Robinhood Profit Quadruples as Retail Traders Fuel AI Rally Momentum

Robinhood reported that quarterly profit nearly quadrupled as surging retail activity amid an AI-driven market rally pushed trading volumes to record levels in October. The results and the retirement of the company's longtime finance chief underscore both the growing economic clout of retail investors and the governance and regulatory questions that follow.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

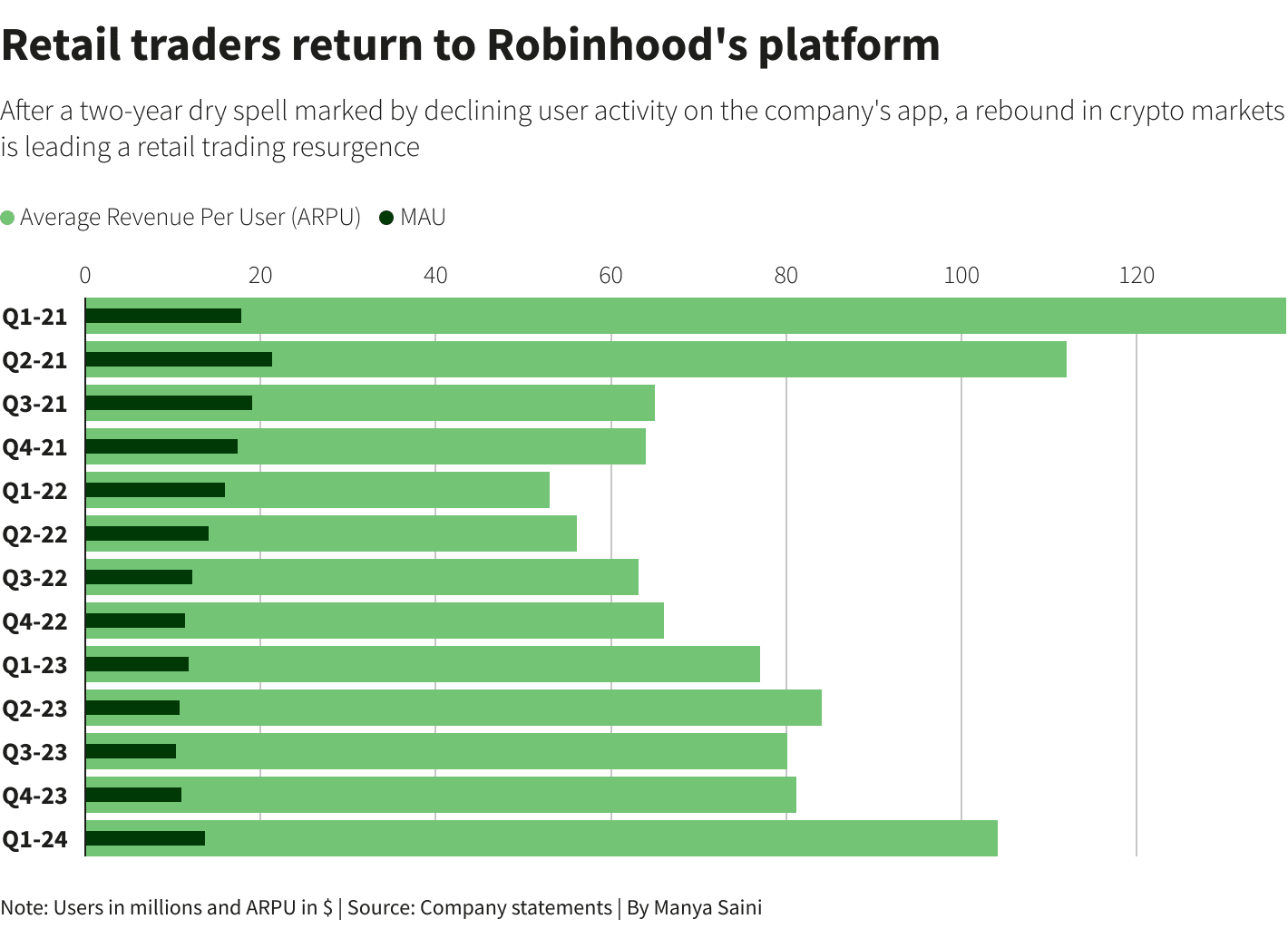

Robinhood Markets said its quarterly profit almost quadrupled, a sharp earnings swing driven by a fresh surge of retail trading tied to an AI-fueled market rally. The company reported that October marked the start of a strong fourth quarter, with record monthly trading volumes across equities, options, prediction markets and futures, reflecting an elevated appetite among smaller investors for both directional bets and leveraged instruments.

The earnings jump underscores how sensitive platform economics are to market velocity: when retail participation climbs, so too do revenues from order flow, margin interest, transaction fees on noncommission products and subscription services. Robinhood’s statement that profitability surged alongside record volumes highlights the leverage that trading platforms have to short-term market sentiment, particularly when technology-driven narratives—such as optimism about artificial intelligence—create persistent momentum in certain sectors.

At the same time, the company announced the retirement of its longtime finance chief. Management turnover at the financial helm of a brokerage that has become synonymous with the democratization of trading will draw scrutiny from investors and analysts focused on corporate governance and financial strategy. A senior finance departure at a moment when revenues are highly cyclical invites questions about how the firm will sustain growth when market momentum fades and how it will manage capital, margins and regulatory compliance in a more volatile environment.

For markets, the episode illustrates the increasing influence of retail flows on asset prices and liquidity profiles. Record activity across options and futures can deepen intraday liquidity but also amplify volatility, particularly in less liquid names or around event-driven trades. Market makers and exchanges adjust spreads and risk parameters in response, which in turn affects execution quality and trading costs for all participants. The concentration of retail volume into a few momentum-driven sectors can create feedback loops that push prices further than fundamentals alone would warrant.

Policy implications are immediate. The prominence of retail order flow renews debates about transparency, best execution and firms’ reliance on payment-for-order-flow arrangements—an area that has drawn regulatory attention in recent years. Policymakers weighing reforms will note that platforms generate outsized profits when retail activity accelerates, raising questions about whether the current market structure adequately protects smaller investors from adverse selection and latency arbitrage.

Longer term, Robinhood’s results are a reminder that the post-2020 trend toward democratized trading remains intact and can meaningfully reshape revenue models in financial services. Yet the very dynamics that produced outsized profits—concentrated retail appetite, momentum driven by thematic narratives such as AI, and elevated derivatives activity—also raise sustainability concerns. A reversal in sentiment could rapidly erode volumes and margins, testing whether Robinhood can translate episodic windfalls into durable earnings growth while navigating governance and regulatory pressures.