U.S. Imposes Sweeping 50% Tariffs on Indian Imports: A New Chapter in Trade Relations

On August 28, 2025, the U.S. government announced the imposition of tariffs reaching up to 50% on a variety of Indian imports, marking a significant escalation in trade tensions. This move underscores a strategic shift in U.S. trade policy and has far-reaching implications for global supply chains and the Indian economy.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

In a major development on August 28, 2025, the United States announced the implementation of tariffs as high as 50% on several categories of imports from India, igniting concern among businesses and policymakers on both sides. This decision comes at a time when trade relations between the two nations have been increasingly strained, reflecting broader geopolitical shifts and economic competition. The tariffs cover a wide range of products, including textiles, electronics, and machinery, significantly impacting India's export-driven economy.

The decision was formally announced by U.S. Trade Representative Katherine Tai, who cited concerns over intellectual property theft and market access barriers that have hindered American businesses in India. “This action is not just a response to specific practices, but a reaffirmation of our commitment to fair trade,” Tai stated during a press conference. Analysts suggest that the tariffs could lead to inflationary pressures in the U.S. as import costs escalate, while simultaneously stifling India's economic growth due to reduced foreign demand.

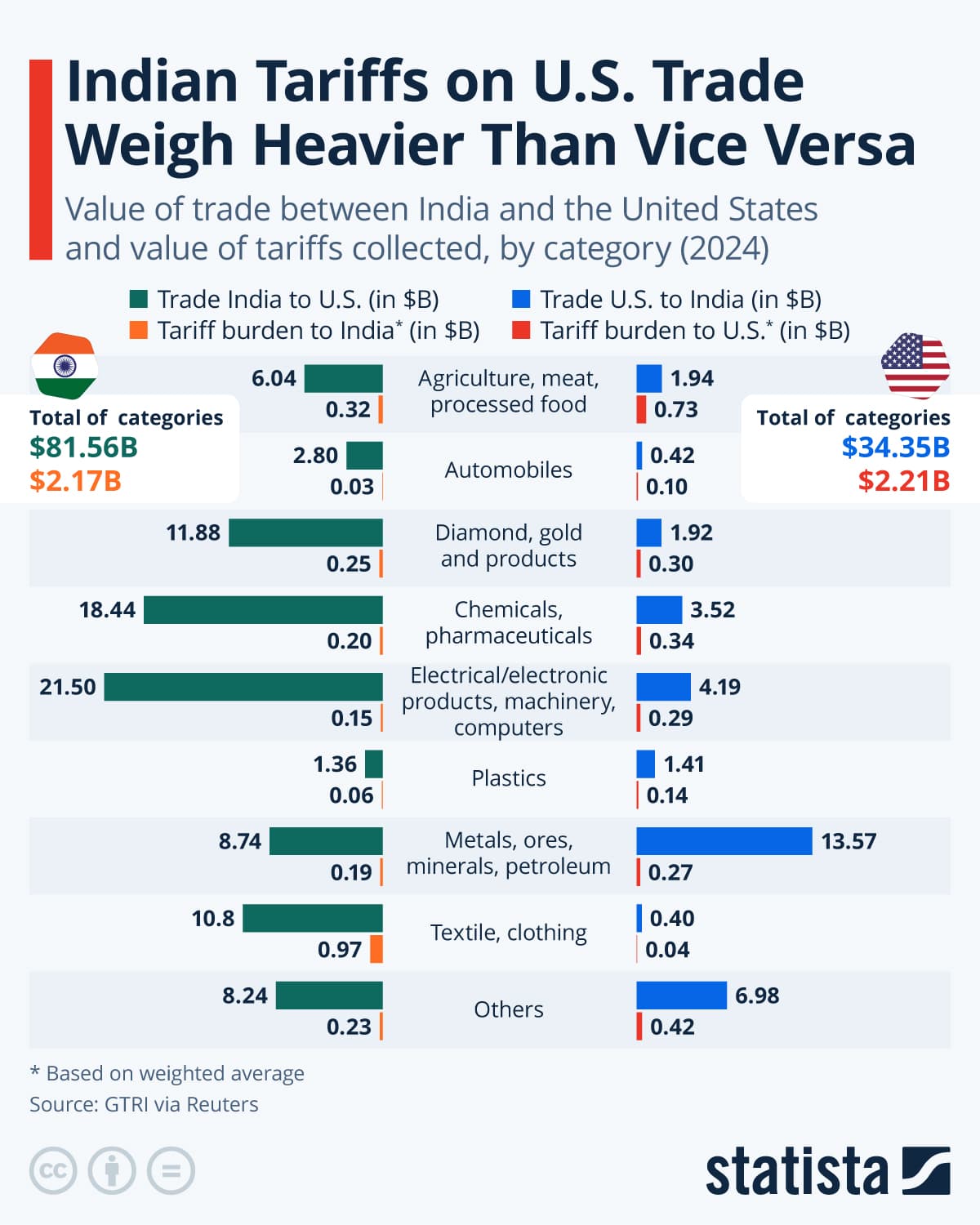

The backdrop to this tariff imposition is a complicated relationship marked by both cooperation and contention. While India and the U.S. have worked together on various fronts—including defense, technology, and climate change—rising tensions have consistently surfaced around trade. According to the Office of the United States Trade Representative, trade in goods and services between the two countries reached approximately $154 billion in 2022, but the U.S. trade deficit with India has remained a point of contention. In 2024, the U.S. ran a goods trade deficit of $30 billion with India, highlighting the imbalance that tariffs aim to address.

Economic analysts predict that these punitive tariffs could have a cascading effect on global supply chains. With India emerging as a key player in manufacturing and information technology services, American companies that rely on Indian products may experience disruptions. A recent survey by the National Association of Manufacturers indicates that nearly 60% of U.S. manufacturers source materials or components from India, prompting concerns over increased costs and operational delays.

