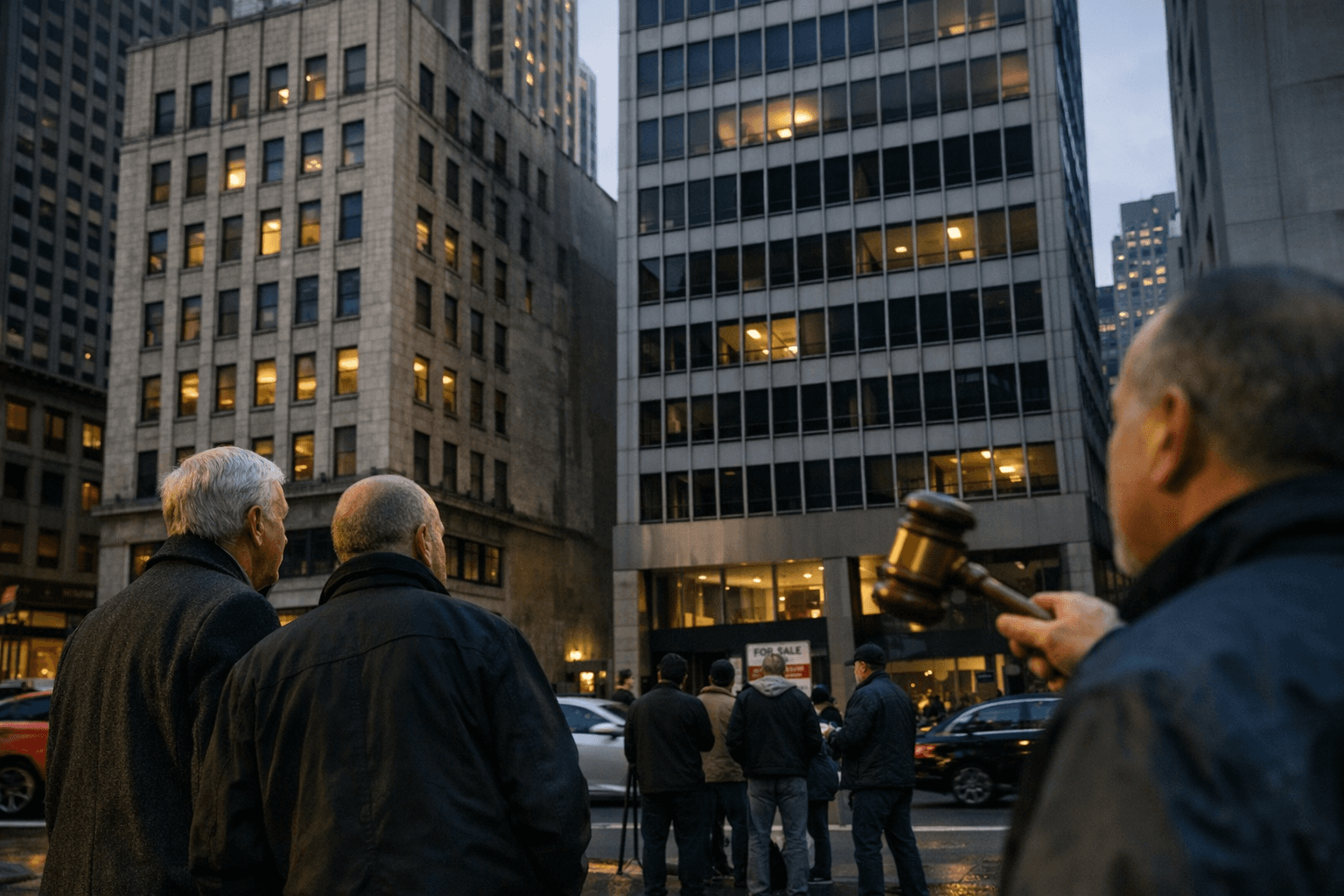

Two Union Square Office Buildings Sell at Auction for About $5 Million

Two downtown Union Square-area office buildings, 180 Sutter St. and 222 Kearny St., totaling roughly 145,000 square feet, transferred at auction in December for about $5 million — a fraction of their combined 2019 purchase price of $74.4 million. The low recorded price reflects a foreclosure auction and credit bid tied to roughly $56.7 million in unpaid debt, a development that highlights downtown office distress and could reshape property ownership and reuse in San Francisco County.

City records show that two office buildings in the Union Square area, 180 Sutter Street and 222 Kearny Street, were recorded as transferring ownership in December for about $5 million. Together the properties total roughly 145,000 square feet. The sellers had paid a combined $74.4 million for the pair in 2019.

The December transfer followed a foreclosure auction and a credit bid process linked to an unpaid loan of roughly $56.7 million. Because the sale came through a foreclosure auction and involved a credit bid rather than an open-market purchase, the recorded $5 million does not necessarily reflect ordinary market value and omits financial terms often disclosed in negotiated sales. Public records identify the buyer on record as a newly formed Richmond-based entity, SVN Properties LLC, tied to an individual listed in those records.

This transaction is symptomatic of broader pressures on downtown office real estate. Occupancy at the two buildings has declined since 2019, mirroring a wider pattern of reduced demand for traditional office space across central business districts. Analysts note that foreclosure-driven transfers and credit bids tend to produce headline-low sale prices while masking the underlying balance-sheet transfers between borrowers and lenders or related entities. Such distressed transfers can also create openings for nontraditional buyers, including regional investors and redevelopment-focused firms, as vacancy and lender defaults reshape ownership patterns.

Local economic implications are immediate and tangible. Lower transactional values and rising delinquencies can reduce assessed values and property tax revenue over time, complicating budgets for city services. Downtown retail and hospitality businesses that depend on office worker foot traffic face continued demand uncertainty as large blocks of office space remain underutilized. Conversely, the distressed sales may accelerate conversations about conversion and adaptive reuse of vacant office buildings into housing, hotels, or mixed-use space, although such conversions require significant capital, zoning approvals, and time.

For lenders and city planners, the sale underscores rising credit risk in commercial real estate and the limits of relying on pre-pandemic valuation benchmarks. For neighborhood stakeholders, the transfer points to a market in transition: ownership change may eventually lead to rehabilitation and new uses, but the short-term effect is more vacancy and financial strain in a district that once relied heavily on daily office occupancy.

As downtown San Francisco continues to adjust to altered work patterns and changing demand for office space, these foreclosure-linked transactions will be a bellwether for how quickly the market stabilizes, how lenders and new owners deploy capital, and whether city policy steps will be required to guide conversions and protect the local tax base.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip