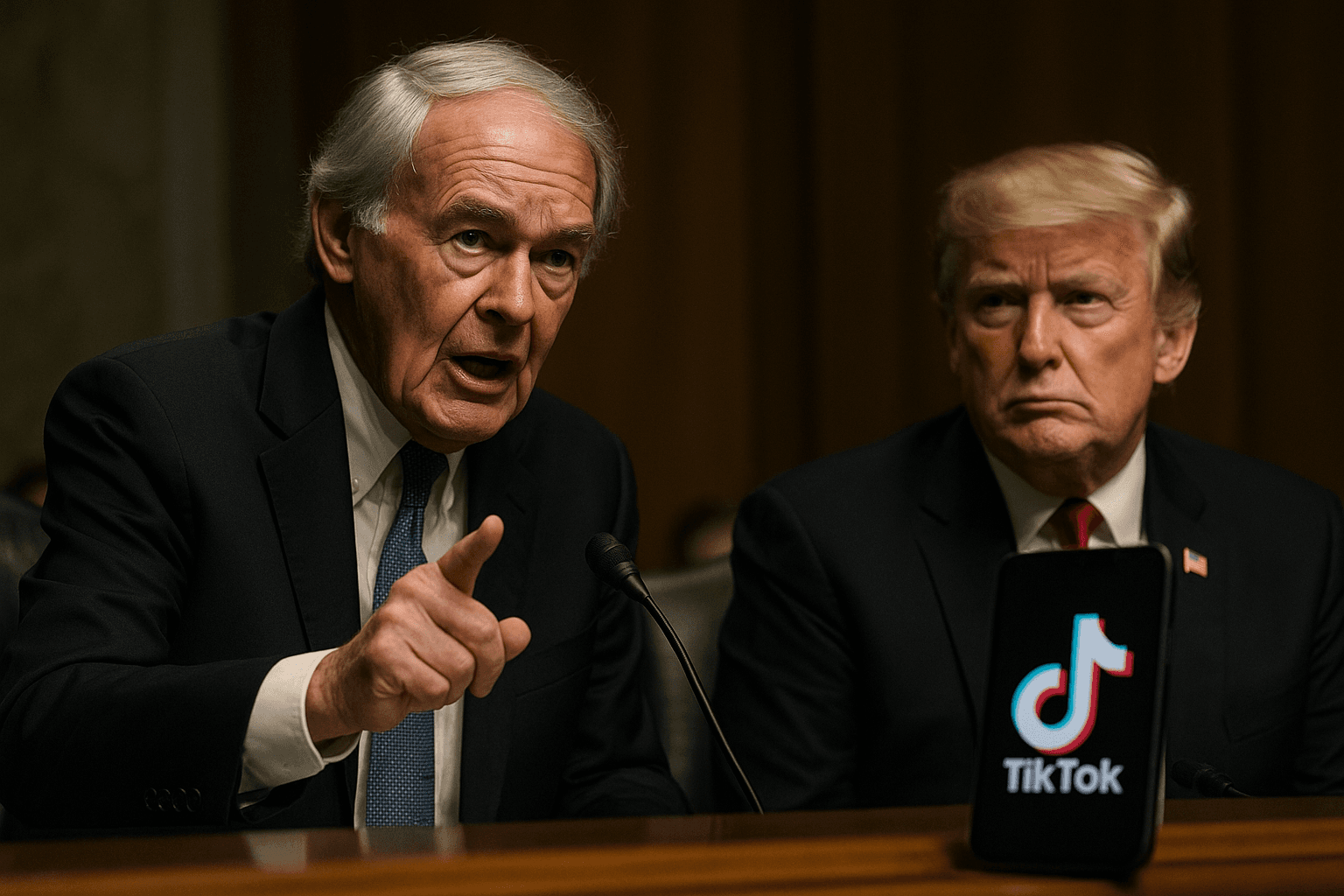

Senator Markey Demands Answers From Trump On TikTok Divestiture

Senator Ed Markey has asked President Donald Trump to disclose key details about the administration’s handling of the mandated divestiture of TikTok’s U.S. operations, pressing for clarity on licensing, algorithm governance, and foreign approvals. The request highlights growing concerns about legal transparency and market uncertainty as the administration extends enforcement deadlines to January 20, 2026.

Senator Ed Markey pressed the White House on November 24 for detailed information about how the administration is implementing the 2024 national security law that requires the divestiture of TikTok’s U.S. operations. In a letter to President Donald Trump, Markey sought specifics on whether Chinese approval had been obtained for any licensing arrangements, whether licensing of TikTok’s recommendation algorithm would be a one time transfer or require periodic renewals, and how retraining and monitoring of the algorithm would be governed.

The request follows an executive order issued by President Trump on September 25 that declared a proposed divestiture plan met the statutory requirements and extended the enforcement deadline to January 20, 2026. That extension, which aligns with Inauguration Day, has intensified scrutiny from lawmakers who say repeated deadline pushes and broad public statements by the administration have left key legal and transparency questions unresolved.

Markey argued that Congress and the public should be shown the terms and status of any deal, warning that continued opacity risks undermining the rule of law and public confidence in a process premised on national security concerns. The White House did not immediately respond to requests for comment about the senator’s letter.

The dispute sits at the intersection of technology policy, national security, and market regulation. How algorithm governance is handled will have practical consequences for potential buyers and for the broader digital advertising ecosystem. If algorithm licensing requires renewals or ongoing approvals from foreign authorities, that could create persistent operational risk for any acquirer and complicate valuation and financing for a deal. Conversely, a one time transfer of code and models might assuage investor concerns but raise questions about the adequacy of security guarantees.

Legal experts and industry participants say the case could set a precedent for how Washington treats foreign owned platforms with large domestic user bases. The 2024 law and subsequent executive action reflect a trend toward more aggressive scrutiny of technology ownership on national security grounds, a shift that has increased regulatory uncertainty for cross border deals and for investors in social media and ad tech companies.

For Congress, the Markey letter signals a push for greater oversight. Lawmakers could seek classified briefings or push for redacted disclosures to resolve whether foreign approvals are involved and to assess the sufficiency of safeguards governing algorithm retraining and monitoring. That oversight could influence the timeline and terms of any final transaction and affect market confidence.

Markets and potential bidders now face a narrowing window before the January 20, 2026 compliance date. Unless the administration provides greater transparency on the mechanics of the deal and the legal basis for extensions, businesses and investors will continue to weigh significant policy and operational risk as they evaluate participation in any divestiture process.