Refinance Rates Largely Unchanged, 15 Year Edge Slightly Lower

Mortgage refinance rates remain effectively flat for November 13, with the 15 year fixed average nudging down to 5.4 percent and the APR at 5.44 percent. For homeowners weighing shorter terms, the math is stark, a $100,000 15 year refinance now implies an $812 monthly payment and roughly $46,522 in interest over the life of the loan.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

The national refinance market showed little movement on November 13, with headline figures signaling stability after weeks of incremental shifts. The 15 year fixed mortgage refinance averaged about 5.4 percent this week, down marginally from 5.41 percent the prior week, and the associated annual percentage rate stood at 5.44 percent. Market summaries also flagged a larger drop in select longer term products, noting that 30 year jumbo refinance interest rates have fallen by 0.89 percentage points in recent measures.

Those numbers matter in tangible terms for homeowners considering shorter term financing. At the current 15 year rate, a borrower refinancing $100,000 would see principal and interest payments of about $812 per month, not including taxes and fees. Over 15 years that borrower would pay roughly $46,522 in total interest, a figure that underscores the trade off between faster principal pay down and larger monthly obligations.

Lenders and mortgage brokers described demand as cautious. Refinancing activity historically responds to clear, sustained drops in mortgage costs. A 0.01 percentage point weekly change on a widely quoted average does not typically trigger refinancing waves because closing costs and break even horizons remain significant considerations. Where larger moves have occurred, notably in jumbo 30 year loans, some high net worth borrowers with ample equity may find refinancing attractive to reduce monthly cost or to switch to fixed rate certainty.

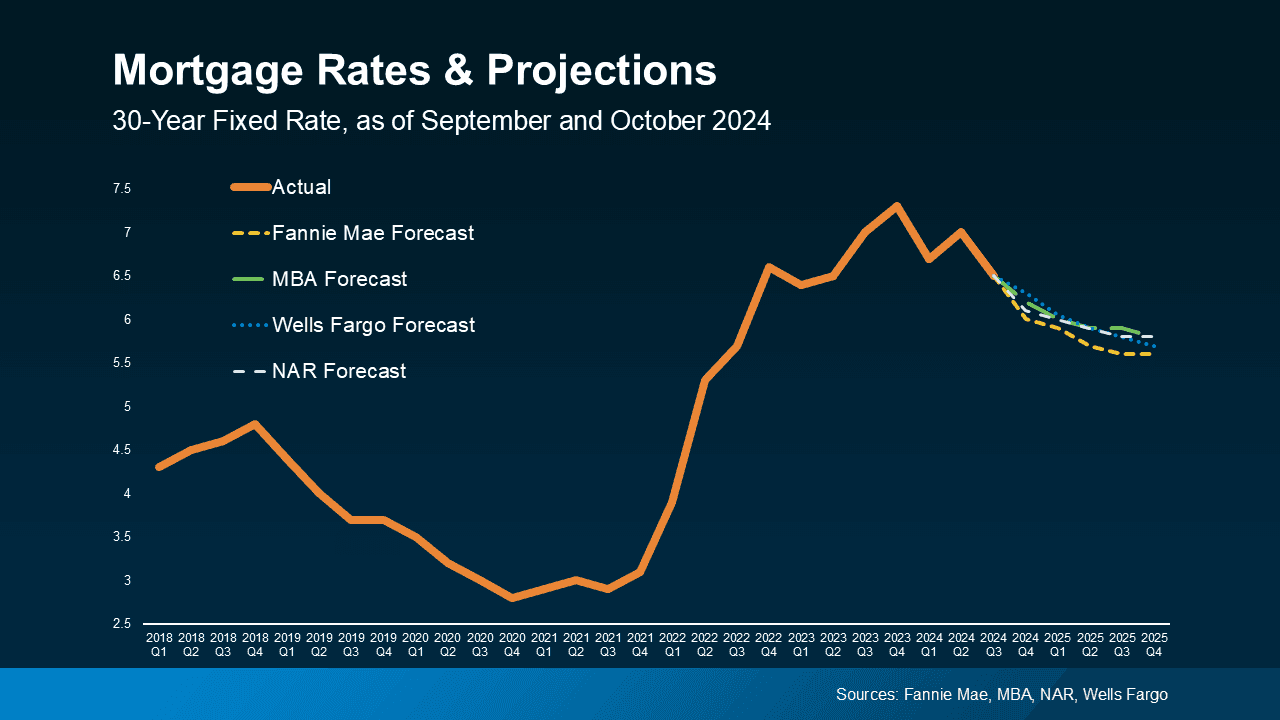

Macroeconomic conditions will determine whether the pause in rates persists or gives way to another trend. Analysts emphasize that mortgage rates do not move in isolation. If inflation slows and national unemployment remains stable or rises, the Federal Reserve could lower the federal funds rate, a policy move that tends to put downward pressure on long term borrowing costs including mortgages. Conversely, if inflation stays elevated and unemployment declines, the Fed is likely to keep policy tighter for longer, which would keep mortgage rates from falling.

The current levels remain well above the historic lows seen during the pandemic era, and they are closer to the range typical of pre pandemic market norms. That broader context matters for household balance sheets and housing market dynamics. Higher long term rates have compressed affordability, cooling buyer demand in many markets and limiting the pool of homeowners who can lower monthly payments through refinancing.

For prospective borrowers, the decision calculus continues to hinge on personal timelines and costs to close. The narrow week to week movement in the 15 year average suggests that borrowers with urgent objectives or short break even horizons should lock where appropriate, while those who can wait will be watching inflation and labor market reports for clearer signals on the Fed and the direction of mortgage rates.