U.S. Mint stops penny production, local costs and equity concerns

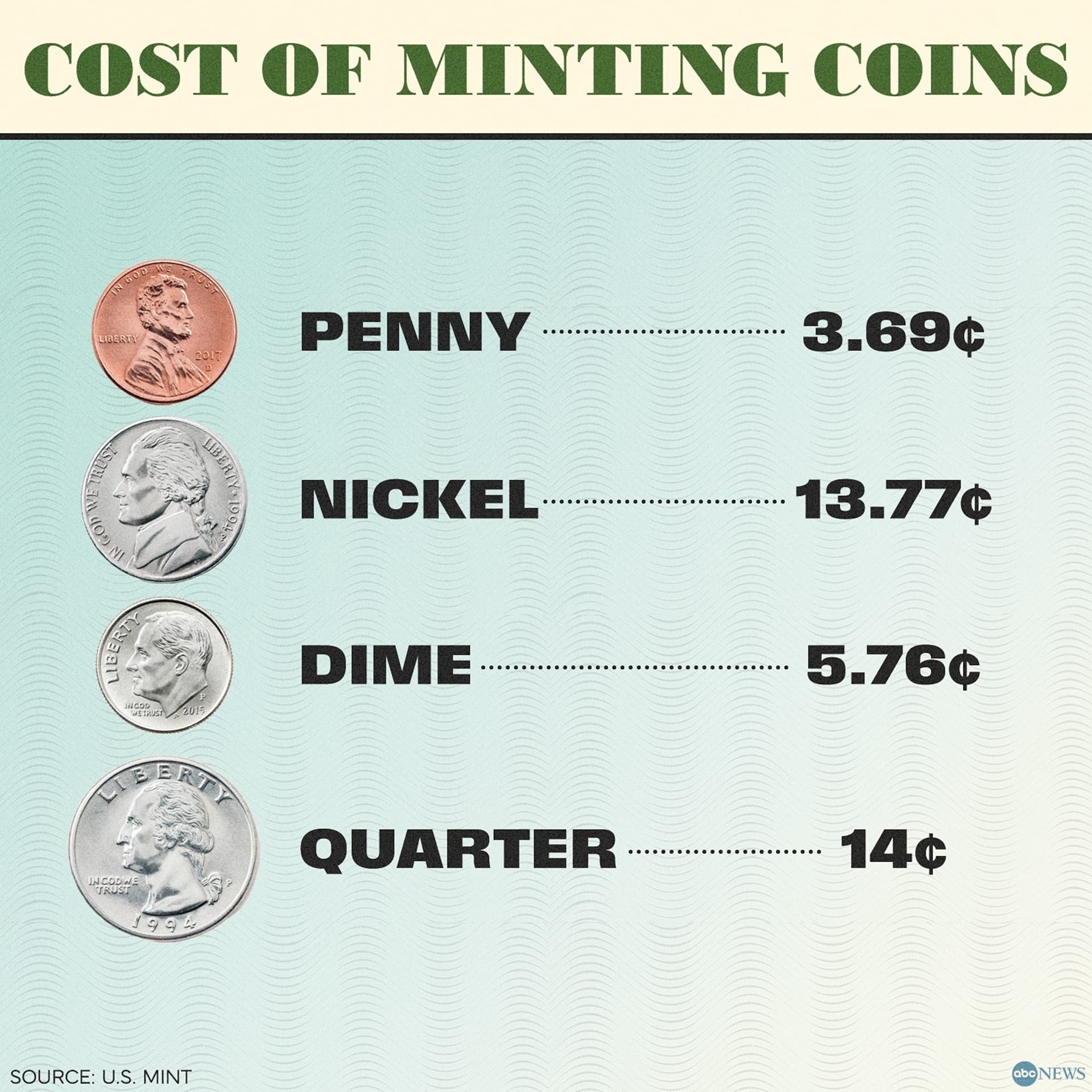

The U.S. Mint ceased production of the one cent coin, with the last penny struck on November 12, 2025, a move republished in commentary on November 20, 2025 that highlights winners and losers. For Morgan County residents the change could mean rounding impacts at small businesses, higher relative card processing costs for merchants, and disproportionate effects on older and unbanked households.

The federal decision to end production of the penny capped a long running debate over the coin's economics and practical use. The last penny was struck on November 12, 2025, and a republished commentary on November 20, 2025 from a former credit union chief financial officer and small business owner laid out likely beneficiaries and those who could be hurt during the transition. The article is a reminder that a national change in coinage policy has distinct local consequences for Morgan County.

At the national level the commentary identified winners including the federal government, banks and credit unions, armored carriers, and large retailers that can absorb or manage the operational change. These institutions may see savings in production, handling and logistics over time that smaller actors cannot capture as easily. By contrast some Main Street small businesses and cash dependent households were singled out as potential losers. The commentary warned that even modest price adjustments and operational frictions could matter for communities with many small cash transactions.

For Morgan County the most immediate economic effects will fall on small merchants and cash reliant residents. Local retailers that handle a high volume of low value transactions could face rounding effects when pennies are removed from circulation, and small shops may experience relatively higher card processing expenses if more sales move to electronic payments. Older residents and people without bank accounts may be more likely to pay in cash and therefore face the largest relative impact from any systematic rounding up of totals or new rounding conventions.

Transition issues highlighted in the commentary include the need to adopt clear rounding rules and to update point of sale systems. Schools, senior centers, nonprofit providers and small vendors in farmers markets will need guidance on how to implement rounding fairly. Without careful policy design there is potential for regressive outcomes, where the costs of simplifying currency fall most heavily on those with the fewest financial alternatives.

Policy makers and local leaders can mitigate those risks. Guidance on neutral rounding rules, support or subsidies to update point of sale equipment at small businesses, and outreach to unbanked households are practical steps that would reduce distributional harm. Monitoring how large retailers and financial institutions adjust processing practices will be important because their decisions can set market norms for the rest of the county.

On balance the end of penny production reflects longer term trends toward electronic payments and lower public demand for small denomination coins. But the shift is not costless for every Morgan County resident. Local officials, business associations and community groups will need to coordinate next steps so that savings at the system level do not translate into higher relative costs for vulnerable households.