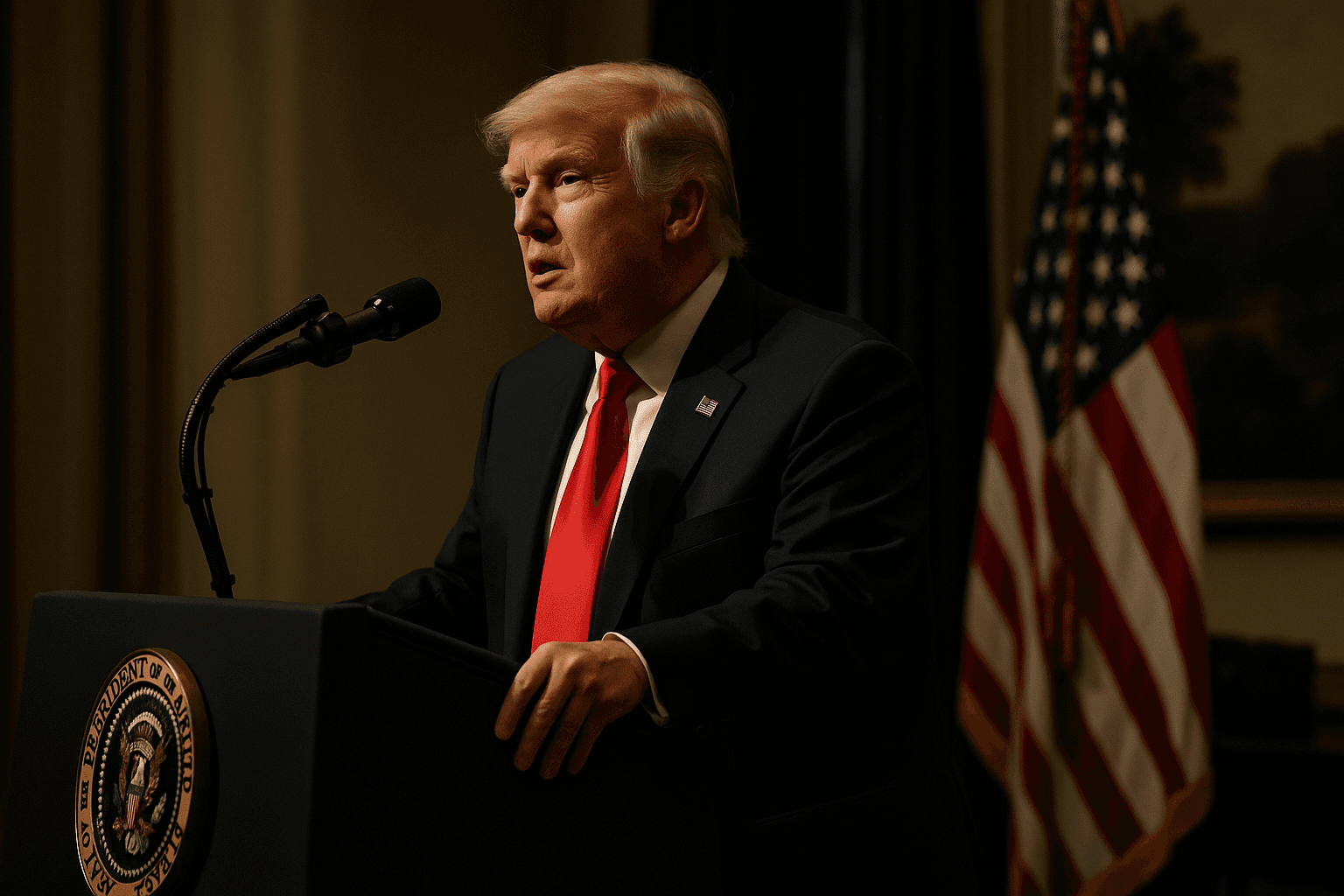

Trump Orders Task Forces To Probe Food Prices And Competition

President Donald Trump signed an executive order directing the Justice Department and the Federal Trade Commission to form Food Supply Chain Security Task Forces to investigate alleged price fixing and anti competitive behavior across food industries. The move raises immediate questions about enforcement strategy, the role of foreign owned firms in U.S. markets, and potential changes to regulation that could affect consumers, farmers and global suppliers.

President Donald Trump signed an executive order on December 6, 2025 directing the Justice Department and the Federal Trade Commission to create Food Supply Chain Security Task Forces to investigate price fixing and anti competitive conduct across food related industries. The directive placed special emphasis on whether foreign controlled companies were contributing to higher U.S. food prices or creating national security risks. The attorney general and the FTC chairman were empowered to bring enforcement actions and recommend regulatory changes, and were required to brief congressional leaders on progress within 180 days and again within a year.

The order signals a federal pivot toward intensified scrutiny of market conduct in the food sector after years of public complaint about rising grocery bills. By tasking both the Justice Department and the FTC the administration combined the criminal antitrust authority of the Justice Department with the civil enforcement and rule making capacity of the FTC. That dual agency approach is intended to allow parallel inquiries into both price fixing and broader patterns of anti competitive conduct, but it also poses organizational and evidentiary challenges. Criminal prosecutions require proof beyond a reasonable doubt of an agreement to rig prices, while civil enforcement can address unilateral conduct and merger effects under different standards.

The inclusion of a national security lens for foreign controlled companies expanded the scope beyond conventional antitrust inquiry and raised questions about how national security assessments would be conducted. That focus could intersect with existing national security review mechanisms for foreign investments, and it may lead to coordination needs between antitrust enforcers, the Committee on Foreign Investment in the United States and other national security agencies. The order did not identify specific firms or countries, leaving the task forces to define investigative priorities.

Policy implications are wide ranging. If investigations produce enforcement actions or regulatory recommendations, changes could affect supply chain contracts, distribution practices and merger approvals across the food sector. Proposed regulatory changes could move beyond enforcement to reshape market rules, influencing how grocery chains, processors and commodity traders operate. For farmers and small producers the outcome could either open competition or introduce new compliance burdens, depending on the remedies pursued.

Politically the move speaks to a core voter concern, food affordability, and is likely to draw bipartisan scrutiny from members of Congress who have pressed for action on concentration and price inflation. The requirement for briefings to congressional leaders within 180 days and again within a year established a timetable for oversight that could accelerate legislative interest in antitrust reform or trade policy adjustments.

Observers will watch whether the task forces translate investigatory activity into sustained enforcement actions and whether findings prompt statutory or regulatory changes. The effectiveness of the initiative will depend on the agencies ability to marshal evidence, coordinate with other federal bodies and resist politicization while pursuing complex cases in a sector that is both economically vital and globally integrated.