September Inflation Cools to 3%, Easing Path for Fed Rate Cut

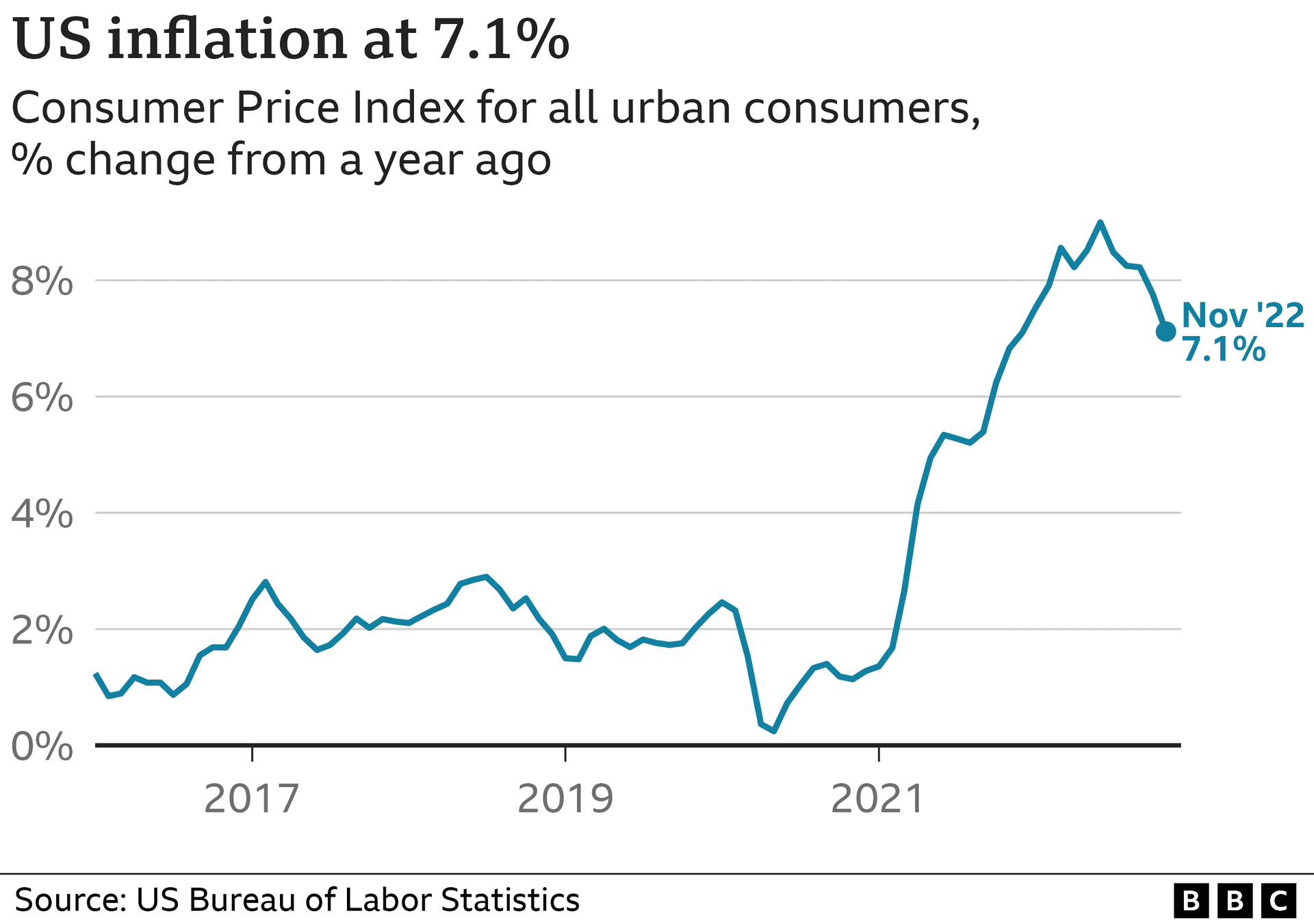

U.S. consumer inflation rose to 3% in September, a slightly lower-than-expected reading that increases the likelihood the Federal Reserve will trim interest rates at its meeting next week. The number buoyed markets but also stirred questions about data reliability amid a partial government shutdown, leaving policymakers and investors weighing uncertain signals ahead of a pivotal decision.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

U.S. consumer inflation registered at 3% in September, a modestly softer outcome than economists had anticipated and a development that market participants say clears the way for the Federal Reserve to reduce interest rates at its policy meeting next week. The report arrived after the Fed issued a first quarter-point cut last month — its first reduction since December 2024 — and is widely viewed as reinforcing the central bank’s shift from tightening to easing monetary policy.

Wall Street reacted quickly: the Dow Jones Industrial Average jumped 66 points, or about 0.1%, in premarket trading on the inflation release. Investors have been searching for clear signals on growth and price pressure, and a cooler-than-expected inflation print increases the odds that the Fed will follow through with another easing step when officials conclude their meeting next Wednesday.

Yet the headline number is not without controversy. Questions have been raised over the accuracy of the consumer inflation report because much of the federal government has been shut down, complicating data collection and prompting analysts to caution against over-interpreting a single monthly reading. The Bureau of Labor Statistics (BLS) said the report was produced under constrained conditions, and economists noted that revisions or subsequent monthly readings could alter the near-term narrative.

Some market strategists viewed the September reading as confirmation of a sustained easing trend. “Inflation coming in weaker-than-expected further solidifies a continuation of the Federal Reserve’s rate cutting cycle, at least for the next two meetings,” Skyler Weinand, chief investment officer at Regan Capital, wrote in a note issued Friday. Weinand added a scenario dependency that underscores the policy trade-offs facing the Fed: “Once the government reopens and if we start to see weak unemployment data and the unemployment rate rises precipitously towards 5%, we could expect either a 50 basis point cut for December or the Fed to communicate a string of cuts in 2026.”

Policy decisions now hinge on a narrow set of incoming indicators — employment, consumer spending and any revisions to price data once full government operations resume. The Fed has emphasized it will act on a data-dependent basis, and officials have repeatedly said that a return of sustained inflationary pressures would delay further easing. For households and businesses, the likely near-term trajectory of lower borrowing costs could relieve pressure on mortgages, auto loans and corporate borrowing, while savers and fixed-income investors continue to face the prospect of compressed returns.

Economists caution that one month of softer inflation does not guarantee a durable downtrend. The Fed’s room to maneuver depends on the labor market and whether underlying inflationary measures, such as services excluding shelter, remain elevated. With the next Fed meeting only days away and uncertainty around data quality, markets and policymakers alike will be watching employment releases and other indicators closely to confirm whether September’s report represents a trend or an anomaly.