U.S. jobless claims fall to lowest level since 2022, raising questions

Initial unemployment claims plunged by 27,000 to a seasonally adjusted 191,000 for the week ending November 29, the lowest reading since September 2022, surprising forecasters and tightening an already complex labor market picture. Economists warned that Thanksgiving seasonal adjustments may have exaggerated the drop, and private payroll measures showing November job losses leave policymakers and markets parsing mixed signals.

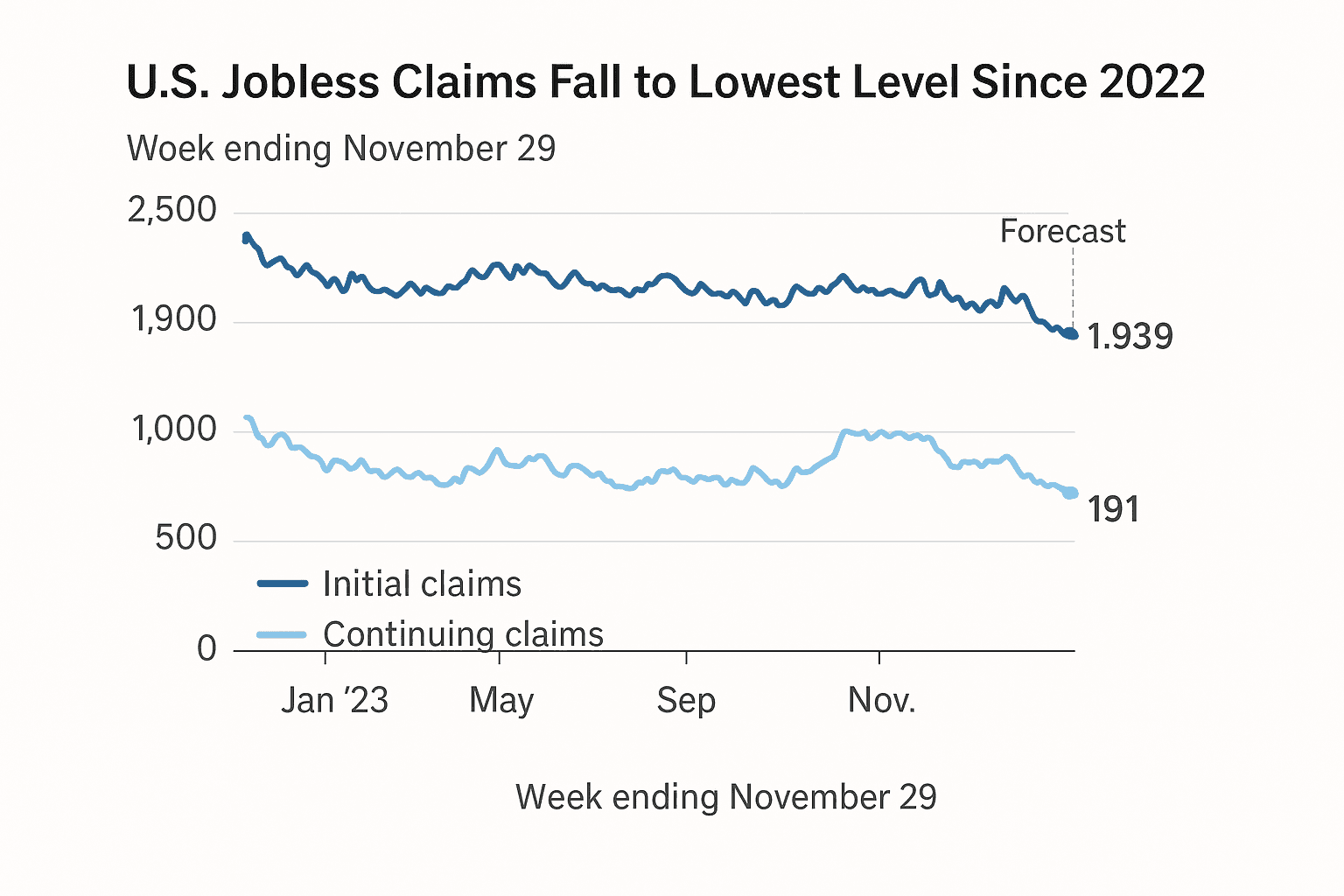

The Labor Department reported that initial jobless claims fell by 27,000 to a seasonally adjusted 191,000 for the week ending November 29, marking the lowest weekly level since September 2022 and underscoring continued resilience in headline labor market indicators. Continuing claims stood at about 1.939 million, a high frequency measure that tracks those remaining on unemployment rolls and provides a broader view of joblessness beyond new filings.

The decline came as a surprise to many forecasters and arrives amid a spate of data that paints a contradictory portrait of employment. Two private payroll measures, ADP and Revelio Labs, indicated job losses in November, suggesting hiring momentum has cooled. Economists cautioned that seasonal adjustment procedures around the Thanksgiving holiday can amplify week to week swings in the claims series, and that the headline figure should be interpreted with care until monthly payroll data from the Bureau of Labor Statistics is available.

Seasonally adjusted claims incorporate statistical corrections designed to remove predictable calendar effects, but holiday weeks often compress reporting and can make adjustments larger and less reliable. That issue was front of mind for analysts when reconciling the sharp weekly drop with other indicators showing weakness. The BLS monthly employment report for November will offer a more complete snapshot of payrolls and unemployment at the start of December, and its timing has heightened attention on how policymakers read the mixed signals.

From a market and policy perspective the contradiction matters. Low initial claims are traditionally interpreted as evidence of tight labor supply, a factor that supports consumer income and spending and can sustain inflationary pressures. Conversely, measures pointing to payroll declines suggest cooling demand for labor, which would ease inflationary concerns and could reduce pressure on the Federal Reserve to tighten further. Analysts said the divergent readings complicate the Fed's near term policy calculus because monetary officials must weigh high frequency weekly signals against monthly and private data that may point in the opposite direction.

Longer term the labor market has shifted from the extraordinarily hot post pandemic period to a phase of slower hiring and episodic layoffs across some sectors. The claims figure returning to levels not seen since late 2022 signals underlying durability in employer decisions to retain workers, even as hiring softness appears more pronounced in private payroll tallies. That nuance matters for households and businesses planning for 2026, with wage growth, consumer spending and credit conditions likely to respond differently depending on which set of indicators proves most predictive.

For now markets and policymakers will watch the forthcoming BLS employment release closely, along with upcoming inflation readings, to decide whether the labor market is steadying or drifting toward a weaker footing. The weekly claims headline is a notable datapoint, but in a year of uneven signals it is only one piece of a complicated macroeconomic puzzle.