Typhoon Kalmaegi Kills 188 in Philippines, Deepens Economic Strain

At least 188 people have died after Typhoon Kalmaegi battered the Philippines, leaving widespread damage to homes, farms and infrastructure and prompting large-scale emergency operations. The human toll and disruption to agriculture and transport threaten near-term food prices, fiscal outlays for relief and a test of the country’s climate resilience policies.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

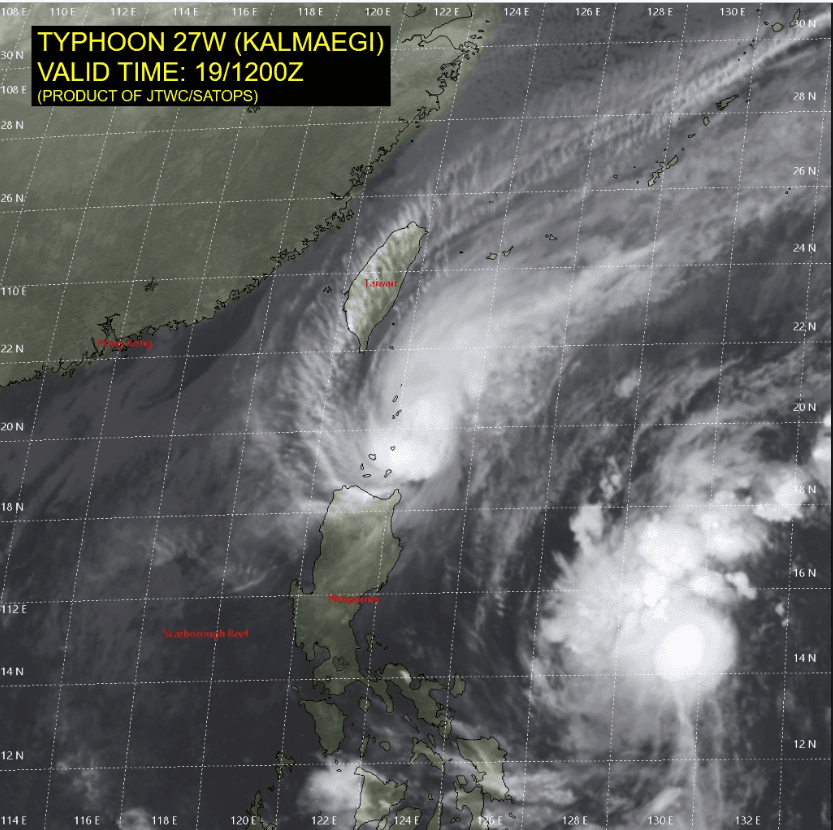

Typhoon Kalmaegi swept across the Philippines this week, killing at least 188 people and inflicting heavy damage to coastal communities and inland provinces. Local officials reported collapsed homes, submerged roads and widespread power outages as rescue teams worked to reach cut-off areas. The storm’s rapid intensification and broad swath of destruction underscored the country’s vulnerability to powerful tropical cyclones.

The immediate economic consequences are concentrated in agriculture, transport and utility networks. The Philippines’ agricultural sector—which contributes around one-tenth of national output and supports a large rural workforce—was hit by both wind damage and flooding. Early indications point to significant losses in rice and high-value crops that supply domestic markets, exacerbating pressure on food availability and prices. Markets are likely to see localized spikes in staples as harvests are disrupted and logistics remain constrained.

Transport infrastructure damage, including port closures and blocked roads, threatens to slow the distribution of relief supplies and delay exports of perishable goods. The logistics hit may create short-term supply bottlenecks and raise transportation costs for businesses already contending with higher fuel prices. In urban areas, power outages will interrupt manufacturing and services, with smaller firms and informal-sector workers—who lack insurance and savings buffers—bearing disproportionate income losses.

Fiscal implications will depend on the extent of physical damage and the speed of government response. Disaster relief and reconstruction typically require large emergency outlays; the government will likely need to reallocate budget lines or tap contingency funds to finance immediate shelter, food distribution and infrastructure repairs. That can raise near-term fiscal deficits or crowd out planned spending unless supplemented by external assistance or restructured loan financing. Low insurance penetration in the Philippines compounds public exposure: many households and small businesses lack private coverage, transferring more of the recovery burden to the state.

Financial markets could see modest, short-lived reactions. The peso may face downward pressure if the disaster disrupts exports or prompts concerns over fiscal financing, but much depends on damage estimates and policy signaling. Remittances—a stabilizing source of foreign exchange that account for roughly 8–10 percent of GDP—can provide a buffer for affected households, though they do not substitute for large-scale reconstruction financing.

Kalmaegi’s destruction reinforces longer-term policy questions about climate resilience. Scientists link warming seas to more intense tropical cyclones, making investments in resilient infrastructure, flood defenses and early-warning systems economically urgent. Effective adaptation will require predictable financing—through public budgets, risk-transfer instruments and international climate funds—and tighter integration of disaster risk into urban planning and agricultural policy.

For millions of Filipinos, the immediate test is survival and recovery. For policymakers and markets, Kalmaegi is a reminder that climate-driven disasters are now an economic risk as well as a humanitarian one, with implications for prices, public finances and long-term growth unless resilience is scaled up.