Top Economist Says US Mortgage Rates Likely Stay Above 6 Percent Through 2028

The Mortgage Bankers Association's chief economist warns that a widening federal deficit and expectations of higher inflation will keep mortgage rates from falling below 6 percent for the next three years, a projection that would further strain affordability and reshape the housing market. Recent modest rate declines may intensify competition in low-inventory markets and could pressure prices if demand picks up.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

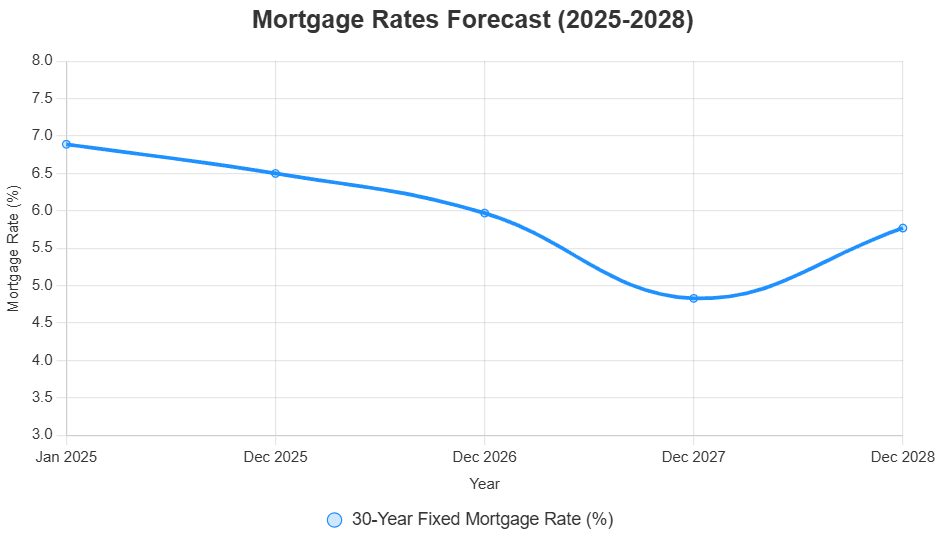

Mike Fratantoni, chief economist at the Mortgage Bankers Association, warned over the weekend that a growing federal deficit and expectations of higher inflation will prevent U.S. mortgage rates from slipping under the 6 percent mark for roughly the next three years, extending through 2028. The forecast underscores how fiscal and inflationary pressures are feeding into longer-term borrowing costs, complicating a housing market still grappling with supply constraints and elevated home prices.

Fratantoni’s warning comes after a period of modest rate relief: mortgage yields have moved down from peaks reached in prior years, producing what industry observers have called the lowest levels of the year for some lenders. “Over the past few weeks, rates have been at their lowest levels of the year,” she said. “Perhaps perversely, the recent drop in rates could make it harder for some buyers, ratcheting up competition particularly in areas where inventory is still low. Price growth has slowed. However, if there is an increase in demand in the market, there is a possibility we could see price growth begin to accelerate again.”

The projection matters because 30-year fixed mortgage rates near or above 6 percent materially reduce the pool of buyers who can afford median-priced homes. Even modest differences in mortgage rates translate into significant monthly payment changes and borrowing costs over 30 years, shifting purchase decisions and slowing refinance activity. Lenders and real-estate agents report pockets of renewed demand where affordability margins exist, but nationwide inventory remains thin, sustaining a competitive environment in many metro areas.

Fratantoni ties the persistence of high mortgage costs to two macro forces. First, a larger federal deficit tends to put upward pressure on long-term Treasury yields by increasing the supply of government debt and raising the term premium investors demand. Second, if inflation expectations re-anchor higher, the Federal Reserve may keep policy rates elevated longer or markets may price in a higher neutral rate, both of which lift mortgage rates despite recent nominal declines.

For buyers, builders and policymakers, the forecast highlights a familiar trade-off: higher rates cool some buyer segments but can exacerbate affordability challenges for others while leaving home-price dynamics dependent on local supply and employment growth. Economists caution that national averages mask regional variation. Areas with robust job growth and constrained housing supply can still see price acceleration even as national price growth moderates.

Policy responses are limited in the near term. The Federal Reserve controls short-term policy rates, but long-term mortgage pricing is sensitive to fiscal policy decisions and structural supply constraints in housing. Long-run solutions to affordability will hinge on boosting housing supply, streamlining permitting, and recalibrating fiscal trajectories to lower upward pressure on long-term interest rates.

Fratantoni’s projection serves as a reminder that the housing market’s next chapters will be shaped not only by short-term rate moves but by broader fiscal and inflation trends that influence the cost of borrowing for years to come.