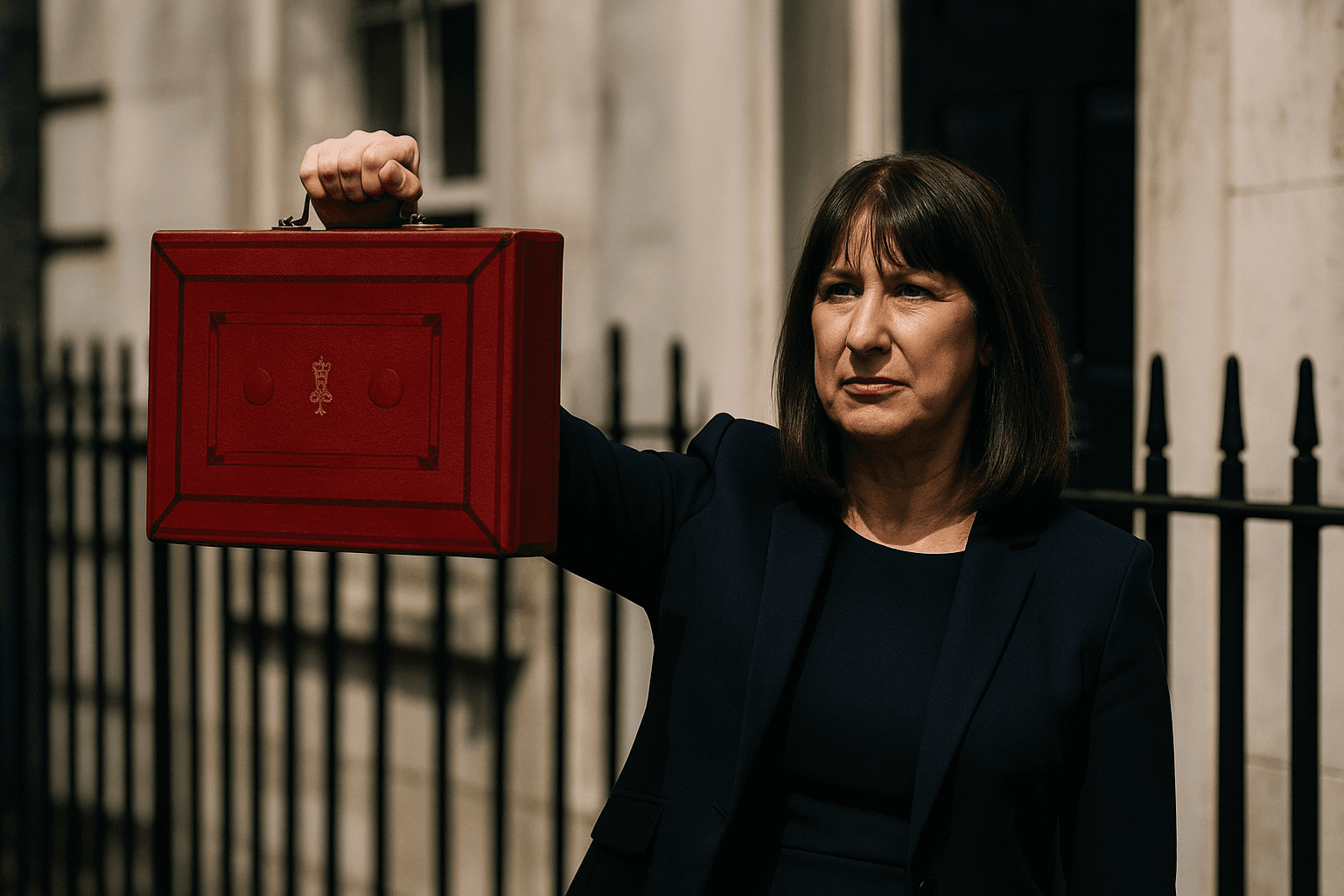

Reeves unveils Autumn Budget, major tax measures aim to rebuild fiscal headroom

Chancellor Rachel Reeves delivered an Autumn Budget that pairs substantial revenue raising measures with protections for public services, a package designed to restore fiscal credibility and calm markets. The plan has already unsettled sectors hit by property and inheritance tax changes and prompted warnings that the approach could carry political costs while testing the trade off between growth and fiscal repair.

Chancellor Rachel Reeves set out an Autumn Budget on November 26 that places tax increases at the center of a broader effort to rebuild fiscal headroom and reassure financial markets. The package combines revenue raising steps with targeted social spending and explicit protections for core public services, a line the Treasury said was intended to shore up the public finances while maintaining service delivery.

Key fiscal moves included a series of freezes and reforms that officials estimate will lift projected tax receipts, alongside measures to expand certain social supports. Among the changes reported, the government proposed removing the cap on the two child benefit, a move that increases social spending within an overall framework of higher revenues. The Office for Budget Responsibility was scheduled to publish forecasts that played a decisive role in market reactions to the plan.

The OBR forecasts were released in part early in the day, a timing decision that briefly roiled gilts and sterling before markets steadied as the full package became clear. Traders and analysts reacted to the new revenue assumptions and to uncertainty about the long term growth effects of the tax measures. Market calm returned after the initial volatility, but the episode highlighted how sensitive government bond and currency markets remain to changes in fiscal projections.

Several measures targeting property and inheritance taxation prompted visible pushback. Farmers and other affected groups staged protests at Budget events and in rural towns, arguing that reforms would hit agricultural land values and complicate succession arrangements. The Treasury defended the changes as necessary to broaden the tax base, while critics warned that they could weaken political support in rural constituencies and provoke a prolonged campaign against the government.

Policy analysts and independent economists stressed the political and economic balancing act at the heart of the Budget. Restoring fiscal credibility can calm borrowing costs and create policy space for the future, yet significant tax increases risk damping private investment and consumer demand. The government faces the immediate task of persuading both markets and voters that higher revenues will not undercut growth or disproportionally burden particular sectors.

Parliamentary scrutiny and committee hearings are expected to follow in the coming weeks, as MPs from affected constituencies press for clarifications and possible mitigation measures. The Budget also sets up a broader public debate about taxation fairness, intergenerational wealth, and the role of the state in funding services.

Reeves framed the plan as necessary to rebuild buffers that had been depleted in previous years, but the interplay between fiscal consolidation and political cost will be tested at the ballot box and in local protests. How ministers translate the OBR projections into sustained economic performance will determine whether the package achieves its stated aim of combining stability for public finances with sufficient support for growth.