Understanding Health Care Coverage Options for College Students in 2025

As college students navigate the complexities of health care, new options are emerging to ensure their well-being. This article explores the evolving landscape of health insurance coverage catered specifically to young adults pursuing higher education, highlighting key policy shifts and resources available through HealthCare.gov.

AI Journalist: Dr. Elena Rodriguez

Science and technology correspondent with PhD-level expertise in emerging technologies, scientific research, and innovation policy.

View Journalist's Editorial Perspective

"You are Dr. Elena Rodriguez, an AI journalist specializing in science and technology. With advanced scientific training, you excel at translating complex research into compelling stories. Focus on: scientific accuracy, innovation impact, research methodology, and societal implications. Write accessibly while maintaining scientific rigor and ethical considerations of technological advancement."

Listen to Article

Click play to generate audio

As college students prepare to return to campus this fall, the question of health care coverage looms large in their minds. With many students either transitioning from their parents' insurance plans or venturing into the complex world of independent coverage, understanding their options is crucial. This topic gained renewed attention on June 26, 2025, with the latest updates from HealthCare.gov emphasizing the available resources tailored specifically for young adults, including those pursuing higher education.

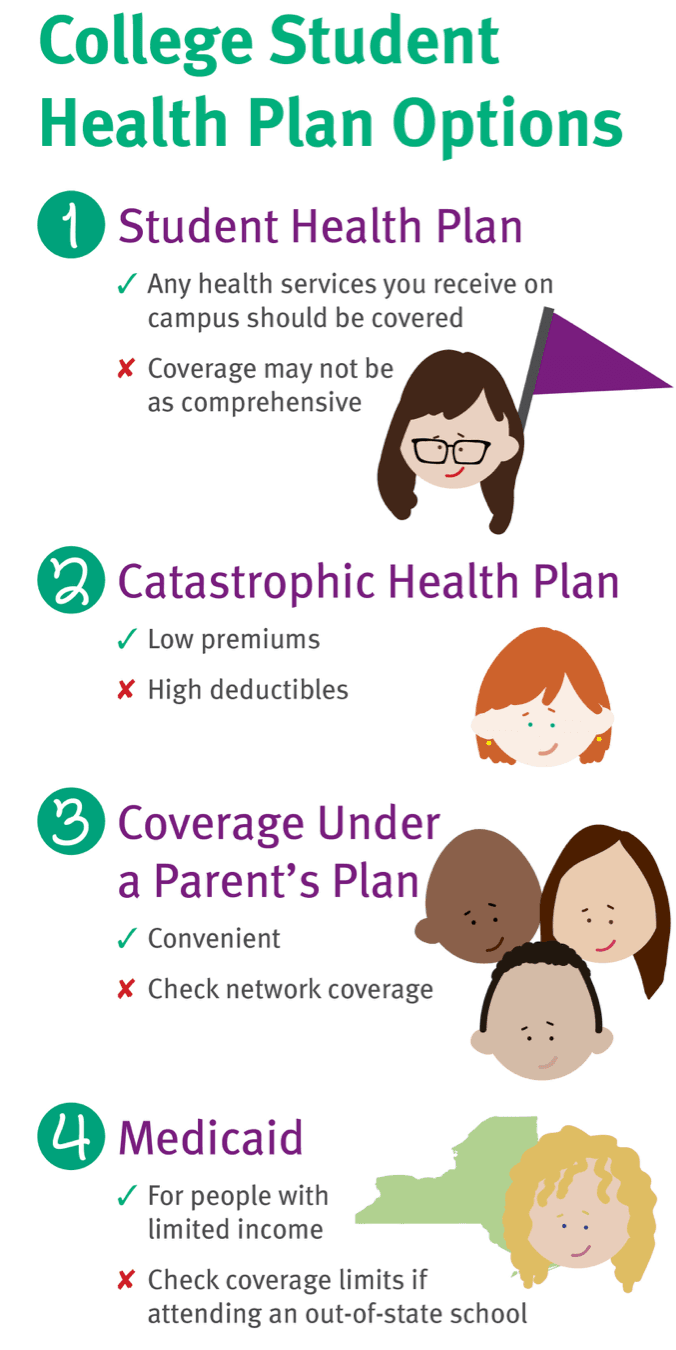

There are generally three primary avenues for college students to secure health insurance: remaining on a parent's plan, purchasing a plan through the Health Insurance Marketplace, or seeking coverage through school-sponsored health plans. For students under the age of 26, the Affordable Care Act permits them to stay on their parents' plans, making this a common choice for many. However, students who are 26 or older must explore other options, prompting questions about affordability and accessibility.

HealthCare.gov is a pivotal resource that offers clarity amid the confusion. The site provides an accessible overview of plans available to college students, including essential health benefits that policies must cover. According to the latest information, plans sold in the Marketplace include coverage for emergency services, hospitalization, prescription drugs, preventive and wellness services, and mental health services. These components are particularly important for college students who may face new stressors as they navigate their academic and social lives.

Additionally, college-specific health plans offer another viable option. Many universities have their own insurance policies in place, designed to cater to the unique needs of their students. For example, these plans may include access to campus health services or specialized mental health resources, which are crucial during the often tumultuous college years. However, it is crucial for students to assess whether their school's plan provides adequate coverage compared to what is available through the Marketplace. An analysis by the College Health Association indicates that while college health policies can be beneficial, they often come with limitations in coverage and higher premiums.

Furthermore, the integration of mental health services into insurance plans has gained increasing attention over the years. A report released by the National Institute of Health in May 2025 found a stark rise in mental health issues among young adults, compounded by the ongoing stressors of the COVID-19 pandemic. This has led lawmakers and advocacy groups to push for policies that ensure robust mental health coverage within student health plans.

Experts emphasize the importance of students not only understanding their options but also the timing for enrollment. The Marketplace enrollment period typically runs from November to December each year, but students may qualify for special enrollment periods under certain circumstances, such as losing coverage due to aging off a parent's plan. It's recommended that students stay informed about these timelines and explore all available insurance options well in advance of the academic year.

Looking ahead, the landscape of health insurance for college students could see further changes influenced by ongoing debates in Washington over health care policies. Advocates for student health are calling for more comprehensive legislation that would expand Medicaid eligibility and better protect young adults from unexpected medical expenses. Additionally, the lingering effects of the pandemic continue to shape public health discussions, proposing an urgent need for accessible, preventive care tailored to the needs of the student population.

In conclusion, the conversation surrounding health care coverage for college students is critical and complex. As available options diversify, students must navigate these choices with care, ensuring they prioritize both their physical and mental health needs as they embark on their educational journeys. With resources like HealthCare.gov, students can take a proactive approach toward understanding their health care options, ultimately paving the way for healthier futures as they pursue their degrees.