Perham Approves Nearly Three Percent Levy Increase for 2026

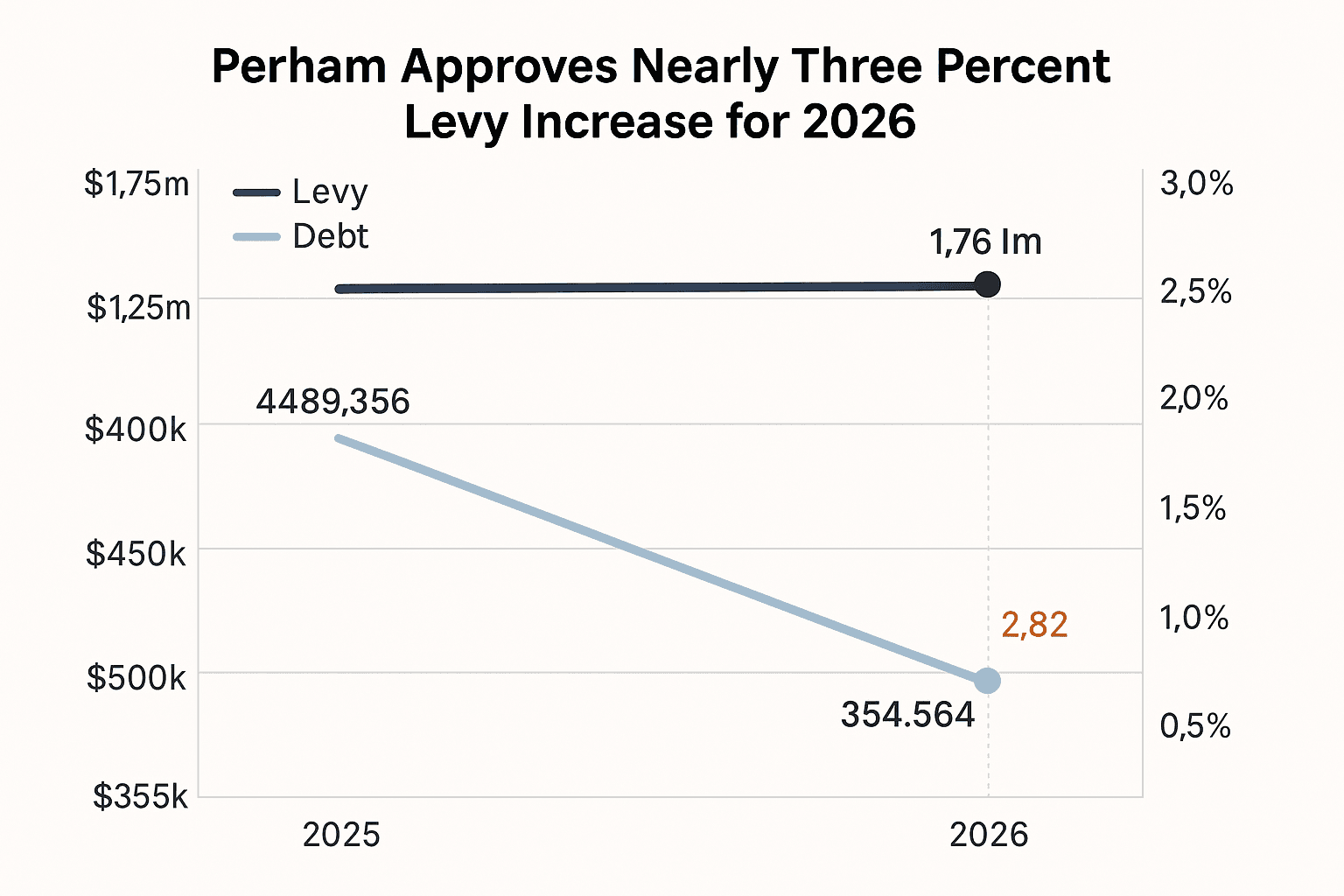

Perham City Council approved a 2.82 percent levy increase at its December 8 meeting, raising the city operational levy from $1.56 million to $1.76 million for 2026. The increase will add only a few cents to typical residential tax bills while lowering the city debt burden and addressing rising personnel and insurance costs.

Perham City leaders voted to raise the municipal levy by 2.82 percent during their December 8 meeting, increasing the city portion of the tax levy to $1.76 million for 2026. City officials framed the change as a measured adjustment to cover growing operational costs, while also noting a substantial reduction in outstanding bonds and debt for the coming year.

City Administrator Jon Smith explained the levy is distributed across the entire tax base and is not a direct one to one reflection of individual property tax increases. Smith presented illustrative calculations showing the local effect on homeowners under 2026 valuations. For a residential property with a $163,000 tax value the city levy increase translated to 25 cents. A home with a $326,000 tax value would see about a 50 cent increase from the city levy alone.

Officials also reported a near 28 percent decline in bonds and debts, from $489,356 in 2025 to $354,564 in 2026, which reduces long term interest costs and frees capacity for other spending. At the same time general fund expenses rose notably due to wage increases for city employees, higher health insurance premiums, and paid leave. The levy for 2026 included increases for economic development and the general capital fund, while the library and fire department levies were reduced.

For Perham residents the immediate pocketbook impact from the city portion of the levy will be small under the examples provided, but the overall property tax statement will also include school district, county, and state levies which were not reflected in the city calculations. The council decision balances near term operating pressures with debt reduction, a move that could help stabilize municipal finances in future years.

Residents seeking clarity on their full tax picture should review next year s property tax statements and contact city hall for questions about how the combined levies affect their individual bills.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip