Senators Urge Federal Probes into Meta Over Scam Ad Revenue

Two U.S. senators have called on the Federal Trade Commission and the Securities and Exchange Commission to investigate Meta Platforms after a Reuters review of internal documents suggested the company expected billions from illicit advertisements. The move raises fresh questions about platform responsibility, investor disclosures, and the scale of consumer harm tied to scam ads on Facebook and Instagram.

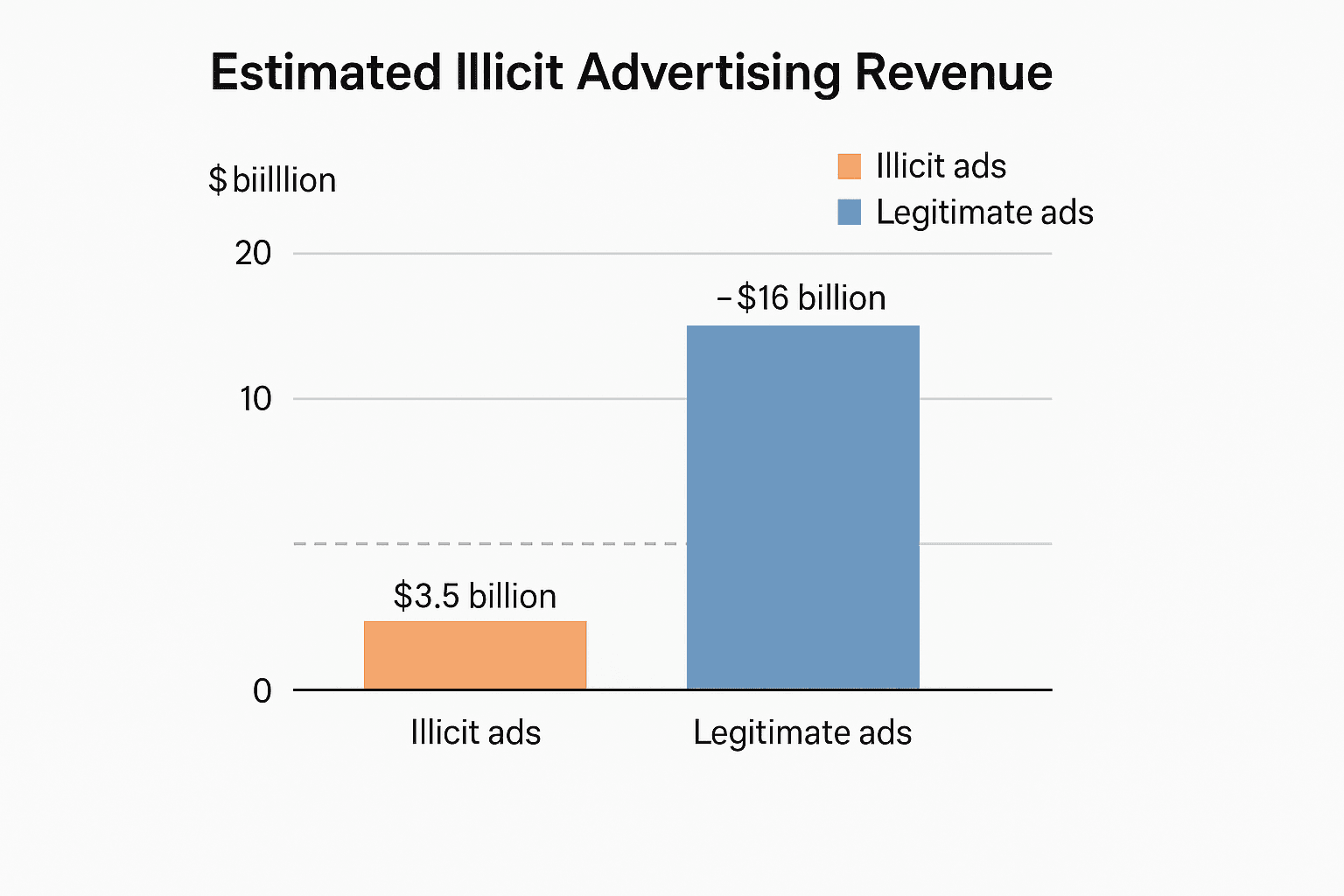

Two U.S. senators wrote to the heads of the Federal Trade Commission and the Securities and Exchange Commission on November 24, asking the agencies to investigate Meta Platforms for allegedly earning substantial revenue from scam and illicit advertisements on Facebook and Instagram. Senators Josh Hawley of Missouri and Richard Blumenthal of Connecticut cited a Reuters examination of internal Meta documents that said the company expected roughly 10 percent of 2024 revenue from illicit advertising, an amount Reuters estimated at about sixteen billion dollars, and about three and a half billion dollars every six months from so called higher risk scam ads.

The senators urged both the consumer protection regulator and the securities watchdog to pursue vigorous enforcement if the reporting is accurate, seeking disgorgement of profits, civil penalties and orders to end the appearance of such ads on the social networks. In their letter they pointed to examples visible in Meta’s Ad Library, including illicit gambling promotions, payment scams, cryptocurrency fraud, AI deepfake services and fake federal benefit offers.

The disclosure has two distinct regulatory implications. For the FTC the issue centers on consumer protection, advertising practices and whether Meta allowed deceptive or illegal content to be monetized at scale. For the SEC the question is whether company disclosures to investors accurately reflected the risks and sources of revenue, making potential misstatements material to shareholders. Together the agencies have tools that could include financial penalties, restitution and injunctions that would shape how platforms police advertising content and safeguard users.

Meta pushed back on the senators’ claims, describing the letter’s assertions as exaggerated and wrong and noting the company has reduced user reports of scams by fifty eight percent over the past eighteen months. The company has in recent years invested in detection systems, advertiser verification and transparency features such as the Ad Library, but the Reuters review of internal material and the senators’ letter suggest those efforts may not have fully eliminated high risk ads or the revenue they generated.

The allegations expose a persistent tension at the heart of modern ad supported online platforms. Advertising is a major revenue stream, and scaling automated systems to vet content creates incentives that can conflict with effective moderation. The emergence of AI driven deepfakes and rapidly evolving scam techniques makes detection more difficult and raises the stakes for regulators, consumers and investors alike.

Beyond enforcement, the episode is likely to accelerate policy debates in Washington about corporate responsibility for third party content and the adequacy of existing consumer safety and securities rules for the digital age. If investigators find that millions or billions of dollars flowed from illicit advertising into Meta’s balance sheet, the company could face costly penalties, investor litigation and renewed pressure to change how it monetizes and moderates ads.

The senators’ request increases scrutiny on a company that remains a dominant advertising platform and highlights the potential human and financial toll of scam ads. The unfolding response by regulators will determine whether this becomes a pivotal moment for tougher oversight of digital advertising ecosystems.