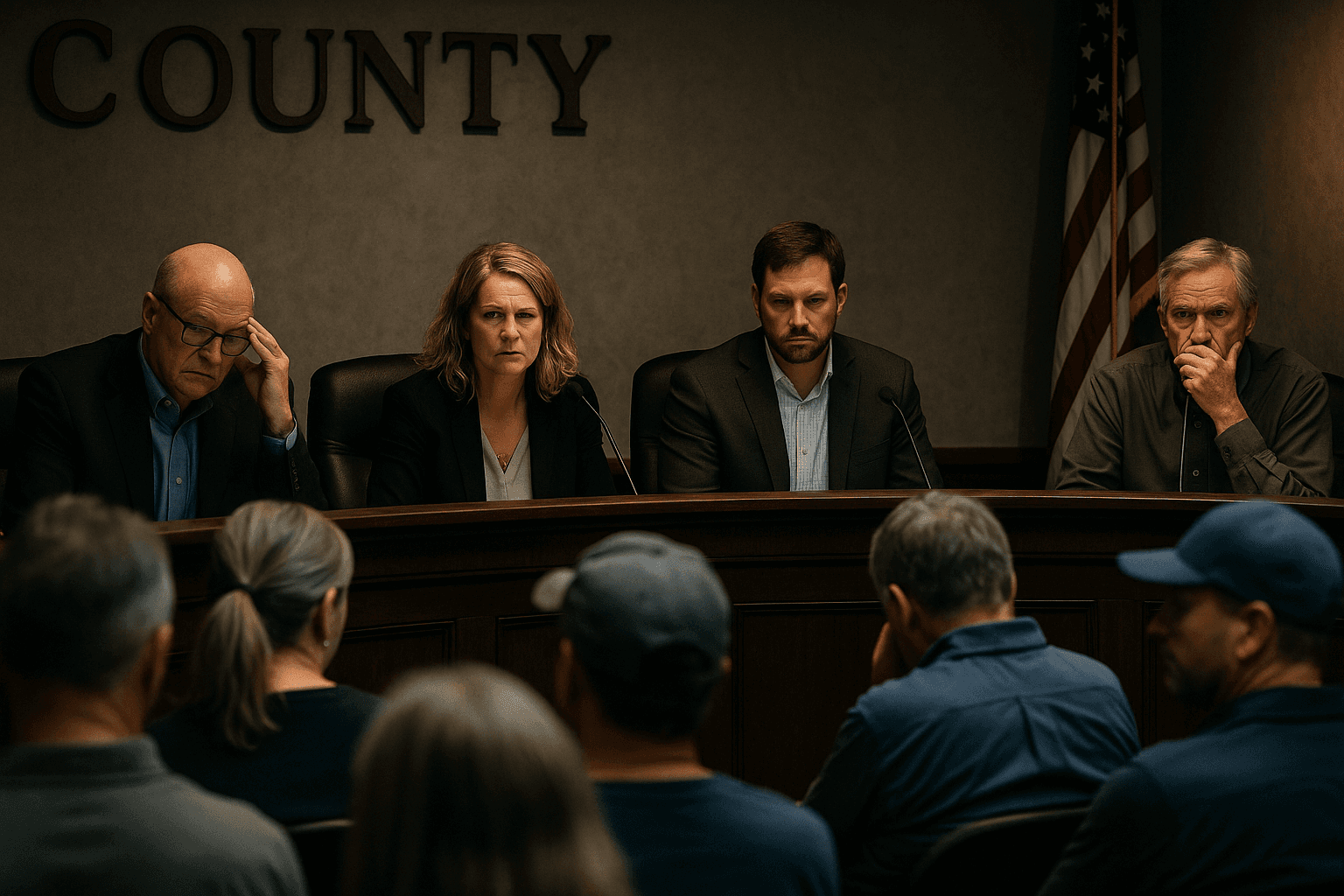

Summit County Council Deadlocks on Basin Rec Tax Increase Decision

Summit County Council split 2 to 2 over Basin Recreation’s proposed 2026 budget, including a 15 percent property tax increase, and postponed the vote to allow an absent councilmember to review public comment before deciding. The delay matters because the proposal would raise roughly 1.3 million dollars for employee salaries and ongoing facility costs, while opponents warned of increased tax burdens for local property owners.

The Summit County Council reached an impasse at its meeting when four members present could not produce a majority on Basin Recreation’s 2026 budget proposal, which included a 15 percent property tax increase. With one councilmember absent, the vote was postponed to December 10 so the absent member could view meeting materials and public testimony prior to casting the deciding vote.

The proposed increase would generate roughly 1.3 million dollars in additional revenue, funds the recreation district said are intended primarily to support new employee salaries and cover ongoing costs such as facilities maintenance and insurance. Residents who addressed the council during the public hearing largely opposed the increase, citing rising property taxes and related cost burdens for homeowners and renters in Summit County.

Council Chair Tonja Hanson moved to continue the meeting to ensure the absent councilmember could watch the recorded meeting and hear public comment before making a determination. The council chose to reschedule the decision rather than risk a tied 2 to 2 outcome that could have left Basin Recreation without an adopted budget heading into 2026.

The delay highlights several local governance issues. First, it underscores how a single absence can determine fiscal outcomes when votes are closely divided. Second, it illustrates the tension between ensuring full consideration of public comment and the practical urgency of passing a budget on schedule to avoid service interruptions or administrative uncertainty. If Basin Recreation enters 2026 without an approved budget it may face operational constraints that could affect programming, maintenance, and staffing.

For residents, the immediate impact is twofold. Property owners face the prospect of higher taxes if the council approves the measure on December 10. Meanwhile, community members who use Basin Recreation facilities could see changes in services if the budget is delayed or altered. The council’s decision next week will determine whether the district secures the proposed additional revenue or must identify alternative cuts or efficiencies to balance its 2026 finances.