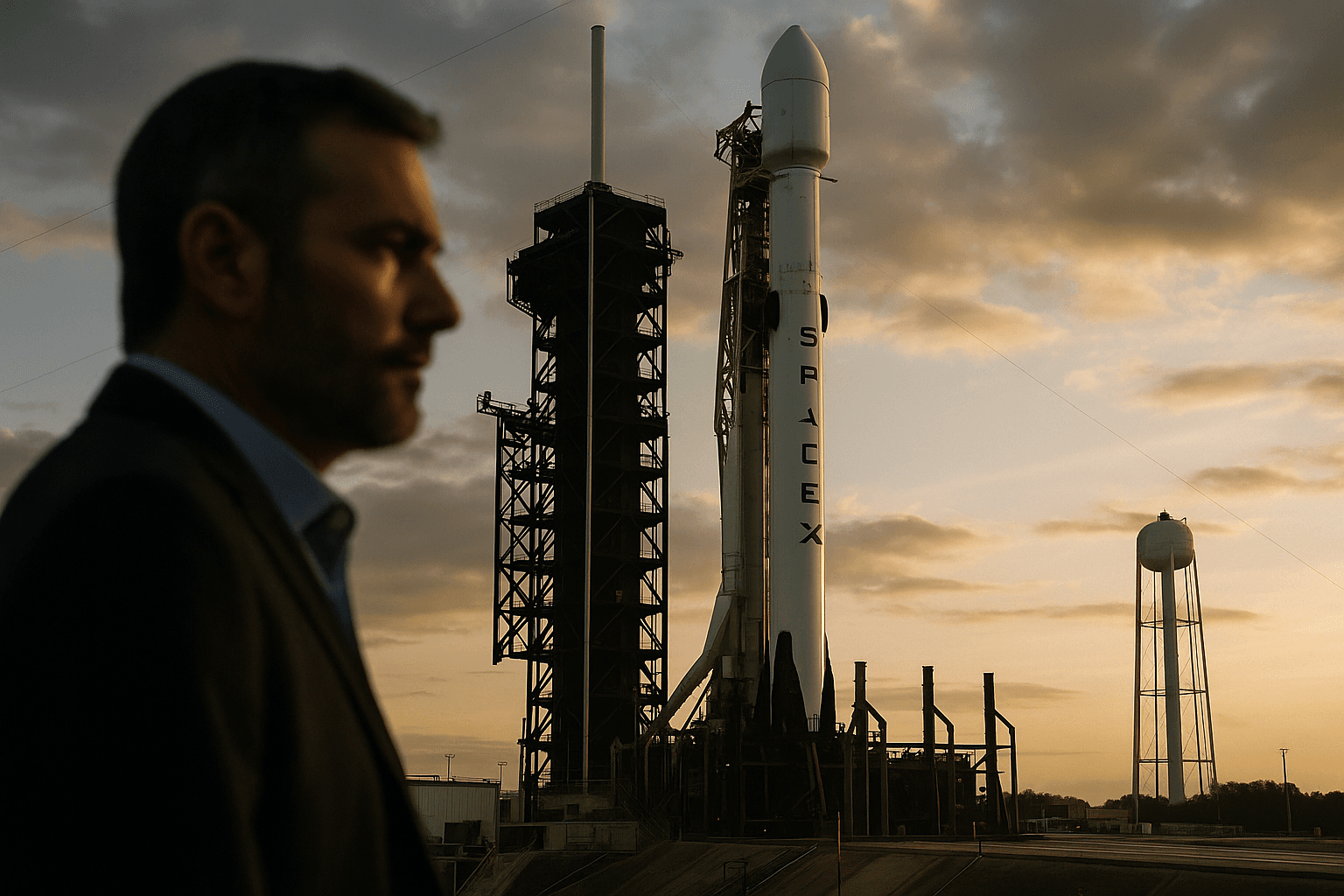

SpaceX Insider Sale Talk Implies Up to Eight Hundred Billion Valuation

Bloomberg reported that SpaceX held director-level discussions about a tender sale that could imply a $750 billion to $800 billion valuation, reviving speculation about a broad initial public offering. If executed, the transaction would make SpaceX the most highly valued privately held company and could set the stage for an IPO as soon as late 2026, with material implications for satellite investors and market structure.

SpaceX held internal discussions at its Starbase facility on December 5 about a possible insider tender sale that Bloomberg reported could value the company at between $750 billion and $800 billion. The proposal would price shares above the $212 per share level set in July and, if completed, would make SpaceX the most highly valued privately held company on record. Company directors reviewed scenarios that market participants say could also lay groundwork for a broader public offering as soon as late 2026, contingent on investor appetite.

The move follows years of private capital accumulation behind SpaceX as it built out launch capacity and scaled its Starlink satellite broadband arm. An insider tender typically allows employees and early investors to sell share stakes to new or existing backers at a negotiated price, providing liquidity without a full IPO. Market participants framed the potential tender as a bridging step, one that could help clear valuation questions and test institutional demand ahead of a full public listing.

News of the discussions lifted related satellite and spectrum linked equities on December 5 as investors reassessed the sector’s long term growth prospects. Analysts noted that a SpaceX valuation in the three quarter to four hundred billion range would recalibrate comparable valuations for companies that provide satellite services, ground equipment and radio spectrum capacity. For firms already trading publicly, the announcement suggested renewed investor interest in connectivity plays that benefit from high throughput low latency satellite networks.

Beyond market mechanics, the prospective valuation raises regulatory and strategic questions. SpaceX’s role as a major national and international satellite communications provider means any path to public markets would draw scrutiny from spectrum regulators and national security reviews. Agencies such as the Federal Communications Commission oversee spectrum allocation and licensing, and broader reviews of critical communications infrastructure are likely to feature in any transition from private to public ownership.

The timeline Bloomberg outlined points to a delicate dance between market conditions and corporate readiness. Investors weighing a late 2026 IPO would factor in macroeconomic variables including interest rates, the appetite for growth at scale and recent volatility in high multiple technology names. A private tender at the $750 billion to $800 billion range would also present governance questions about share class structures and insider liquidity that underwriters and institutional investors typically examine closely.

For employees and early backers, a tender would offer a rare chance to monetize holdings after years of private ownership. For competitors and suppliers, a public valuation that high could accelerate consolidation and fresh capital flows into satellite infrastructure and spectrum acquisition. SpaceX declined immediate comment to reporters, leaving market participants to parse the Bloomberg account and the strategic signaling behind director level conversations held at Starbase.

As investors digest the possibility of a super charged private valuation, the ultimate outcome will depend on whether the company and market conditions align to support either a large tender or a full IPO. Either path would be a landmark event for the aerospace and communications industries and a barometer for investor willingness to pay for next generation global connectivity.