OPEC Secretariat Receives Compensation Plans from Five Producers

The OPEC secretariat said it received updated compensation schedules from Russia, Iraq, the UAE, Kazakhstan and Oman covering last month through June 2026 to make up for output above agreed targets. The submissions signal a renewed effort within OPEC+ to manage compliance and could affect near‑term supply expectations, market volatility and fiscal prospects for producers.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

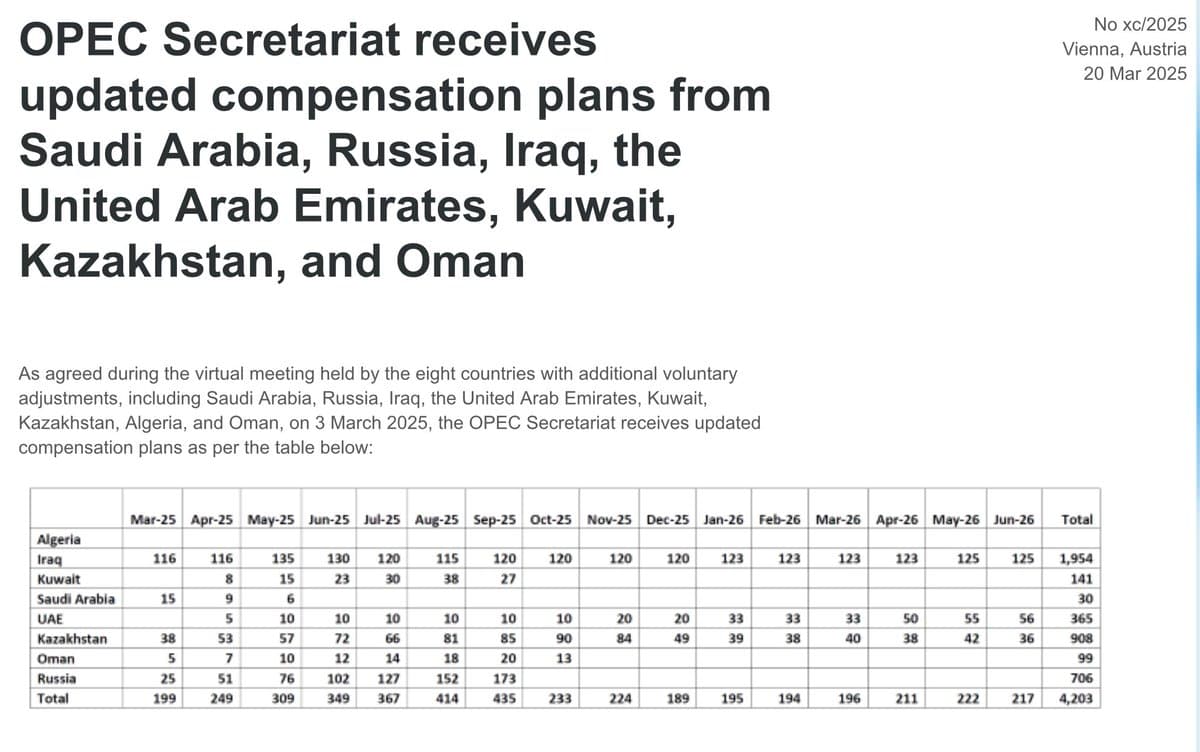

The Organization of the Petroleum Exporting Countries’ secretariat announced on Sunday that it had received updated compensation plans from five members and partners — Russia, Iraq, the United Arab Emirates, Kazakhstan and Oman — covering the period from last month until June 2026. The filings are intended to make good on production that exceeded agreed targets under OPEC+ arrangements and are the latest procedural step in the group’s long‑running attempt to police quotas across a heterogeneous set of producers.

Compensation plans are an administrative mechanism within the OPEC+ framework that require countries to reduce output in subsequent months to offset earlier overproduction. The recent batch of schedules from five countries underscores the persistent challenge the cartel and its allies face in aligning sovereign production decisions with collective targets. Russia, a key non‑OPEC ally, and major Gulf producers such as the UAE and Iraq carry particular weight in any calculation of effective spare capacity and market influence.

For markets, the practical implication is straightforward: if the compensation schedules are implemented as declared, forward supply will be tighter than otherwise expected through mid‑2026. That potential tightening can support crude futures and reduce prompt‑month liquidity, heightening price sensitivity to geopolitical or demand surprises. Conversely, delays, revisions or weak enforcement of these plans would leave the market with higher near‑term supply and greater downside risk to prices.

The filings also have fiscal and investment implications for the countries involved. Many oil exporters rely on hydrocarbon revenue for budget balance, with fiscal breakeven oil prices varying widely across the group. Committing to future output reductions forces an intertemporal tradeoff between stabilizing price and protecting short‑term revenue. For producers with constrained fiscal buffers, the willingness to accept future production sacrifices may be limited, raising the risk of non‑compliance and political pressure on quota discipline.

Beyond immediate market mechanics, this development highlights longer‑term tensions within the energy transition era. Sustained coordination to restrain supply can elevate price trajectories that improve producer cash flows and potentially shorten the payback period for new upstream projects. At the same time, prolonged higher prices can accelerate demand responses, efficiency gains, and policy pushes for cleaner energy—factors that could erode long‑run oil demand growth and alter investment decisions.

Enforcement remains the central uncertainty. OPEC+ lacks a supranational enforcement mechanism; compliance has historically relied on transparency, reputational costs and occasional production cuts from other members to compensate. The submission of schedules from five producers is a signal of procedural compliance, but market participants will watch actual output and pipeline flows closely to judge the substantive effect.

Analysts and traders will monitor monthly production data, tanker tracking and refinery intake reports to assess whether the compensation manifests in real supply restraint. For now, the updated plans are a reminder that cartel management is as much about paperwork and credibility as it is about pumps and platforms, with tangible consequences for prices, government budgets and the pace of the energy transition through 2026.