Tel Aviv B2C AI Startup Secures Funding to Scale Consumer AI Assistant, Signaling Renewed Israeli Appetite for Direct-to-Consumer AI

A Tel Aviv-based consumer AI startup disclosed a new funding round to accelerate the scaling of its AI-powered personal assistant, with plans to enhance voice and mobile capabilities for global markets. While the amount and investors remain undisclosed, the deal underscores growing investor interest in Israeli B2C AI products amid a crowded global landscape.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Tel Aviv, Israel — a Tel Aviv-based consumer AI startup disclosed a new funding round aimed at scaling its AI-powered personal assistant for everyday use, with ambitious plans to broaden voice and mobile features for global markets. The company said the round would accelerate product development, user acquisition, and international expansion, though it did not disclose the exact amount or the investors involved. The move signals renewed investor interest in B2C AI products emerging from Israel, as founders race to translate laboratory breakthroughs into consumer-ready applications in a crowded global landscape. Early responses from market observers suggest that the round could recalibrate expectations for regional players aiming to scale direct-to-consumer AI services.

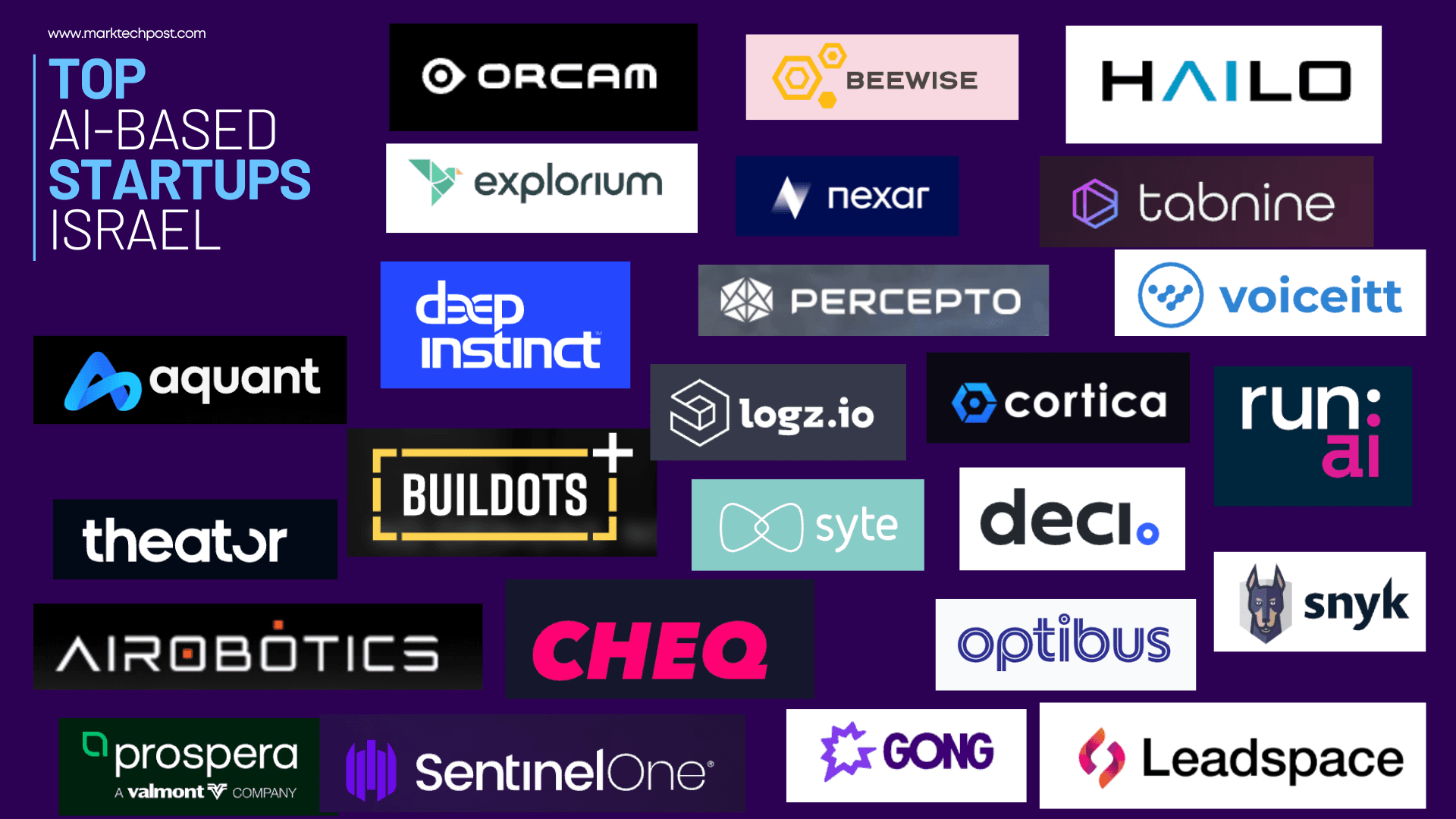

Israel's AI startup scene has matured from a focus on defense-related or B2B enterprise applications to a broader consumer-driven frontier. TechCrunch, Calcalist Tech, and Reuters have highlighted a rising cadence of funding rounds for Israeli generative AI ventures, alongside a popular belief that the country can translate research into scalable consumer products. Industry trackers estimate hundreds of Israeli generative AI startups collectively securing more than $20 billion in funding through 2025, underscoring a crowded landscape in which a handful of consumer-facing apps aim to break out. The funding round for the Tel Aviv company arrives amid that broader trend, with investors signaling comfort in product-driven AI models that promise lock-in through daily use and data-driven personalization.

Consumer AI assistants, especially those infused with natural language and voice capabilities, are migrating beyond smartphones to wearable devices, smart speakers, and in-car systems. The Tel Aviv startup's plan to scale voice and mobile features reflects a push to harness multi-modal interfaces, support for multiple languages, and tighter integration with popular messaging and mobile ecosystems. Without disclosing terms, executives indicated the product aims to offer more natural dialogue, context-aware suggestions, and offline or on-device processing to reduce latency and address privacy concerns. In an era of intense competition, the differentiator for many B2C AI products is not just accuracy, but onboarding ease, user retention, and a clear value proposition—such as smarter scheduling, personalized reminders, or proactive help with daily routines.

