Summit County Council Moves to Remove Costly Chalk Creek Road Assessment

Summit County officials moved to eliminate Service Area 8, a special road assessment that added about five thousand dollars annually to property tax bills for the small group of residents along Chalk Creek Road. The change promises immediate relief for affected homeowners, while shifting maintenance responsibility into the county budget and raising questions about long term funding and equity for rural service areas.

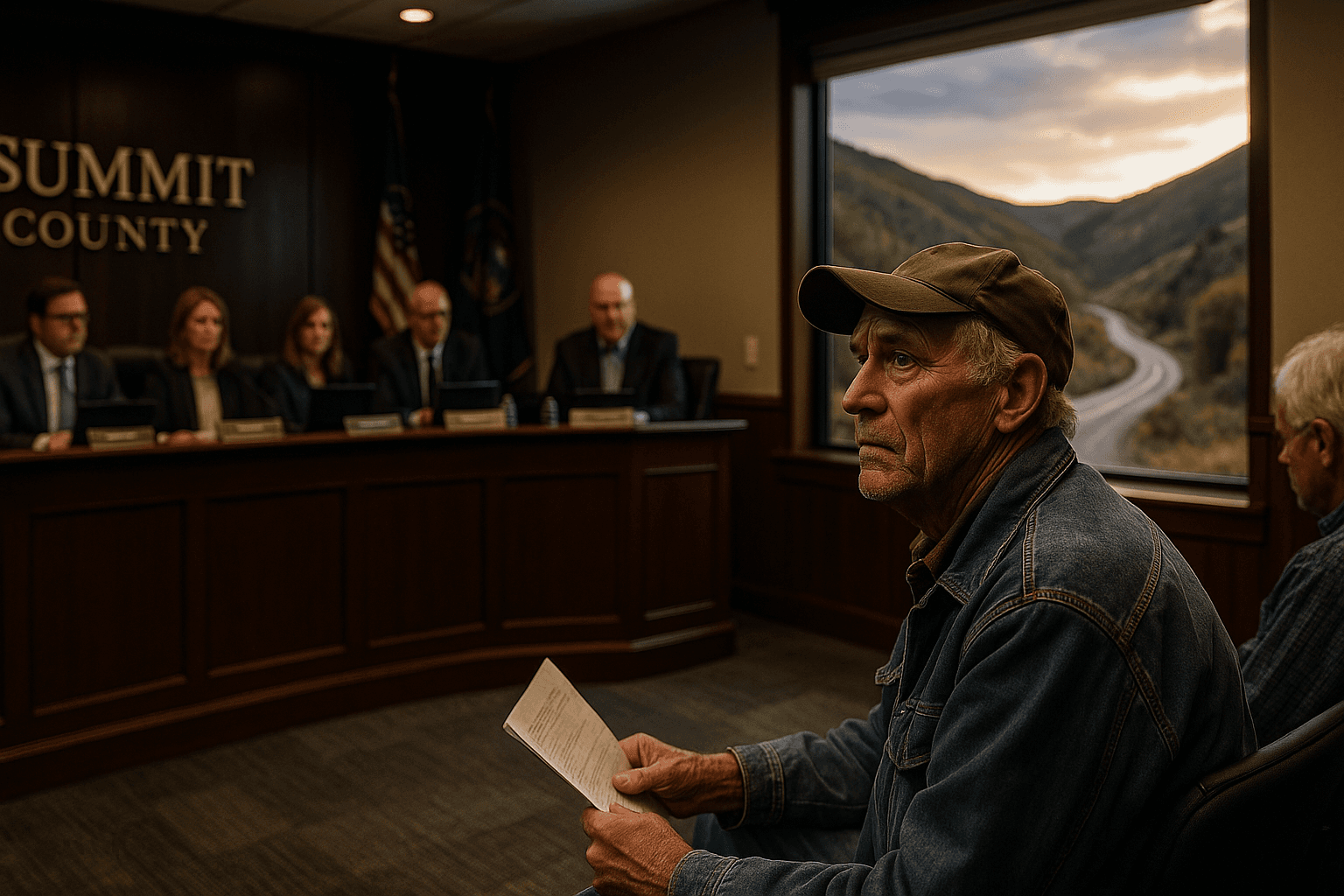

On December 8 the Summit County Council signaled it would remove Service Area 8, a decades old road service assessment that had placed roughly five thousand dollars in annual charges on the properties along Chalk Creek Road between Coalville and the Wyoming border. County Manager Shayne Scott said the proposed 2026 budget would include eliminating the special assessment.

Service Area 8 was created in the 1980s when oil companies paid most maintenance costs. As oil activity declined, residential parcels absorbed the growing share of expenses. Only eight full time residents currently live inside the service area boundaries, making the levy an unusually concentrated burden on a small number of taxpayers.

Summit County Finance Officer Matt Leavitt said the change will not take effect immediately but property owners should see a "significant difference" by the end of 2026. County officials plan to use remaining Service Area funds to cover maintenance needs for the next few years while the county public works department absorbs ongoing costs.

The proposal is folded into the county manager's larger suggested operating budget for 2026, which totals about one hundred million dollars. Removing the assessment will reduce revenue tied directly to Chalk Creek Road, and county leaders will need to account for that shift within the general fund and the public works work plan. That trade off highlights a common tension in local government budgeting, where targeted assessments promote user based fairness but can become inequitable if the original payer base changes.

For the eight residents on Chalk Creek Road the near term effect is clear, household tax bills will decline and the financial unpredictability tied to special assessments will ease. For the broader community the decision sets a precedent, and invites scrutiny about how the county evaluates other legacy service areas established under different economic conditions.

County officials must now detail how long reserve funds will carry maintenance, what costs public works will assume, and whether policy changes are needed to prevent similar mismatches between payer populations and service obligations in the future. Residents should watch budget hearings and council actions as the proposal moves from the manager's draft into the final 2026 budget.