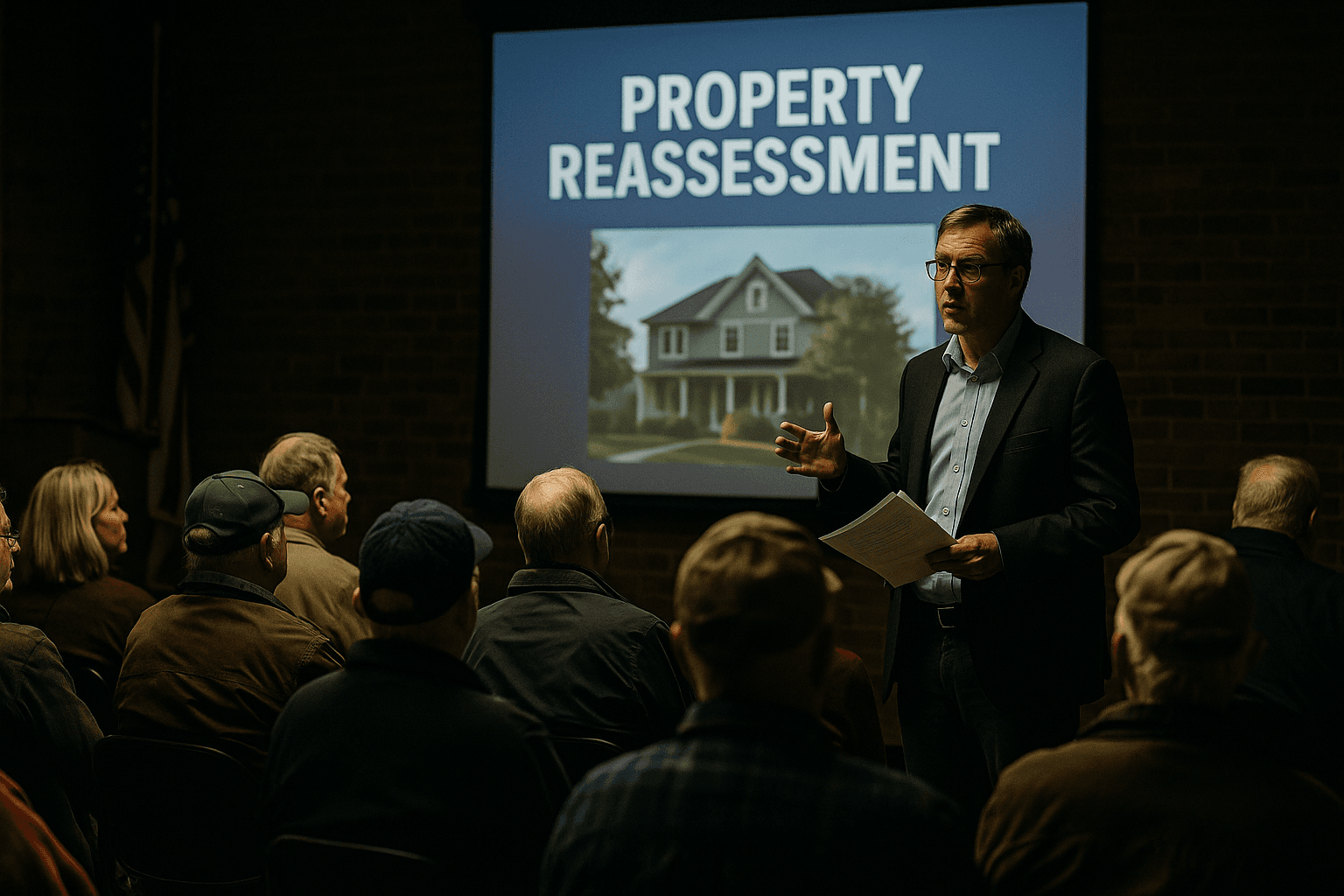

Union County Holds First Comprehensive Property Reassessment in Decades

On December 3, Union County hosted a public reassessment meeting as part of a countywide property reassessment project, the first comprehensive reassessment in decades. The session outlined field data collection schedules, how valuation notices will be delivered, and the procedures and deadlines for filing informal and formal appeals, information that could influence local tax bills and planning decisions.

Union County on December 3 opened a formal public forum to update property owners on a long planned countywide reassessment. The meeting offered residents an overview of timelines for field data collection across townships and boroughs, how preliminary valuation maps and assessment methods are being developed, and the mechanics for receiving valuation notices and filing appeals.

County officials described the reassessment as the first full review in decades, a process intended to align assessed values with current market conditions. Field crews will visit properties throughout the county to confirm building characteristics and other data that inform valuations. Multiple public meeting opportunities are scheduled so residents can review preliminary maps, ask questions, and present supporting evidence.

For homeowners and business owners the immediate implications are practical. Updated assessed values can change the distribution of property tax burdens even if tax rates set by school districts and municipal authorities remain unchanged. Property owners should be prepared to receive valuation notices through the county notification channels, examine the preliminary valuation maps, and take early steps to gather documentation such as recent appraisals, sales records, or evidence of property condition.

The meeting also covered the appeal framework, including both informal review options and formal appeal procedures, along with associated deadlines. Residents who believe an assessment does not reflect their property should follow the county instructions for submitting evidence and public comment. The county public calendar and reassessment pages list links and contact points for meeting materials and for submitting supporting documentation or comments.

Beyond individual tax impacts, the reassessment has broader community significance. Changes in assessed values can affect housing affordability, business costs, and municipal revenue planning. Vulnerable groups such as seniors on fixed incomes may be particularly sensitive to sudden shifts in tax liabilities, which makes transparency and accessible public outreach a priority.

Residents are advised to monitor the county calendar and reassessment pages for upcoming meetings, review available materials, and use the listed channels to ask questions or submit evidence before appeal deadlines.