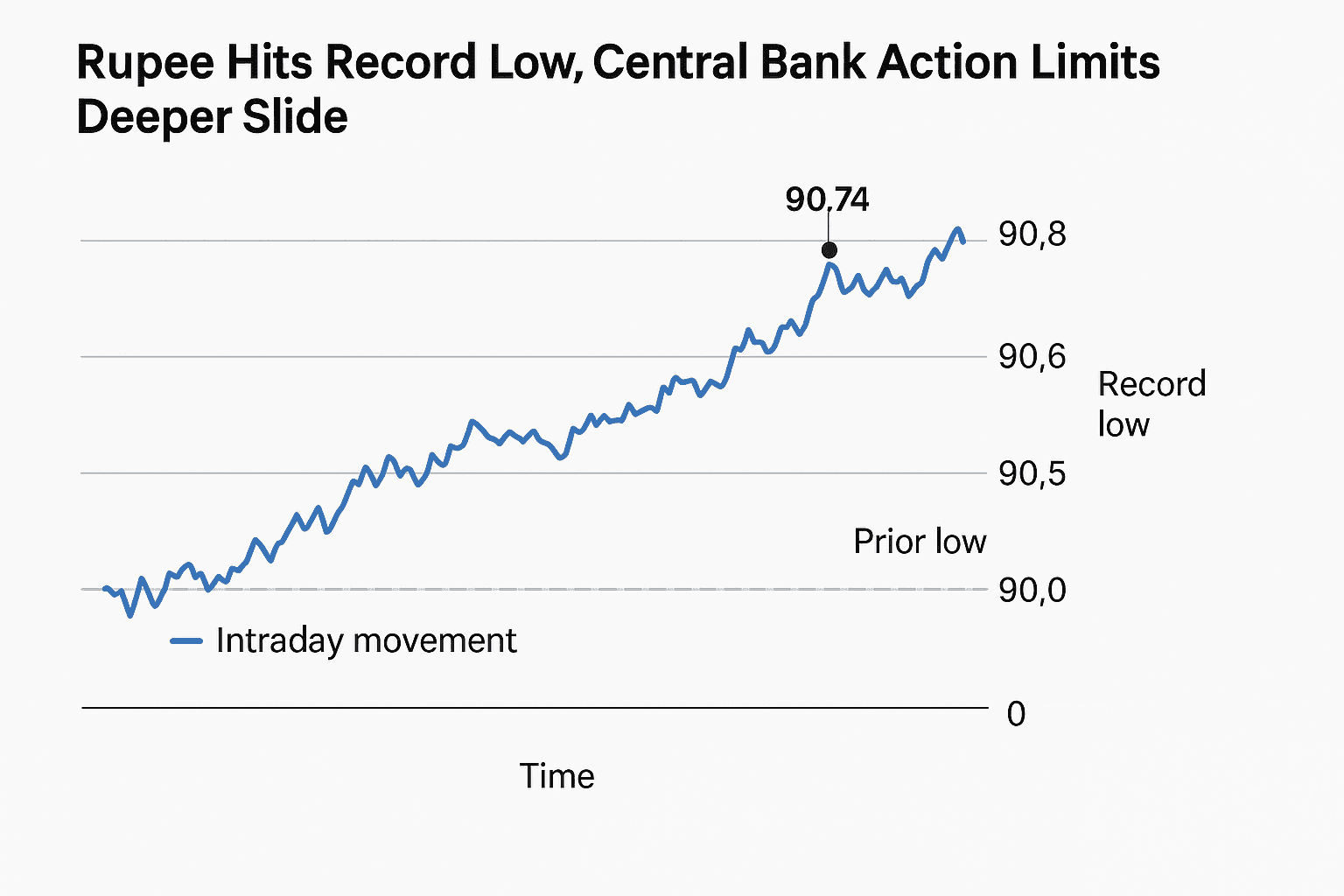

Rupee Hits Record Low, Central Bank Action Limits Deeper Slide

The Indian rupee slips to a fresh record low in Mumbai, weakening 0.3 percent to 90.74 per U.S. dollar on Dec 15, surpassing the prior peak of 90.55 set three days earlier. The move reflects pressure from a stalled U.S. India trade dialogue and sustained foreign portfolio outflows, while central bank intervention helped prevent a larger depreciation that could have amplified inflation and market volatility.

The Indian rupee slipped to a fresh record low in Mumbai on Monday, weakening 0.3 percent to 90.74 per U.S. dollar and breaching the prior all time low of 90.55 recorded on Dec 12. Traders attributed the intraday decline to a combination of external and domestic pressures, with a prolonged deadlock in U.S. India trade negotiations and continued selling by foreign investors in both equities and bonds weighing on the currency.

Currency markets reacted swiftly as offshore investors maintained net selling across Indian assets, a flow pattern that has tended to push the rupee lower this quarter. The 0.3 percent move was notable because it came despite visible central bank intervention, which market accounts say curtailed a larger fall though details on the timing and scale of the intervention were not disclosed. Authorities stepped in to limit the slide, preventing a more disorderly adjustment that could have fed through to borrowing costs and inflation expectations.

The immediate market implications are clear. A weaker rupee raises the local currency cost of imports, notably oil and other commodities priced in dollars, which can exert upward pressure on consumer prices. Corporates with dollar debt face higher servicing costs when converted into rupees, and sustained depreciation risks putting additional strain on corporate balance sheets and government financing if bond yields rise in response. Foreign portfolio outflows amplify those pressures by constraining local liquidity and forcing domestic investors to demand higher yields for perceived currency and sovereign risk.

Policy makers face a delicate balance. Intervention to defend the currency can buy time but is not costless. Using foreign exchange reserves or standing swap lines can stabilize the rupee in the short run, but prolonged defence may require tighter domestic monetary conditions or fiscal adjustments to close external deficits. Officials provided no public details on the intervention on Monday, leaving markets to assess how durable the central bank’s support might be and what policy mix would be used if pressures persist.

Beyond the immediate episode, the episode underscores longer term vulnerabilities in emerging market external positions when global uncertainty rises. A stalled trade negotiation with a major partner increases policy uncertainty, and recurring foreign portfolio withdrawals suggest investors are recalibrating exposures to India amid shifting global risk appetite. Over time, persistent current account pressures or weaker capital inflows could force a more prolonged adjustment in the exchange rate or necessitate structural policy measures to bolster competitiveness and attract longer term capital.

For now, the central bank’s intervention limited the depth of Monday’s fall, but markets will watch whether diplomatic progress on trade talks and a return of foreign inflows follow. Absent such developments, the rupee may remain sensitive to headlines and flows, with implications for inflation, corporate finances, and monetary policy decisions in the months ahead.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip