OPEC Secretariat Receives Compensation Schedules From Five Producers

The OPEC secretariat said it has received updated compensation plans from Russia, Iraq, the United Arab Emirates, Kazakhstan and Oman covering the period from last month through June 2026 to offset earlier production above targets. The filings, disclosed by Reuters and Refinitiv, could influence market sentiment about future supply tightening and sustained price volatility, with implications for inflation and energy policy worldwide.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

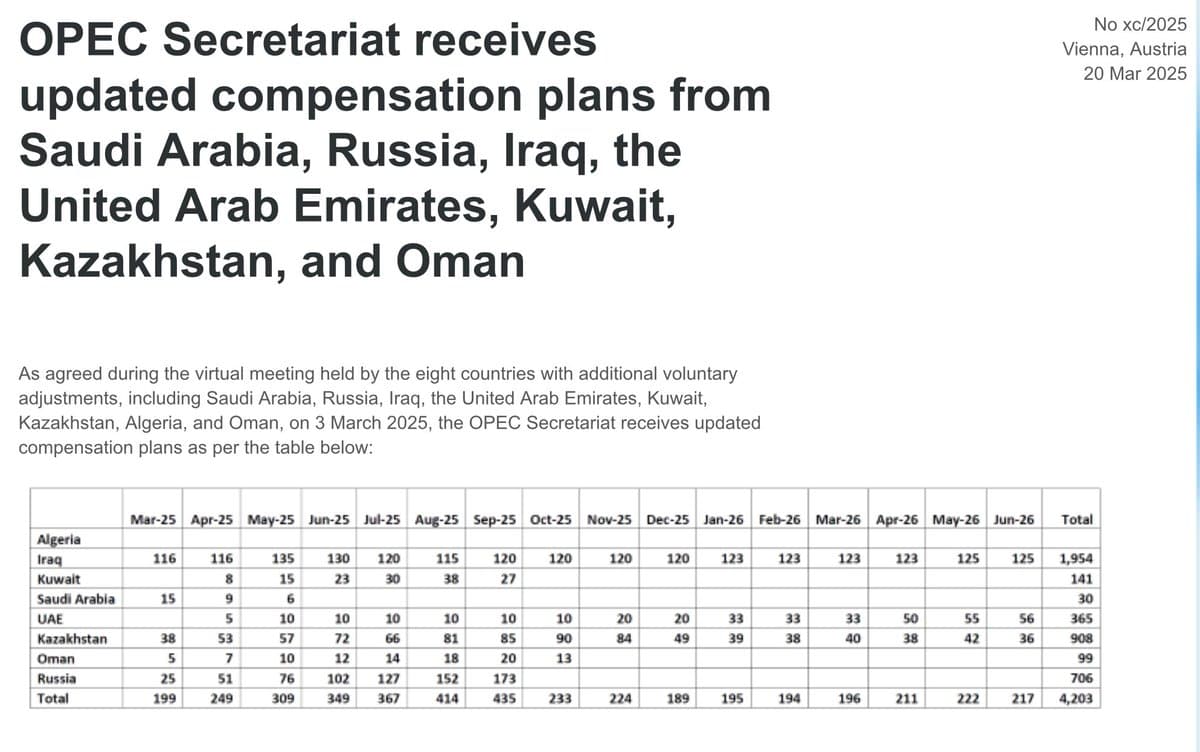

The Organization of the Petroleum Exporting Countries’ secretariat announced on Sunday that it had received updated compensation plans from Russia, Iraq, the United Arab Emirates, Kazakhstan and Oman. The submissions, reported by Reuters and distributed via Refinitiv and TradingView, set out schedules "from last month until June 2026" intended to make up for volumes produced above agreed targets.

Under the informal OPEC+ framework, producers that exceed their quotas submit compensation schedules to reduce output in later months, ostensibly to rebalance aggregate production and restore compliance. The secretariat’s statement did not indicate whether the plans had been accepted or independently verified, and offers no immediate detail on the size of the compensating reductions, leaving market participants to weigh the signal rather than the precise supply math.

The timing matters. Markets remain sensitive to any credible indication of future supply restraint. Global oil demand runs at roughly 100 million barrels per day, so even moderate adjustments by major producers can shift near-term balances and prompt swings in Brent and WTI futures. Traders and refiners will be monitoring whether the compensation schedules translate into materially lower flows into global inventories, or if they instead reflect bookkeeping that leaves physical shipments largely unchanged.

Policy implications extend beyond markets. For oil-importing economies still grappling with elevated inflation, tighter oil supply would raise fuel and transportation costs and complicate central bank plans to bring price growth down. For oil-exporting governments, predictable compensation schedules can stabilize revenues if they shore up prices, but they also require coordination and discipline—a perennial challenge for a disparate group of producers with differing fiscal needs.

Russia’s involvement is particularly notable because it is not an OPEC member but has been a senior partner in the OPEC+ arrangement since 2016. Its production choices have outsized market impact, given output levels and the geopolitical constraints that affect flows to key markets. The participation of Middle Eastern and Caspian producers like Iraq, the UAE and Kazakhstan underscores the cross-regional nature of the compensation mechanism. Oman, a non-OPEC Gulf state and regular OPEC+ participant, completed the list of filers.

Longer-term, the episode underlines a continuing trend: OPEC+ mechanisms for managing supply remain a central variable in global energy markets even as structural factors — from electric vehicle adoption to renewable build-out — slowly reshape demand. The effectiveness of compensation schedules will hinge on transparency and verification. If compliance proves weak, the filings will provide little more than temporary confidence; if compliance is strong, they could tighten the market into mid-2026, supporting higher prices and renewed political pressure in oil-importing countries.

For now the disclosure is principally a policy signal. Markets and policymakers will be watching subsequent data on production, shipment flows and inventories to judge whether the schedule posted by the secretariat translates into measurable changes in the global oil balance.