.

Regulatory review and integration work will drive the timetable for specific changes. Such transactions commonly require approval from federal and state regulators and a transition period during which systems, account records, and loan servicing are moved to the acquiring institution. Until regulators and the institutions provide detailed timelines, customers should monitor official notices and contact their branch or customer service for guidance.

For local policymakers and business leaders, the acquisition is a development to watch for its potential to alter credit availability and banking choices in Yuma County. Expanded consumer lending could support short term spending and investment, while the nature of decision making at a larger, centralized institution will be important for long term access to credit for local firms and households.