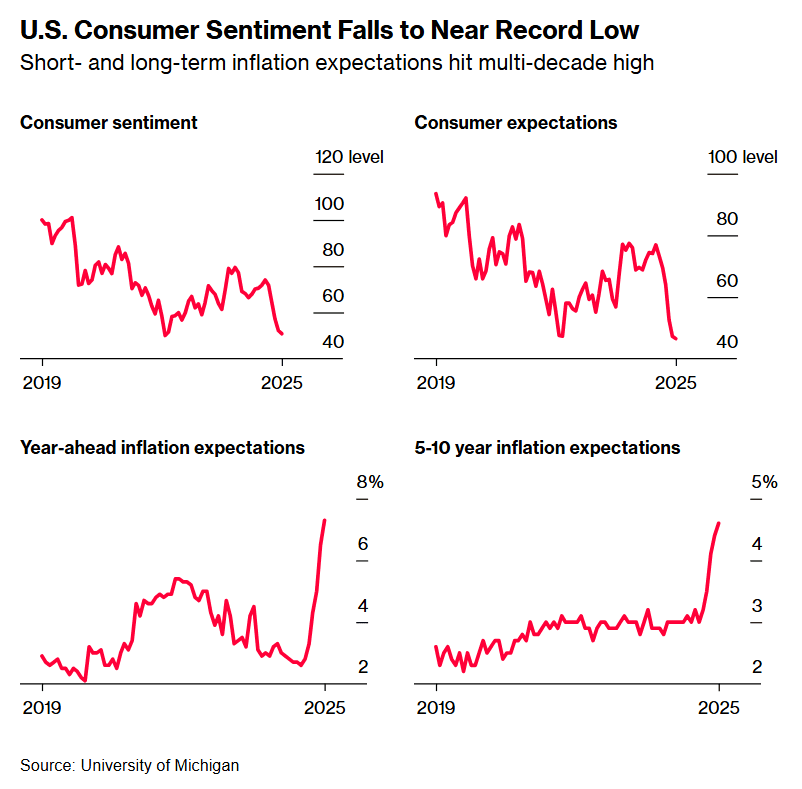

U.S. Consumer Sentiment Plummets, Near One of Lowest Readings on Record

The University of Michigan’s final November consumer sentiment index fell to 51, down from 53.6 in October, signaling a sharp deterioration in American households’ outlook. Elevated inflation perceptions and worries about jobs amid political and economic uncertainty threaten to cool holiday spending and reshape market expectations for growth and interest rates.

The University of Michigan’s final consumer sentiment index for November plunged to 51, falling from 53.6 in October and registering one of the weakest readings in the survey’s history. The decline reflected worsening views of both personal finances and the national economy, with consumers citing high prices and concern about jobs as the main drivers, according to Bloomberg’s coverage of the survey published November 21, 2025.

The drop intensifies scrutiny of household behavior at a pivotal time for the economy. Retailers and economists watch the sentiment gauge closely because consumer spending makes up roughly two thirds of gross domestic product. Even modest pullbacks in outlays during the November and December shopping season could shave growth in the fourth quarter and beyond, compounding the effects of already elevated price pressures and uncertain financial conditions.

Inflation perceptions remained a notable factor behind the shift in sentiment. While the Federal Reserve’s long standing inflation target is 2 percent, households in the survey reported that prices continued to bite, shaping decisions about discretionary purchases and saving. Consumers signaling a heavier focus on essentials and tighter budgets could weigh most heavily on spending for big ticket items and discretionary services that depend on confidence and financing.

Labor market concerns also contributed to the slide. Though official labor market data has shown resilience for much of the past year, survey respondents pointed to jobs as a growing worry. A deterioration in job prospects or rising fears of unemployment typically reduce consumer willingness to commit to durable goods purchases and can increase precautionary saving, further dampening demand.

The sentiment fall has immediate market implications. Weak household confidence can translate into lower sales for consumer facing companies, pressuring equity valuations in the retail and consumer discretionary sectors. Investors may also reassess expectations for corporate earnings as the holiday quarter approaches. Bond markets and interest rate futures could react if investors judge that waning demand reduces the likelihood of additional monetary tightening by the Federal Reserve, or conversely, if sticky inflation perceptions are seen as outlasting consumer weakness.

Policy makers will monitor the data for signs of a sustained downturn. A single monthly reading is not determinative, but persistent depressions in sentiment could influence the Fed’s assessment of the balance between inflation risks and growth risks when setting future policy. Fiscal policy makers and state level officials may also face pressure to consider measures to support incomes or targeted relief if consumer weakness translates into labor market deterioration.

Longer term, a pattern of depressed sentiment can alter household financial behavior, raising saving rates and lowering consumption growth for quarters at a time. For now the immediate question is whether November’s slide represents a transitory scare, driven by short term concerns about prices and politics, or the start of a broader retrenchment that will blunt the strength of the U.S. economy going into 2026.