Investors are weighing the balance of potential user growth against the risks of a crowded field and regulatory scrutiny. Israel benefits from a deep pool of software engineers and a track record of rapid iteration, but building consumer trust around data usage and privacy remains a challenge in many markets. The company will likely rely on a mix of subscription or freemium models, partnerships with device makers, and possibly data-heavy personalization services that could justify higher ARPU. Yet rivals include established platform providers with global distribution, as well as nimble startups that specialize in voice UX, multilingual support, or vertical-specific assistants. The optimistic view is that Israel's lean, product-driven startups can outpace incumbents by delivering better local-language support, privacy-first design, and faster iteration cycles.

Policy developments in the United States and Europe—where the EU AI Act imposes risk-based requirements for consumer AI—create both opportunities and obligations for consumer AI developers. Compliance costs around data handling, consent, and transparency will factor into unit economics and go-to-market strategies for Israeli startups expanding abroad. The company’s emphasis on voice and mobile experiences will also be shaped by privacy regulations such as GDPR and CCPA, which can affect data collection practices and cross-border transfers. In addition, governments are exploring consumer AI governance frameworks, and observers expect standards around safety, bias, and user control to influence product roadmaps in the next 18 to 24 months.

The funding round underscores Israel's role as a springboard for consumer AI products, with potential spillovers in job creation, exports, and R&D intensity. If successful, the startup could contribute to an expansion of Israel's software export base—beyond traditional defense and business software—into consumer apps that generate recurring revenue streams and enable cross-border distribution. For investors, a scaling consumer AI assistant offers a different risk/return profile than heavier B2B AI platforms, with shorter go-to-market cycles and a path to profitability through high user engagement and data-driven monetization. The broader impact includes encouraging more Israeli founders to pursue consumer-grade AI products, attracting international capital, and strengthening collaboration with local universities and research institutes.

As the round becomes public and product milestones emerge, market watchers will watch for concrete details on the funding amount, the investor syndicate, and the envisioned product roadmap. Key indicators will include language support expansion, partnerships with mobile platforms, and a measured shift toward monetization strategies that balance user value with privacy considerations. If the startup can translate its early momentum into rapid international traction while navigating regulatory benchmarks and competitive pressure, it could become a bellwether for Israel's B2C AI ambitions—proof that consumer AI products can scale from Tel Aviv to Tokyo, Lisbon to Lagos, and beyond.