U.S. China Soybean Deal, Global Flows and Market Consequences

A partial thaw in U.S China soybean trade would still leave shipments below recent norms, forcing U.S. exporters to chase buyers across Asia, the Middle East and North Africa. The outcome will shape 2026 acreage decisions, ripple through South American export balances and influence global prices and farm incomes.

U.S. soybean exporters are accelerating efforts to diversify sales as uncertainty about Chinese demand persists, a development with immediate implications for American planting decisions and global soybean flows. Progress has been recorded in markets including Thailand, Bangladesh and Morocco, but analysts warn that these gains face an uphill task replacing a market that, until recently, absorbed nearly 29 million metric tons a year on average from the United States.

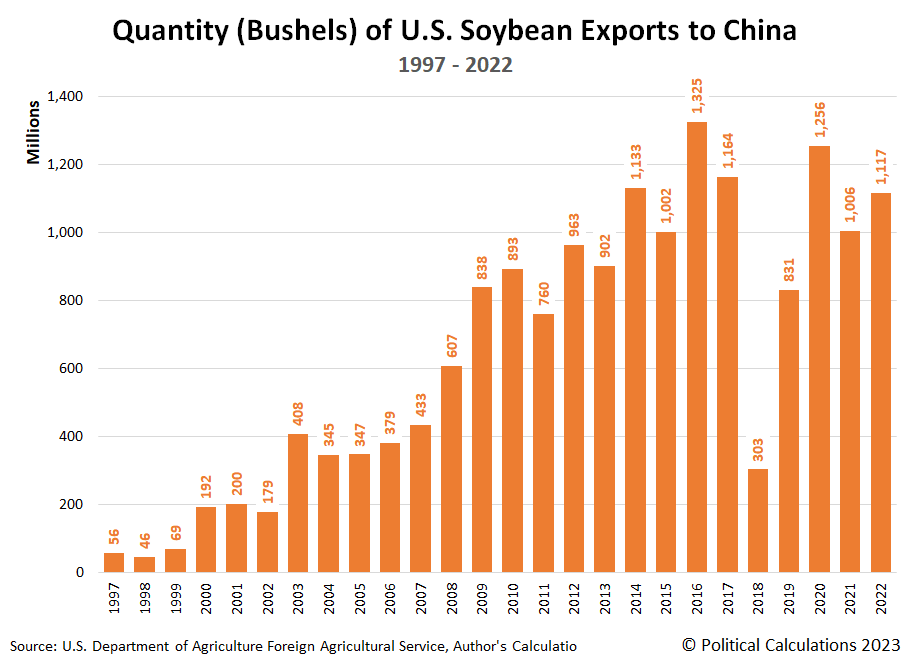

Under one plausible scenario, China would buy at least 25 million metric tons of U.S. soybeans in each year from 2026 through 2028. That level is meaningful, yet it would still be 14 percent lower than the five year average of 29 million tons recorded between 2020 and 2024 and below the ten year average of 27 million tons. The gap underscores a structural downshift in China demand compared with the pandemic era rebound, and it heightens the risk that reduced Chinese purchases could put downward pressure on U.S. acreage and farm revenue.

A central concern for U.S. farmers is whether weaker Chinese offtake will trigger a shift out of soybeans and into corn. Exporters and crop advisers say stabilizing soybean acreage in 2026 is critical to prevent U.S. corn acreage from climbing above 95 million acres, a threshold that would have implications for global corn supplies and domestic biofuel markets. If competitive returns push more acres toward corn, the agricultural landscape in the Corn Belt could change materially, amplifying volatility in both soy and corn markets.

South America will be a key swing factor. If U.S. and Chinese trade normalize next year, Brazil’s soybean exports are projected to fall to between 72 and 75 million metric tons in 2026, a decline of 7 to 10 million tons from 2025 levels. That prospective reduction comes even as Brazilian farmers have already begun planting the 2025 26 crop in October and are expected to expand acreage to record levels. At the same time Argentina has increased shipments, a dynamic that could further pressure Brazil’s export volumes and intensify competition for buyers in Asia, Europe and North Africa.

Market implications are multifaceted. Lower Chinese imports of U.S. beans would likely increase volatility in international soybean prices, shift freight and logistical patterns and alter the seasonal timing of shipments. For U.S. producers, the immediate policy levers include trade promotion, targeted export assistance and domestic risk management via crop insurance and marketing tools. Longer term, structural changes in Chinese consumption linked to dietary shifts, land use policies and soybean crushing capacity will determine whether demand returns to earlier norms or a new equilibrium emerges.

The coming planting and trade decisions will matter for years. If U.S. exporters can convert emerging market wins into stable, recurrent demand, they may blunt the impact of lower Chinese buying. If not, adjustments in acreage, tighter margins for farmers and a reshuffling of South American market shares are likely to follow, reshaping the global soybean landscape into the second half of the decade.