Moreover, the Indian government has expressed strong disapproval of the U.S. tariffs. Indian Commerce Minister Piyush Goyal called the measures “unjust” and “unilateral,” and has threatened retaliatory action. India could impose tariffs on U.S. goods, particularly on agricultural products, which could exacerbate tensions further. Past experience shows that retaliatory tariffs can lead to a trade war, complicating negotiations and creating uncertainty in financial markets.

Market analysts are already predicting movements in stock prices within industrial sectors heavily reliant on imports. Companies in the textile and technology sectors, notably firms in Silicon Valley and fashion hubs like New York City, may face immediate pressures. A report from Morgan Stanley indicates that shares of leading companies could see a price drop of up to 20% if tariffs remain in place for an extended period. As businesses adjust their strategies, some may explore diversifying supply chains outside of India, with countries like Vietnam and Bangladesh seen as potential alternatives.

The long-term implications of these tariffs may hinge on how both nations navigate this dispute moving forward. Economically, India may need to bolster its domestic industries to absorb the shock of reduced exports while seeking new markets beyond the U.S. Markets in Southeast Asia and Europe may present opportunities but will require substantial shifts in marketing and logistic plans. Furthermore, Indian exporters may need to invest in compliance with international trade standards to appeal to diverse markets.

Simultaneously, the Biden administration may find itself under pressure to not only justify these tariffs but also implement additional measures to mitigate inflationary effects domestically while supporting American industries. Policymakers will need to consider whether these tariffs align with long-term economic goals or if recalibrating trade relationships is necessary to foster stable growth.

Looking ahead, the imposition of such high trade tariffs sends a clear message: as the global economy continues to evolve post-COVID-19, countries may increasingly turn to protectionism in the name of economic resilience and national security. The duration and effectiveness of these tariffs in reshaping trade dynamics remain to be seen, but what is certain is that both India and the U.S. will need to engage in constructive dialogue to avoid further deterioration of a critical economic partnership. The coming weeks will be pivotal in determining whether this tariff implementation leads to renewed negotiations or escalates tensions into a prolonged standoff.