SBA Disaster Loans Remain Available, Chamber Urges Hernando Firms to Act

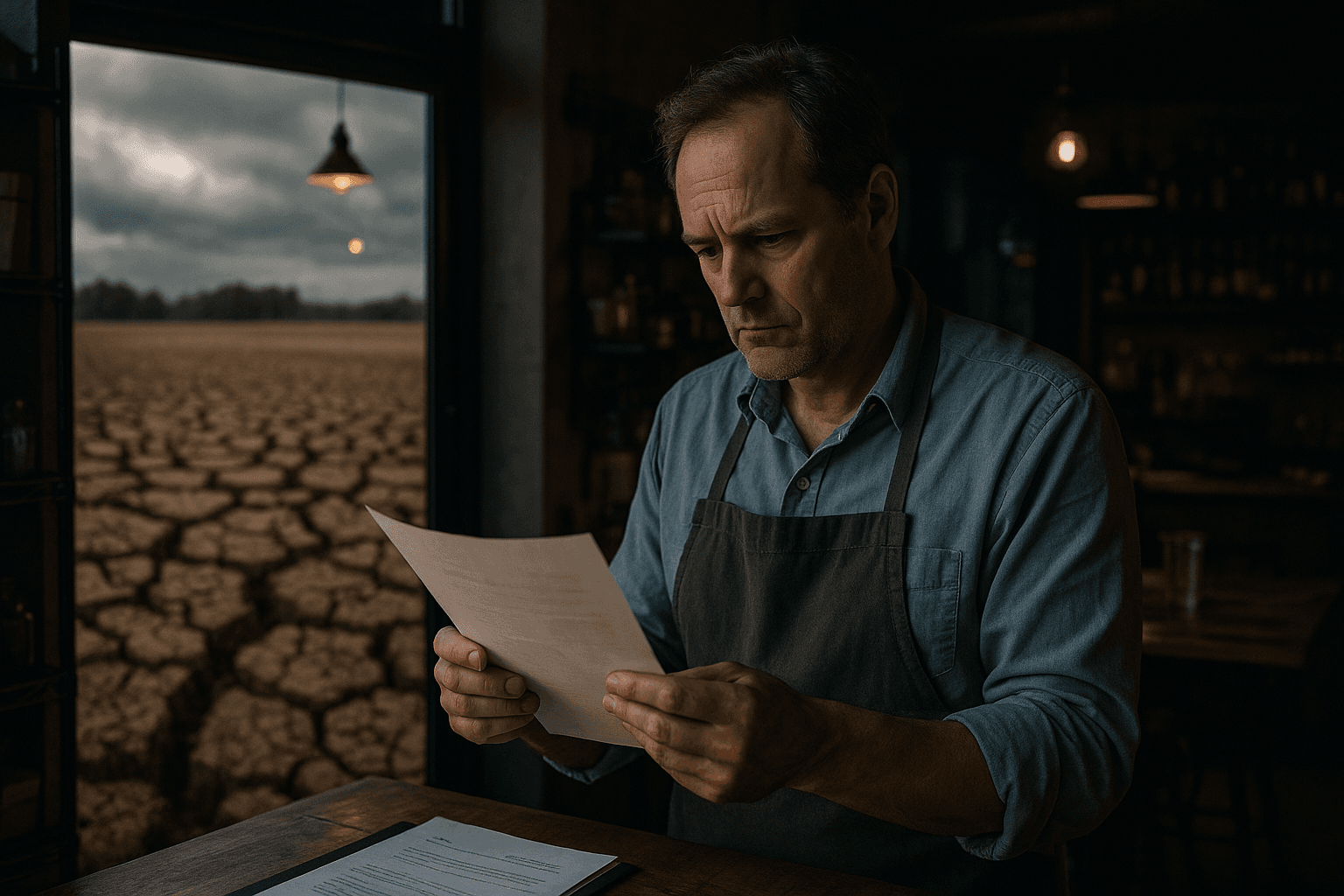

The Greater Hernando County Chamber posted a notice on December 8, 2025 reminding local small businesses and private nonprofits that SBA Economic Injury Disaster Loans remain available for losses tied to the February 2025 drought declaration. The message stresses substantial working capital support may be accessible, deadlines are approaching, and affected firms should contact the SBA and local resources for application help.

On December 8, 2025 the Greater Hernando County Chamber notified local businesses and nonprofits that SBA Economic Injury Disaster Loans, known as EIDLs, remain available to eligible Florida firms that suffered economic losses related to the February 2025 statewide drought declaration. The Chamber emphasized that these loans provide working capital, not funds for physical damage, to help enterprises cover payroll, accounts payable and other operating expenses when revenue has been lost because of the drought.

The release noted that loan amounts can be substantial, with SBA guidance in similar declarations referencing caps up to two million dollars, and that interest rates and repayment terms vary by borrower type and are set by the SBA for each disaster. The Chamber post also warned that application return deadlines are approaching as of December 12, 2025 and urged affected Hernando businesses and private nonprofits to act promptly to preserve eligibility.

For application support the Chamber directed firms to the SBA disaster application channels. Businesses may apply online at sba.gov/disaster, call the SBA Customer Service Center, or email SBA disaster customer service for assistance. The notice encouraged local firms to contact the Chamber for help assembling required financial documentation and to seek guidance on next steps.

Local impact in Hernando County could be meaningful for agricultural suppliers, tourism related services and small retailers that saw revenue declines during the February drought. Access to working capital can preserve payroll and prevent closures while longer term recovery unfolds. Loan terms and eligibility will determine how many businesses obtain funds, and the potential two million dollar cap indicates relief could be significant for larger small firms and established nonprofits.

Residents and business owners should treat the Chamber notice as a call to action. Apply through the SBA at sba.gov/disaster or contact the SBA Customer Service Center for authoritative information and exact deadlines, and reach out to local business support for practical assistance in preparing applications.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip