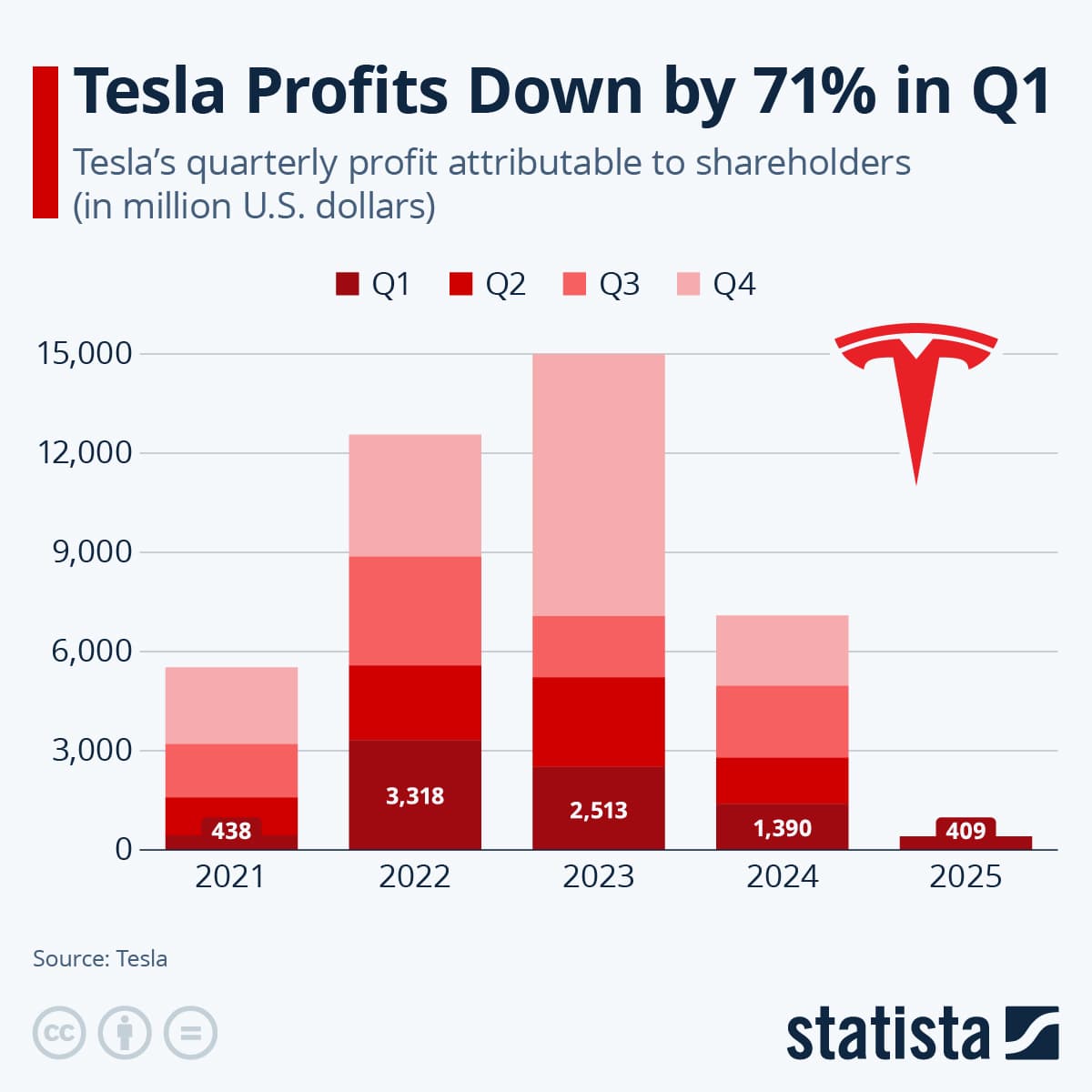

Tesla Q3 Profit Falls to $1.39 Billion as Revenue Climbs 12% on EV Tax-Credit Rush

Tesla reported third-quarter net income of $1.39 billion even as revenue increased 12 percent, a divergence driven in part by a sprint of U.S. buyers seeking federal electric-vehicle tax credits. The results highlight how policy-driven demand can boost top-line growth while exposing margins and earnings to timing, incentive and cost pressures.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Tesla’s third-quarter financial results show a company grappling with competing forces: a clear uptick in sales activity and a simultaneous decline in quarterly profitability. Net income fell to $1.39 billion while revenue rose 12 percent, underscoring a widening gap between growing demand and compressed earnings in the near term.

The revenue increase was attributed to a surge of U.S. buyers rushing to qualify for federal EV tax credits, a pattern that has amplified deliveries and sales in markets where the incentives recently became available or were viewed as at risk of change. Those policy-driven purchases helped push sales higher, but did not translate into stronger net income for the quarter.

A variety of structural and cyclical factors can explain why revenue growth did not produce proportional profit gains. Timing effects linked to tax-credit-driven demand can alter sales mix, with more buyers taking advantage of price reductions, special financing or manufacturer incentives to meet credit deadlines. Such promotions, along with higher selling expenses to convert hesitant buyers into purchasers, can erode margins even as unit volumes rise. At the same time, Tesla continues to invest in capacity, software development and supply-chain flexibility—outlays that support long-term competitiveness but can weigh on short-term earnings.

The interplay between government incentives and automaker economics is central to the quarter’s story. Federal tax credits aim to accelerate EV adoption by lowering consumer costs, but they also encourage temporal concentration of purchases. That concentration can produce a “pull-forward” effect—boosting short-term revenue while potentially leaving a lull afterwards. For Tesla, which has historically relied on volume growth and operating leverage to expand profitability, such lumpy demand can complicate planning and investor expectations.

Market implications extend beyond Tesla’s headline numbers. A tax-credit-fueled sales spike for one manufacturer can ripple through supply chains, dealer inventories and used-vehicle markets, altering price dynamics and competitive positioning in the near term. It also raises questions about the sustainability of sales gains once credit deadlines pass or eligibility rules tighten. For a company that competes on both technology and scale, converting episodic policy-driven demand into steady, margin-accretive revenue will be crucial.

Longer-term trends remain favorable for Tesla: electrification continues to advance globally, battery costs have declined over the past decade, and consumer interest in EVs has grown. However, competition is intensifying as legacy automakers and new entrants expand electric lineups, and regulatory frameworks continue to shape buyer incentives and industry economics. For investors and policymakers alike, the quarter is a reminder that incentives work—often too well in the short run—and that managing the transition to a low-carbon vehicle fleet requires balancing immediate uptake with industry stability.

Tesla’s Q3 results therefore present a nuanced picture: rising sales driven by government incentives alongside squeezed profits that reflect the complex economics of rapid EV adoption. How the company converts this momentum into durable, profitable growth will determine its financial trajectory in the quarters ahead.